Better News, Softer Markets

With the exception of China, where deflation appeared, there was better news on lower inflation. However, that did little to help the mood of financial markets as most asset classes gave back much of July’s positive delivery.

Downgrading

The catalyst for a rise in bond yields and a fall in equity prices came from an unexpected source; Fitch’s downgrade of US government debt from AAA to AA+. Although Fitch’s move was some twelve years after Standard & Poors had made the same change, it focussed investors’ minds on the challenges facing the US Treasury and other governments with swollen deficits. You could argue that as long as you don’t borrow in other currencies, you’ll always be AAA in your own bond market. The US, UK and notably, Japan, are disciples of that mantra. Euro countries that are heavily indebted, post the adoption of the common currency, have suffered periodically from oscillations in borrowing rates viz the reference rates of Germany.

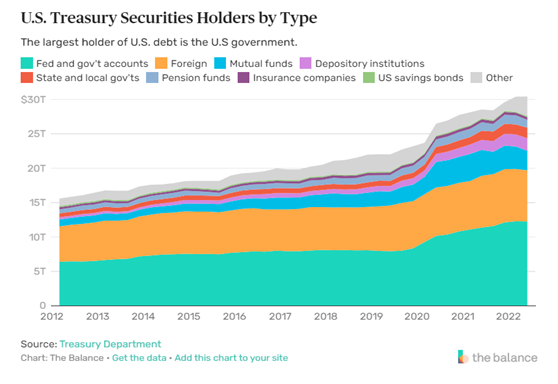

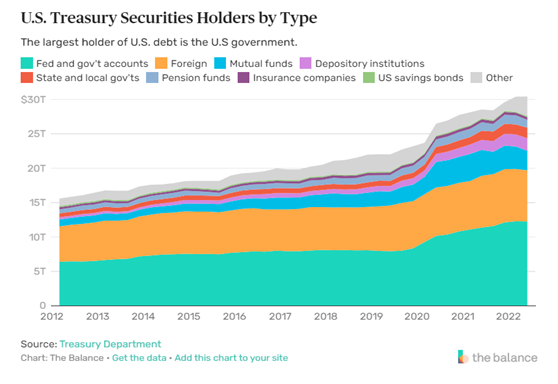

As a reserve currency, the US dollar reserves held by foreign central banks are mainly held in US Treasury securities, meaning that a considerable amount of them are held by non-US institutions as the following graph sourced from ‘the balance’, illustrates. Note the orange (foreign holders) rising consistently with the overall increase in US Treasury debt:

Source: The Balance

As the US Federal reserve unwinds some of its holdings accumulated during the quantitative easing period, supply concerns (too much) have risen.

Bond yields have risen in August in the US and elsewhere despite better (lower) inflation numbers. Ten year gilt yields are up 27bps at the time of writing. US Treasury yields for the same tenure, are up 22 bps month to date as the yield curve steepens to reflect the lower chance of recession in the US.

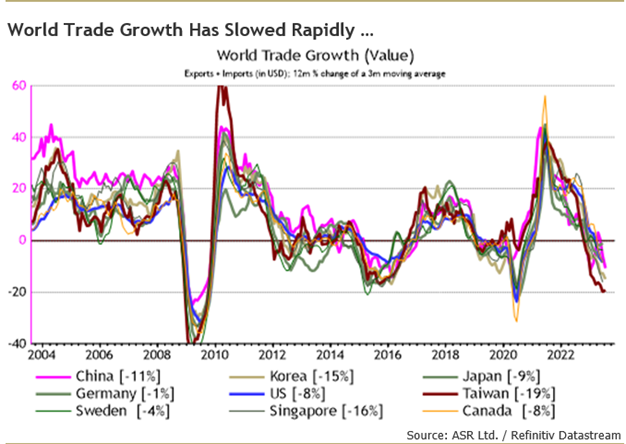

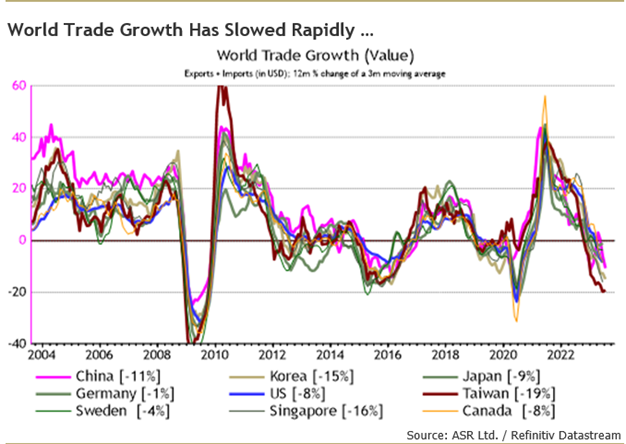

World trade growth has slowed too as the following chart from ASR demonstrates:

