R We Nearly There Yet?

Apologies for re-using a headline used in October (for half term) but the debate for western developed economies is whether they will encounter a recession in 2024, or perhaps interest rate futures in those markets are already forecasting a weaker outcome. Last week saw the announcement that the UK’s October output fell.

In Asia, there is much less economic uniformity. China’s attempt to re-start its economic engine keeps stalling. In Japan, the debate is about when monetary policy normalises, with rates rising accompanied by an expected bounce in the yen which appears to have commenced against the backdrop of a weaker US currency. The Indian economy has been one of the few bright spots but its stock market looks stretched, which leads me to the following question.

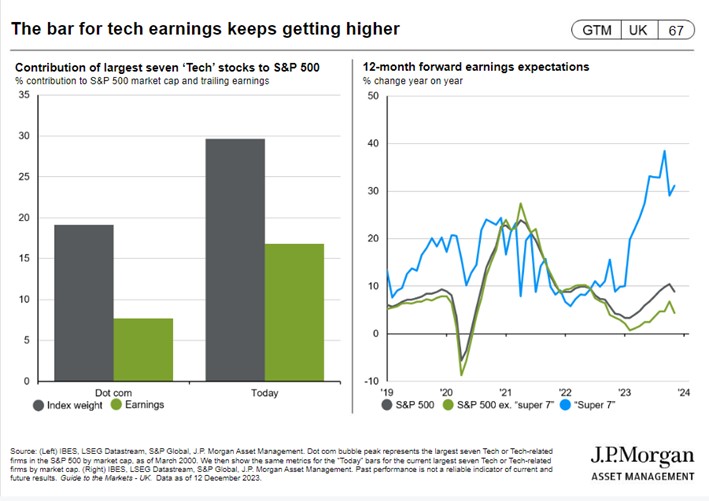

Will this year’s stock market darlings, aka ‘Magnificent Seven’, be immune to a global economic slowdown that’s already underway? The following graph from JP Morgan Asset Management illustrates the challenge facing those few stocks that have attracted considerable investor interest, with their share price increases in 2023 offsetting their poor showing in 2022.

Ever higher earnings expectations translating into higher price/earnings multiples are reasons to be cautious. While not there yet, it reminds those with long enough memories, or careers, of the ‘what were you thinking?!’ comment from Scott McNealy, CEO of Sun Microsystems in 2002 after the bursting of the dot-com bubble.

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

There were 29 stocks within the S&P 500 that traded above ten times revenues at the peak of the dotcom mania. Today there are 38.

Insensitivity

One of the by-products of large scale passive investing is that it leads to price insensitivity. Ultimately the price elasticity stretches to breaking point as valuations become unattainable. Consider that Vanguard, a leading passive investor has over USD8 trillion in assets under management, a sum that is USD1 trillion greater than the combined gross domestic products (GDP) of Germany and the UK. Essentially it feeds its own momentum. As a stock grows it represents a larger portion of an index attracting more flows. Today, seven stocks represent nearly 30% of the US S&P 500 share index (see the previous graph from JP Morgan Asset Management). Does a company represent a better investment because it is bigger?

Apple’s market capitalisation is USD3.1 trillion, greater than the UK’s GDP (the world’s sixth largest economy). In November, Apple posted its fourth consecutive quarter of revenue loss, Apple’s share price is up 52% year to date, admittedly, it was down 28% in 2022.

Why Bother?

If you can garner spectacular returns through herd mentality, why bother with the peripheral investment opportunities? Investor focus or indiscriminate acquisition of a few large companies that make up a high proportion of stock market indices, means that many opportunities become unloved, after all, why bother with Japan and the UK (below the FTSE 100)? Japan was cast aside after many years in the doldrums but corporate governance reform has enabled the Topix index to deliver a 23% return year-to-date in 2023 in yen terms. The UK’s mid and smaller companies have become unloved as UK investors, or their agents, have gone global in their approach. Both Japan and the UK’s mid-sized companies remain attractive, offering value. The level of cheapness can be assessed by increased corporate activity (takeovers) and share buybacks. If you’re a company with cash on the balance sheet and a depressed stock price on a cheap valuation, buying your own shares can look like a great investment.

