Dancing on the Ceiling

Sadly, this article has nothing to do with Lionel Richie’s classic track of the above name. What we’re actually referring to is the game of who blinks first in the process of raising the debt ceiling in the US so the budget can be financed.

This authorisation has to go through Congress which needs the approval of the Republicans to finance expenditure proposed by the Democrats. The Republicans seem intent on leading the Democrats on a merry dance. In the past, when coming to this crossroads, financial markets have adopted the stance that it doesn’t matter too much because the debt ceiling will be raised at the eleventh hour. This time however, markets are reacting in a slightly, but importantly, different manner. With tax receipts down this year as depicted below, the witching hour for the debt ceiling to be raised is coming into sharp focus.

Source: Bloomberg

How concerned investors are can best be shown by the surge in the spread between 1 month and 3 month US Treasury bills in the following chart sourced from Bloomberg – the period that straddles when the debt ceiling might run out.

Source: Bloomberg

Food for Thought

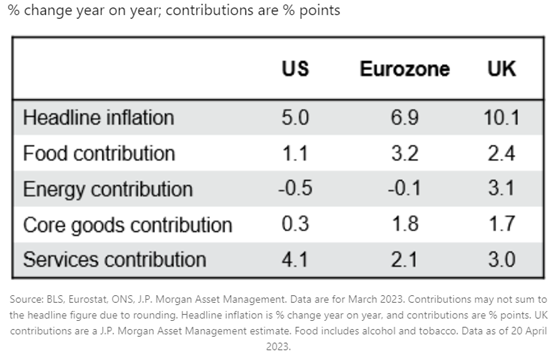

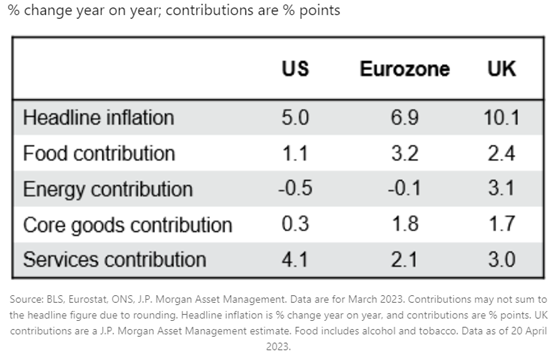

Inflation shows signs of falling by varying degrees in developed economies but remains way higher than where respective central banks want it to be. This manifested itself in the UK’s recent inflation report for March which presented a fall but was both above consensus and showed food inflation running at levels not seen for a few decades. This is likely to mean another round of official interest rate hikes in the US, Europe and UK. Hopefully, food price inflation is peaking.

For the UK, help should be coming from energy prices falling like they have in the US and the Eurozone:

Source: JP Morgan Asset Management

Despite the worse than expected UK inflation report, the cost of living crisis and associated strike action, UK economic data has been surprising to the upside as the following graph sourced from The Daily Shot, illustrates:

Crisis, what Crisis?

The potential banking crisis that could have ensued after March’s collapse of three US banks including Silicon Valley Bank followed by Credit Suisse folding into UBS, didn’t happen. Treasury officials, notably in the US, were happy to tout their success. However the flight of deposits from smaller regional banks to the larger money-centre banks and to higher-yielding money market funds, is a clear pointer to the issue not being resolved beyond the Bank Term Funding Program (BTFP) instigated by the US Federal Reserve. Judging share price performance, the beneficiaries of the crisis to date have been the largest financial institutions, and, with its acquisition of the majority of First Republic Bank announced on 1 May, notably JPMorgan. Crisis is averted for now, but the concentration of the banking sector into “too big to fail” institutions continues.

Trust is Cheap

The investment trust sector in the UK has been somewhat unloved in recent months. The consolidation of the UK financial adviser market and the globalisation of their offering has meant lower allocations to UK equities and disposals of investment trusts that cannot meet liquidity requirements. As a result, the discount on the investment trust sector has widened with many becoming cheap assets. Along with the cheapness of UK equities below the FTSE 100, this relative and absolute cheapness has attracted private equity money as potential purchasers at a time when few assets offer such attractive value.

Markets

Equities

Despite a resurgence of concerns around the banking sector, equity markets held on to their gains for the month. Regional variation was notable however, with Europe gaining 2-3% in aggregate (in sterling terms) whilst Asian and emerging market equities fell by a similar amount. In the UK specifically, investors have been buoyed by a strong rebound in the domestic economy, with GDP growth exceeding expectations in the first quarter of the year.

Healthcare and Insurance were the stronger performing areas of global equity markets.

US equities benefited from better than expected earnings announcements in the midst of the reporting season, particularly in the technology sector, where cost control opportunities have been taken. However, allied with stronger labour markets and robust consumer spending, stagflationary concerns remain.

Debt (Bonds)

UK Gilts, both nominal and inflation-linked, dipped in April, giving up much of their year-to-date gains. Corporate debt, investment grade and high yield, broadly managed to generate modest positive returns for the month.

Real Assets

With stronger activity data from the UK than most had anticipated, and with inflation generally expected to fall from here, UK Real Estate Investment Trusts (REITs) were strong performers in the month. There remains some way to go, however, for the sector to close its apparent valuation discount.

Commodities

Slowing economic activity weighed on industrial metals in April. Gold proved more resilient, particularly hedged back into Sterling.