Source: ASR Ltd/Refinitiv Datastream

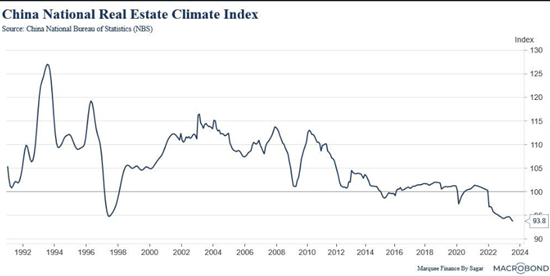

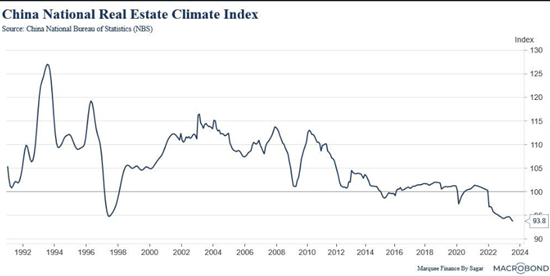

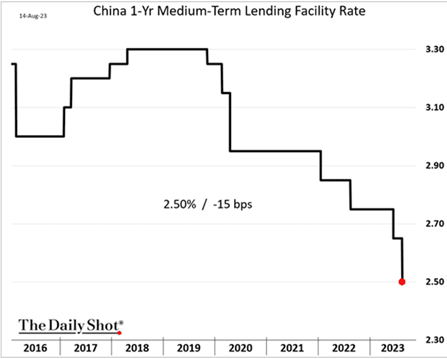

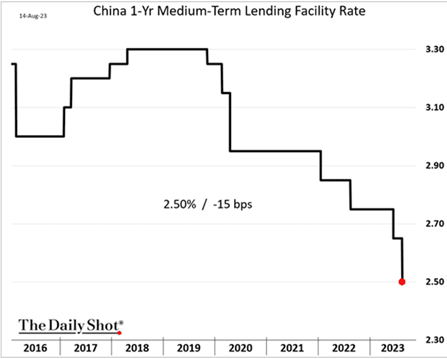

China Cracks

China would like some inflation but has reported deflation in August. Consequently, official rates have been cut. Expect further stimulus as property sector woes (see following chart) continue and youth unemployment remains high – how high will be difficult to ascertain as authorities have decided to stop publishing that number. It was widely accepted that the number was under-reported anyway. When last reported in June, it was 20%.