For investors not encumbered by being too big to only invest in large companies getting larger, there is increasingly good value to be had in areas/sectors/themes left behind by those too big to bother. Our own directly-invested UK Responsibly Invested Equity Fund, which invests in companies of differing sizes, is up 5.4% over the past month.

All Quiet on the Western Front

Last week the US Federal Reserve (Fed), followed by both the European Central Bank (ECB) and Bank of England (Bank) chose to hold official interest rates at existing levels. Better news on inflation, slower economic activity and some evidence of a loosening of employment tightness were evidenced as reasons to maintain interest rates at their previous levels. Having said that, and while better than expected, UK wages running at a 7.3% clip won’t have the Bank jumping up and down with seasonal glee.

There’s a War On

Well, more than one. While the conflict in Gaza continues and dominates the headlines (Iran’s gameplan seems to be on track), the ongoing Ukraine fightback against the Russian invasion continues and with Putin raising the stakes with comments last week in his annual Christmas address. In case you missed it, Venezuela is threatening to venture into Guyana’s territory as it greedily eyes Guyana’s recently discovered oil reserves. However, none of these concerns can stand in the way (currently) of the anticipated lower interest rates’ fuelled Santa rally in risk assets.

This Time Next Year/Outlook

At the time of writing, the futures markets are pricing in the following changes to official rates:

US Federal Reserve -1.10%

European Central Bank -1.30%

Bank of England -1.00%

With ten-year UK Gilts yielding 3.7% and their US counterparts yielding 3.9%, there’s a danger that bond and futures markets have got ahead of themselves, or they are forecasting a recession that is deeper than anticipated. It looks like the former presently.

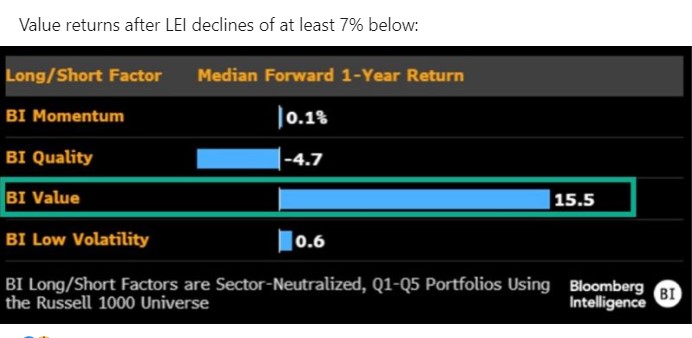

Whether a hard-to achieve soft landing can be delivered in the US in 2024 remains to be seen. Some form of recession is likely given the slowdown currently being evidenced and US Leading Economic Indicators (LEI) having fallen 7% year-on-year. But the question is how severe any recession might be? The resilience of the US consumer would indicate that any recession might be a shallow one. In Europe and the UK, a recession could be underway. Previous rate increases probably haven’t been fully reflected in economic activity yet. Bloomberg’s Chief Equity Strategist, Gina Martin Adams, posted a useful analysis of equity returns based on previous occasions when the LEI has fallen by 7% y-o-y.

Source: Bloomberg

To put this another way, growth at a reasonable price (GARP aka Value) should deliver a decent return rather than growth at any price (GAAP). Valuation discipline is key and fortunately, there are plenty of good businesses with good cash flow and strong balance sheets that are on attractive valuations, especially outside the US.

One Trick Pony

The size of budget deficits almost everywhere means that monetary policy will be the only lever respective authorities can pull to breathe life into faltering economies.

Your Money

Our funds are focused on cheaper valuations for good businesses in long-term themes in attractive markets for the reasons referred to previously. Avoiding stretched valuations is key. The interest rate sensitivity of the funds has come to the fore since the end of October 2023 and should be supportive for the following year. They look likely to beat returns from debt markets given how far yields have fallen. We retain a sizable allocation to the UK (below the FTSE 100) and Japan given their attractive valuations. In themes, Energy Transition/Climate Change is our most favoured with numerous governments’ incentives and momentum providing a following wind (pun intended).

There have been no significant changes to portfolios in December other than general housekeeping.