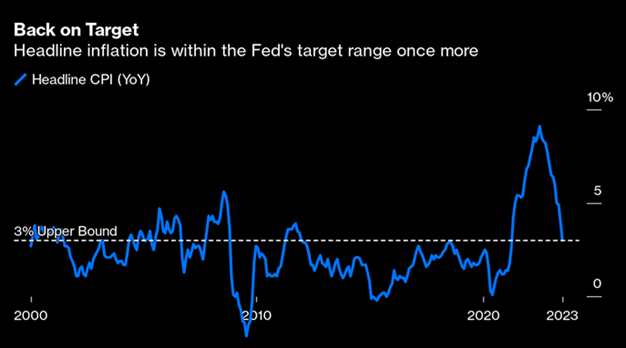

At Last

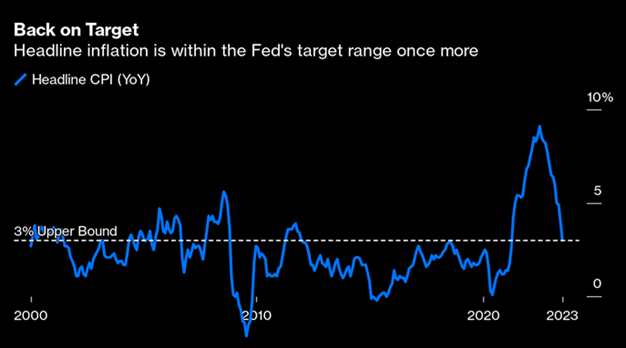

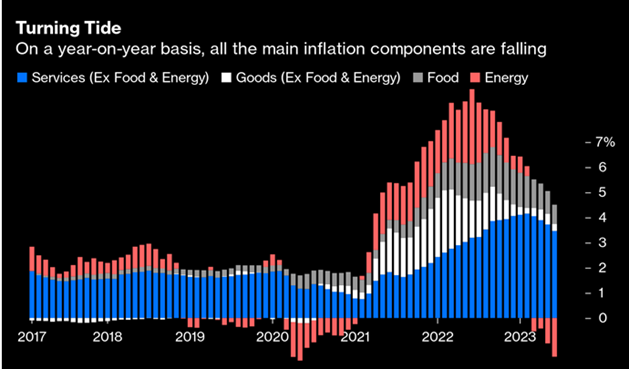

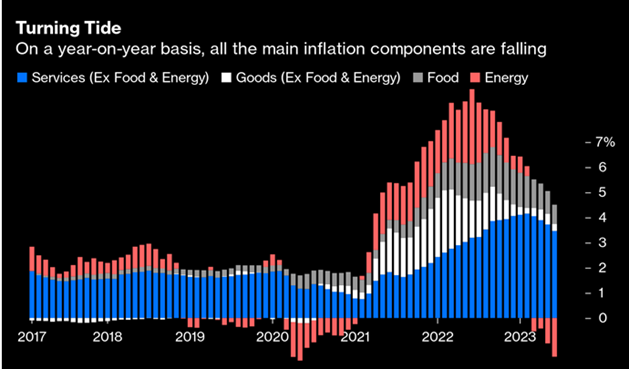

The name of a great track by Etta James but financial markets, central bankers and politicians breathed a sigh of relief that US inflation, as reported for June on July 12th, showed a better than expected, much-needed improvement. The following charts sourced from Bloomberg illustrate the improvement.

Source: Bloomberg

The better than expected US inflation report caused a reversal in fortunes for equity and bond markets which had suffered during the opening week of July because of continued pessimism about rising inflation.

Last week saw the start of the reporting of Q2 earnings in the US with the larger banks first to report. Citigroup and Wells Fargo reported above forecast earnings and JP Morgan reported record quarterly earnings.

Rather than being an indicator of the raft of earnings due to report, these above forecast earnings are more likely evidence of banks utilising higher Fed Funds rates to increase margins between deposits and loans. In JP Morgan’s case, it clearly benefited by being handed First Republic at a cheap price in Q1 2023.

In the UK, in among the strike actions, there was some encouragement of a loosening of the tightness within the labour market. Reed Recruitment reported that jobs listed are down 24.4% for the three months to end June from a year earlier and 26.6% lower than the same time in 2019, before the pandemic.

Meanwhile, Sterling continued its rise against a weak dollar, closing on Friday around 1.31 versus the US currency. The following chart from Marketwatch.com shows the decline in the US Dollar Index (DXY) year to date and its sharp decline in July.

Source: Marketwatch

In the background, China’s drag on financial markets abated last week but Chinese data is weak and weaker than hoped for by authorities, not least inflation rates. In stark contrast to the west, inflation rates border on deflation. With rising youth unemployment and dissatisfaction, further economic and/or monetary stimulus looks highly likely.

Your Money

The major change to asset allocation occurred in the two multi-asset funds. Having bought US and UK government debt at the end of June for the first time in years, after yields rose substantially the allocation was doubled to 10% in both multi-asset funds. This was funded partly from cash and reducing the allocation to absolute return funds.

In the Global Thematic Equity Fund, the Premier Miton European Sustainable Leaders Fund was sold in favour of increasing the fund’s thematic exposure to healthcare which we believe to be attractively valued in the current climate.

Thank you for continued support which is greatly appreciated.