Spread

Last October, post the Iranian-sponsored Hamas attack on Israel, we made an asset allocation call to raise cash across the funds we manage. The multi-asset funds were the main allocators to a cash increase as they would be expected to be more defensive when required. While the allocations at the end of this update show a small percentage in cash, there is also a 5% to 6% allocation to a short-term debt ETF with a duration of less than 0.5 of a year.

Our reasoning at the time and with input from the external contributors of our Investment Committee, was that the carefully orchestrated attack on Israel was intended to bring about a strong response and with it, a high-risk of an imminent spread of conflict within the region. Not least, it could also re-ignite the Sunni versus Shiite Muslim conflict – think Saudi Arabia versus Iran.

Financial markets were indeed concerned for most of last October before oversold risk asset markets were happy to be distracted by the prospect of significantly lower inflation and lower official interest rates to follow principally in the US, EU and UK.

That movement was given greater impetus by Fed Chair, Jay Powell in December 2023. Despite inflation falling slower than anticipated, the rally in risk assets continued almost without pause through to the end of Q1 2024. While government bonds took some of the inflation disappointment on the chin via higher yields, corporate bond spreads have remained tight. Equities barely flinched in the US, but good news in the US that the narrowness of last year’s rally between a few large cap stocks had broadened out to those with less demanding valuations buoyed largely by better earnings, helped UK and European stock markets. Japan was dancing to its own tune (positively) and China remained in the doldrums mired by its own policy hesitancy (negatively).

Apologies for the recent history review but eventually the spread in conflict was ignited last Monday by Israel’s strike on the Iranian consulate in Damascus which killed three high-ranking Iranian generals. As this was, in effect, on Iranian property, sovereignty, a reprisal by Iran was both and expected and promised. So, after a six month rally in risk assets, equity and bond markets took the potential for middle-east conflict escalation on board last week.

The response from Iran duly came on Saturday evening. Israel’s defences claimed to have intercepted 99% of the incoming attack. The Iranian regime posted on X:

Conducted on the strength of Article 51 of the UN Charter pertaining to legitimate defense, Iran’s military action was in response to the Zionist regime’s aggression against our diplomatic premises in Damascus. The matter can be deemed concluded. However, should the Israeli regime make another mistake, Iran’s response will be considerably more severe. It is a conflict between Iran and the rogue Israeli regime, from which the U.S. MUST STAY AWAY!

Financial markets may take some comfort from the phrase, “The matter can be deemed concluded” but will remain nervous nonetheless.

Market nervousness may spread to the US quarterly earnings season where some lofty valuations will need earnings reassurance/evidence.

Labouring

As we have mentioned many times previously, the US employment report gets more attention than is warranted for such a volatile set of data. Inflation reports get the same billing but are arguably more relevant and reliable. Both reports are a snapshot of what has happened and can help define a trend. The following inputs give some leading indicators as to what might be happening in the US economy’s employment. Apologies for the US focus but it is the largest economy and a significant influence on UK and European markets.

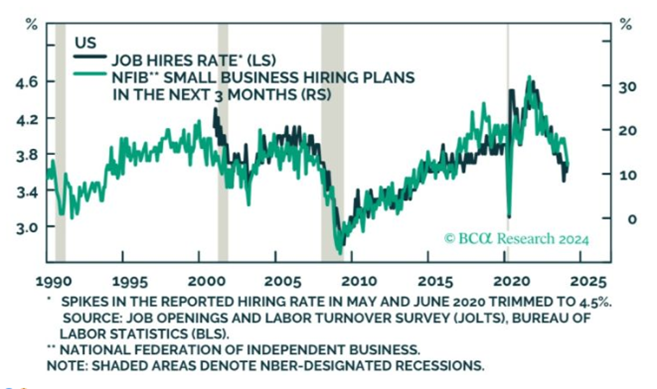

Firstly, hiring is tumbling as the following chart illustrates:

Source: BCA Research

As Bruce Richards, CEO & Chairman of Marathon Asset Management notes:

While the jobs headlines read: “Another Month of Robust US Job Growth with 303,000 jobs added in March”, the reality is that 100% of these job gains came from part-time workers, while full-time workers actually declined. Since August ‘23, all the gains have come from part-time workers as full-time employment has actually fallen by a stunning 1.3 million jobs!

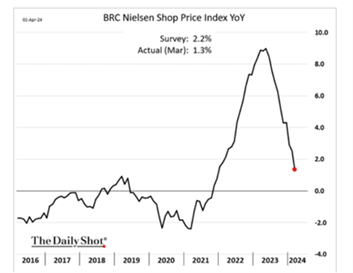

The fear of any central bank monetary policy team is that tight labour markets bring higher wage pressure yet the following chart shows that wages are falling:

Source: BCA Research

In Other News

Good news for UK inflation as economic growth as evidenced by gross domestic product (GDP) was positive again in February to the tune of 0.1%:

Source: The Daily Shot

US Inflation reports were mixed with consumer prices slightly ahead of forecast and producer prices slightly below. The former’s miss due to service price inflation increases, caused bond yields to move higher. Here is the Core Consumer Price Index chart showing a reduction but the pace appears to be stalling:

Source: The Daily Shot

The US has undertaken a new form of onshoring by throwing money at Taiwan Semiconductor Manufacturing Company, TSMC to you and me, to the tune of $6.6 billion in grants and up to USD5 billion in loans to produce their market leading semiconductor chips in Arizona.