Key Market Insights

- US labour market falters: Weak job growth and government upheaval shake investor confidence, particularly in bond markets.

- Monetary policy waits on data: The Bank of England cuts rates and the US Federal Reserve and ECB maintain a wait-and-see approach.

- Commodity and equity markets defy volatility: Gold sets new highs, oil supply expands and global equities post modest gains.

August began with a downward jolt from the United States, where July’s jobs report showed only 73,000 new positions and, disturbingly, sharp downward revisions to previous months’ numbers. Financial markets read this as confirmation that the labour market was cooling fast. Shooting the messenger, US President Trump responded by firing the head of the Bureau of Labor Statistics and accusing officials of fabricating data, a further act to unsettle investors relying on the integrity of government figures.

Source: Statista (https://www.statista.com/chart/34931/difference-between-preliminary-and-final-data-for-additions-losses-to-nonfarm-payroll-employment/).

The US Federal Reserve initially held rates steady despite this growing evidence of labour-market weakness, but Chair Jerome Powell used his Jackson Hole speech later in the month to signal that interest rate cuts were on the table. Inflation measures have provided room for manoeuvre with the PCE index holding at 2.6% and consumer prices undershooting forecasts.

For now, continued optimism across financial assets leans on the anticipation of a response from the Federal Reserve to weakening data and, in particular, that it will ultimately prioritise jobs over price stability. Political pressure continues to push in this direction which was further made clear by the White House during the month in seeking to remove sitting Federal Reserve governors – despite such actions raising questions about central bank independence and putting at risk longer-term borrowing costs which have been steadily climbing for much of the developed world.

G7 30-Year Benchmark Bond Yields

Source: LSEG Workspace.

The modest exposure to US treasuries in the T. Bailey Multi-Asset funds is via a holding in the iShares $ Treasury Bond 7-10yr UCITS ETF. With an average duration of 8.5 years, this sits towards what has been the more stable section of the yield curve whilst generating a yield of 3.9%.

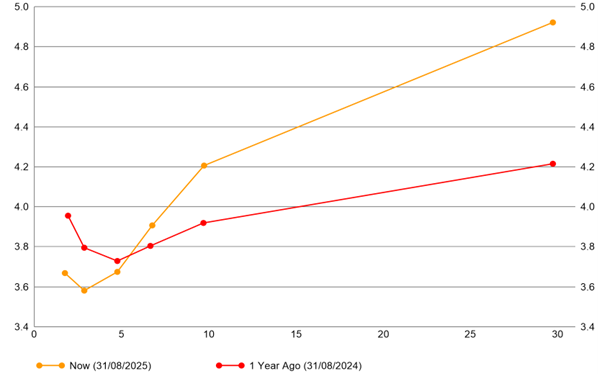

US Yield Curve

Source: LSEG Datastream.

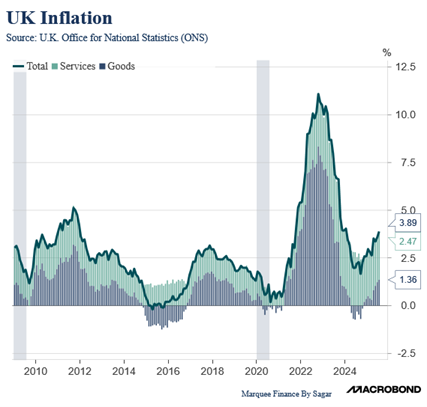

At the shorter end of the curve, rates are under downward pressure. In the UK, the Bank of England cut base rates to 4.0% in a narrow vote, albeit warning that inflation would remain sticky for longer than expected.

UK Inflation

Source: Marquee Finance By Sagar, Macrobond.

The European Central Bank held rates at 2.0%, noting that eurozone manufacturing had returned to expansion for the first time in three years. Furthermore, services activity remained firm across Europe, while Britain’s services PMI reached a one-year high even as factory output lagged. These shifts underscored diverging patterns in activity: resilience in services and weakness in industry.

In the commodity sphere, US oil output hit a record 13.6 million barrels a day whilst OPEC+ confirmed a September oil supply increase of 547,000 barrels a day, erasing the voluntary cuts made in 2023. Despite greater supply, safe-haven demand pushed gold to fresh nominal highs above US$3,400 an ounce during the height of tariff tensions.

Global Equity Performance (in GBP Terms)

Source: LSEG Datastream. Total return in GBP terms. Rebased to 100 at 31 December 2024.

Despite the global economy absorbing shocks from weak US data, sweeping tariffs, and central-bank recalibration, August proved a somewhat calm month across global equity markets which collectively progressed around 0.5% in Sterling terms. Nonetheless the overriding pattern of fragile growth, persistent trade conflict and stretched valuations in sizable pockets of equity markets provides us with reason to remain cautious and diversified within the T. Bailey portfolios.