Source: Marquee Finance by Sagar LLC

Source: The Daily Shot

Upgraded

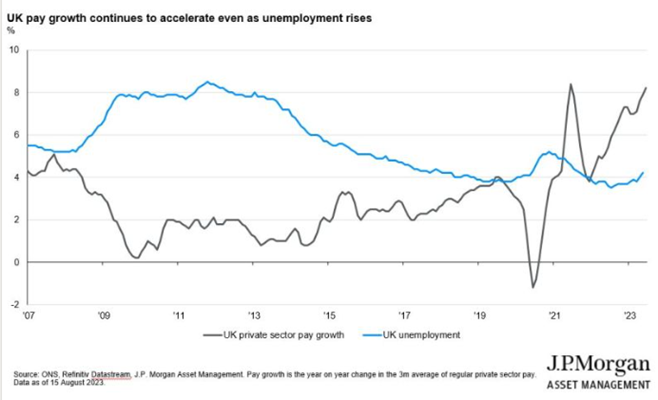

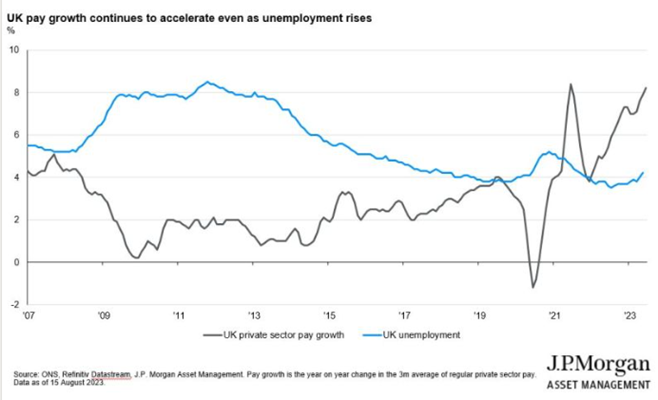

The latest UK wages & unemployment data released on August 15th give the Bank of England a dilemma. As unemployment ticks up, it would be unusual for private sector wage growth to accelerate. Labour shortages persist though. The Bank is concerned about wage growth so it’s understandable that markets are pricing in a slightly higher peak in official short rates nearer 6%. The first week of August saw official short rates rise by 0.25% to 5.25%. The following graph from JP Morgan Asset Management provides an illustration of the historical relationship between unemployment and wages and its recent divergence.

Source: JP Morgan

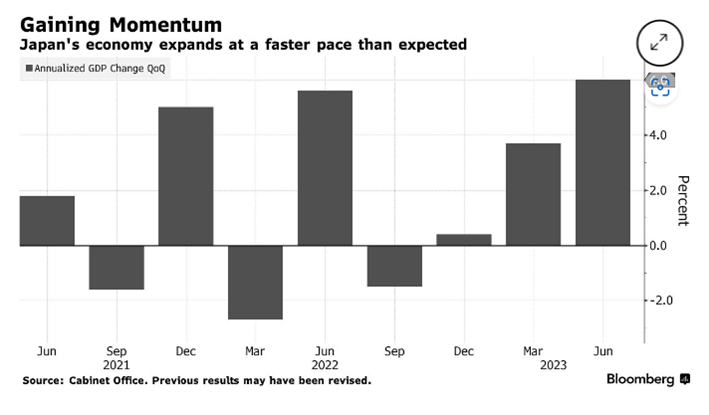

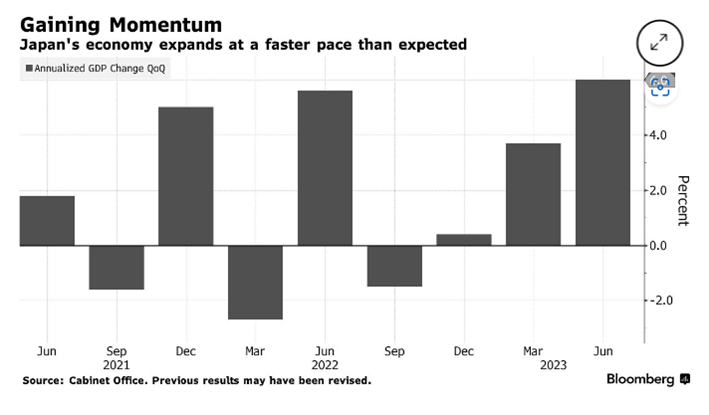

Japanese second quarter GDP beat expectations, rising 6% on an annualised basis, largely export-led and benefitting from a weak yen.

Source: Bloomberg

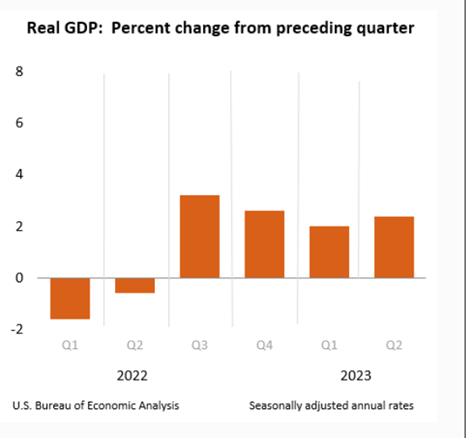

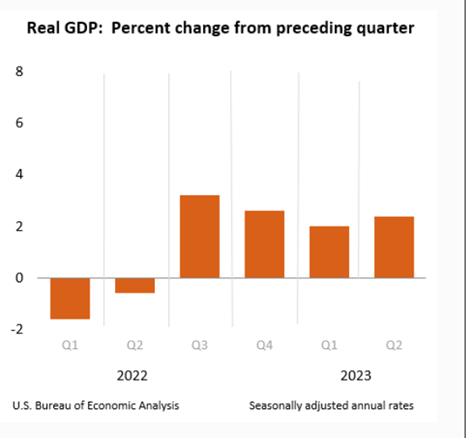

US Q2 GDP was also better than expected coming in at an annual rate of 2.4%.

Tighter lending standards, as evidenced by the Senior Lending Officer survey should trim that number, without triggering a recession.

Source: Bloomberg