Global equity markets achieved positive returns in aggregate for the month despite a significant downturn early on.

Source: FE Analytics

Numerous wide ranging factors contributed to market stress including:

- Berkshire Hathaway’s announcement that it had halved its Apple Inc. position,

- escalating tensions between Israel and Iran in the Middle East,

- comments from the Bank of Japan regarding likely future interest rate hikes.

The latter factor saw a sharp strengthening in the Yen, in the region of 10% against the US dollar, which unsettled carry traders and saw a rush for liquidity.

This also served to demonstrate the aggregate positioning of investors is a further factor not to be underestimated, particularly as profitable trades begin to reverse. Even the stock de jour, Nvidia, experienced a dip before rebounding in anticipation of its results later in the month. The information embedded in these market movements identify areas of investor excess and potential for future profit taking.

Later in the month the US Federal Reserve held its annual symposium at which its governor, Jerome Powell, remarked: “The time has come for policy to adjust”, emphasising a shift in focus to the growth half of its mandate and, in particular, labour market signals. Indeed, the US jobs market is not as strong as once believed as revisions to nonfarm payrolls during the month saw a downward move of 818k jobs for the year ending March 2024.

However, the propensity for US consumers to spend has been a surprisingly strong driver of economic growth and, although a softening in employment conditions warrants some caution, job creation (i.e. economic growth) continues to be positive, albeit at a slower pace.

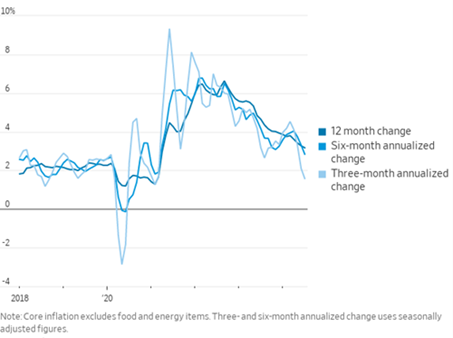

Source: Bureau of Labor Statistics, Bloomberg

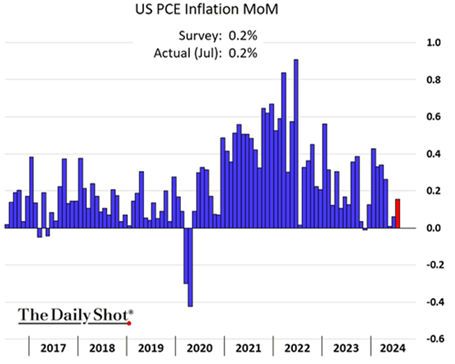

The corollary to the shift in focus by the Fed is that inflation is no longer the primary concern. Indeed, year-over-year US PCE inflation figures (the Fed’s preferred measure) now have a “2” handle putting the Fed on track to achieve its long-term objectives and providing scope for interest rates to be reduced, easing monetary policy to support a softer economy.

Source: The Daily Shot

As both growth and inflation converge towards 2% p.a., the benefits of the trade-off for equity markets have already been maximized. A change in monetary policy focus sets the stage for a potential shift away from the multiple expansion that has benefited mega-cap US technology companies towards earnings growth and a broadening of equity returns across industries and sectors.

Markets

Equities

A mixed month for equity markets which, in aggregate, steadily recovered from a sharp initial sell-off. Some regions (e.g. Europe, UK) marginally gained on the month whilst others (e.g. Japan, US Tech) fell a little short in their recovery.

Bonds

A shift in focus for central banks on reduced concerns for inflation relative to supporting economic growth point to falling interest rates. Indeed the Bank of England reduced its base rate by 0.25% to 5.0% on 1 August 2024.

With inflation now below interest rates, yields provide a positive real income and the potential for core bonds to act as a diversifier in periods of weaker economic conditions has begun to re-emerge.

Source: US Labour Department via Hamilton Lane

Commodities

Priced in US dollars, exposure to both copper and gold via exchange traded products gained on the month. However, translation of those returns to Sterling was a headwind that saw Gold marginally outperform and copper underperform over the month.

Currencies

Sterling has shown tentative signs of turning a corner in recent weeks after a long period in the doldrums. Sentiment towards the UK has been improving as the political landscape has become more stable post this year’s general election. In addition, growth in the UK has gathered some positive momentum and a cautious Bank of England has remained hawkish, both of which have helped support the story for the currency. The relative attractiveness of UK assets which have languished on low valuations for some time is a current theme within the T. Bailey funds reflected in sizable UK equity weights (representing over a quarter of overall equity allocations in the T. Bailey funds of funds).