December 2022 Mid-Monthly Update

Moderating Inflation

In our review of November, we referenced the three peaks challenge that financial markets are facing; will inflation continue to moderate in the US and start to in Europe and the UK? If so, how much will it help the respective central banks and controllers of monetary policy ease back on future interest rates increases? That and the relaxation of Covid restrictions in China, have been the focus of investors in the first half of December. Unsurprisingly, financial markets took stock of November’s rally ahead of key rate decisions from the US Federal Reserve, European Central Bank and the Bank of England due in the week commencing 12 December.

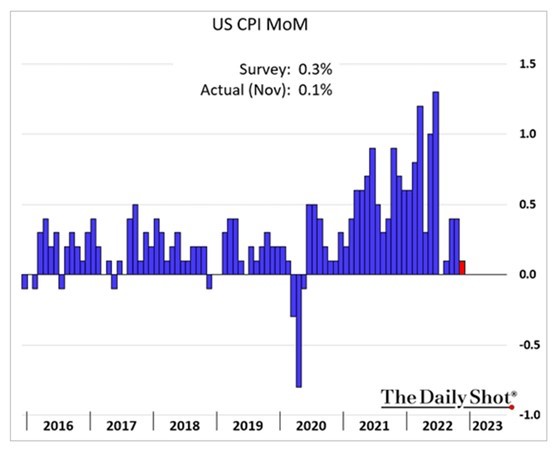

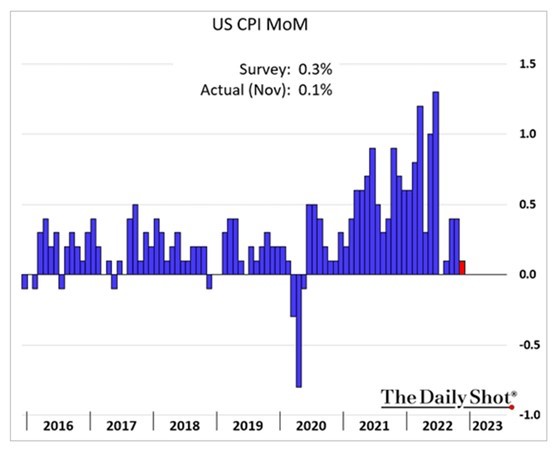

US inflation, as measured by its consumer price index (CPI), got an update with the release of November’s data on 12 December. The graph sourced from The Daily Shot, shows a small and smaller than forecast rise in month-on-month inflation.

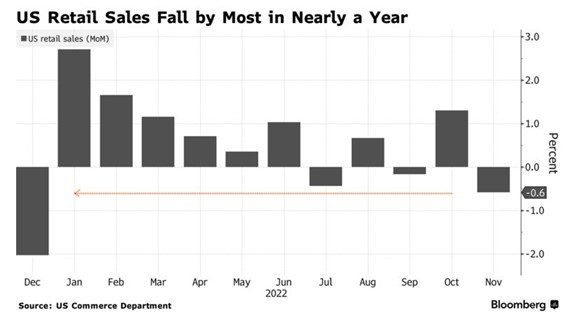

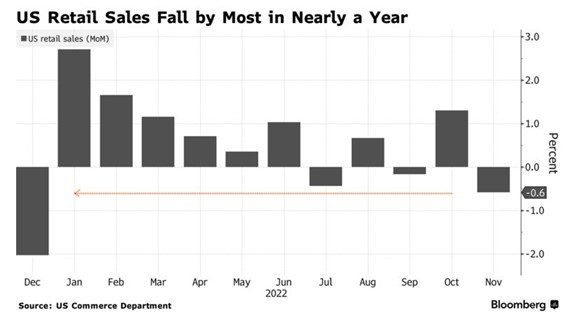

Further evidence of a slowing US economy emerged with the release of November’s US retail sales which was weak and weaker than forecast as the following chart sourced from Bloomberg illustrates.

In the UK, inflation also moderated in November to 10.7%, down from a 41 year high of 11.1% in October. While November’s was better than forecast, it will feel like cold comfort when food prices were up 16.5%.

A Game of Three Halves

With the football world cup concluding this weekend, one might think the above heading relates to the length of added time in the games that have been played to date. That isn’t the case. My only comment would be on the poor and inconsistent level of officiating which has let the tournament down. For the many who wanted Morocco to get to the final, France’s first goal was scored by a player who shouldn’t have been on the pitch.

The three central banks of the US, Europe and the UK duly obliged with half of one per cent increases to official rates on Wednesday and Thursday of this week. The US Federal Reserve was first on Wednesday and accompanied their rate increase with strong rhetoric about more rate increases to come. A sell-off in financial assets ensued but Fed Chair Jay Powell’s words were not unexpected. The expectation of where the terminal rate for Fed Funds will be barely changed from minor oscillations around 5% implying perhaps two 0.25% hikes in the new year.

Some differences of opinion occurred within the Bank of England’s Monetary Policy Committee with three different opinions on what base rates should be which largely reflects the recessionary environment in the UK.

The Crypto Factor

The collapse of crypto platform FTX has undermined the crypto currency market and crypto currencies have reflected the unease behind the unfolding story and arrest of key individuals. An unregulated (for good reason to date) wild west of investing which has never been on our agenda.

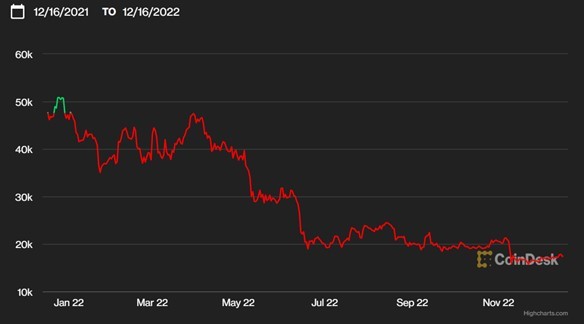

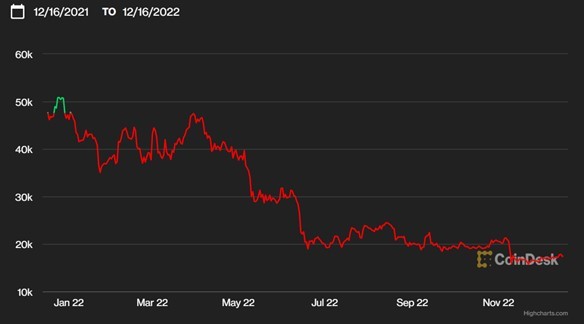

The following chart from CoinDesk and Highcharts.com illustrates the demise of Bitcoin over the past year.

There have been few changes to portfolios to date in December. A disappointing macro fund where we observed a change in management style we deemed not to be in the fund’s interest was sold and proceeds invested in two different funds. One is a UK equity long/short fund we have been monitoring for some time. The other is a high yield opportunities offering with the ability to take short positions in poor credits. These trades were placed for both multi-asset funds, Dynamic and Multi-Asset Growth.

We thank you for your continued support and would like to take this opportunity to wish you, your family and friends, a wonderful Christmas and New Year.