Sense and Sensitivity

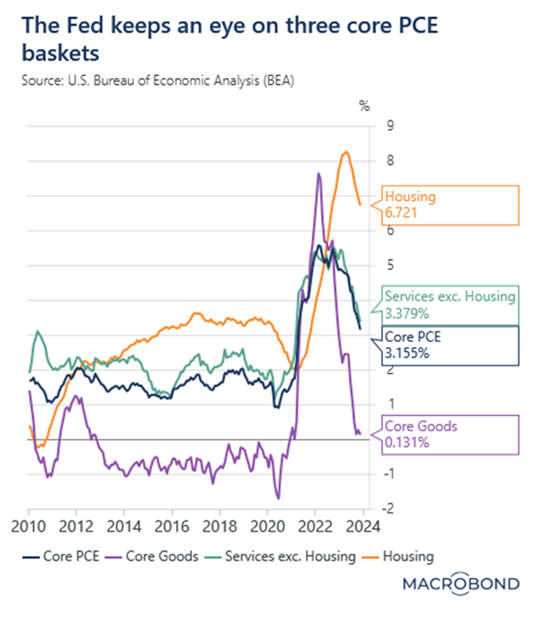

With apologies to Jane Austen, December was a month when inflation continued to fall in developed countries allowing financial markets to price in significant official rate cuts for 2024. This optimism was boosted with US Federal Reserve Chair, Jerome Powell’s dovish comments at the Federal Reserve’s meeting on 13 December. Markets sensing an about turn in interest rates led to a continuation of a rally in financial assets that had started at the end of October, especially those with any interest rate sensitivity. Economic data was supportive and welcomed along with the improved inflation backdrop.

Source: Marquee Finance

While most of 2023 was all about the performance of a few mega-cap US stocks, November and December witnessed a sharp rebound in attractively valued, previously unloved (in 2023) stocks. This was notable in the UK beneath the FTSE 100 where the absolute and relative attractiveness of UK mid and smaller sized businesses saw significant volumes of share buybacks, mergers and acquisitions and private equity activity.

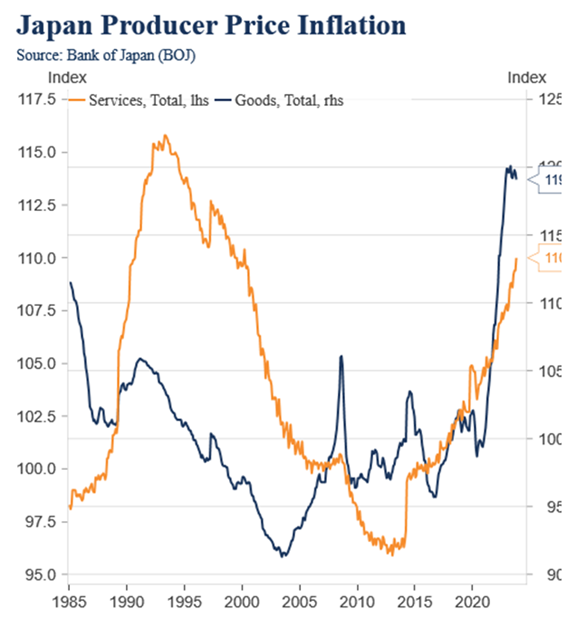

In Asia, it was a tale of three large economies. Many of the same influences on UK equities were evidenced in Japan as Japanese equities rounded out a stellar year in yen terms, buoyed by the continuation of corporate governance reforms. India too has enjoyed a strong period of returns but might be stretched. China continued to disappoint investors as official measures failed to ignite the economy which remains in the doldrums.

The US dollar had a weaker month as interest rate expectations reflected a greater fall than before Jerome Powell’s dovish comments. The Japanese yen reversed the direction it had endured for much of 2023, appreciating against the US currency and Sterling.

Time for Change in Monetary Policy – away from negative interest rates

Source: Marquee Finance

Of course, one of the key beneficiaries from lower interest rate expectations in western developed markets has been the debt market where government bond yields fell sharply and credit markets piggy-backed on their capital appreciation.

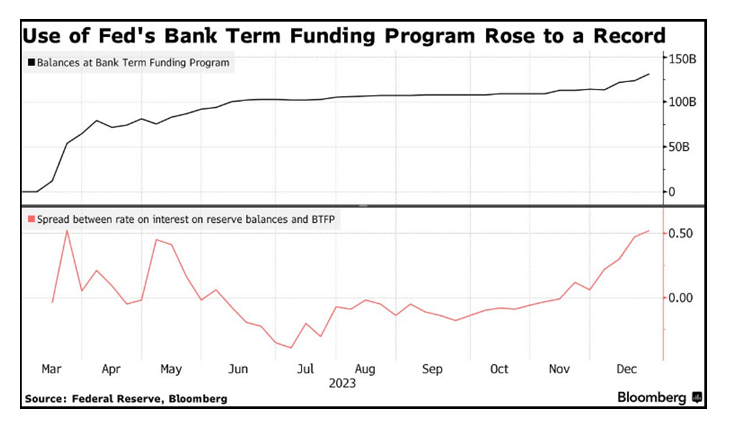

The US banking crisis that revolved around Silicon Valley Bank’s failure in March of 2023 may seem like a distant memory but it heralded the Federal Reserve’s Bank Term Funding Program to give banks access to liquidity as depositors fled to higher interest paying money market funds. Nine months on and banks upped their use of the program to round-trip and park the funds back at the ‘Fed’ as the spread increased in their favour as the chart below illustrates.

Source: Zerohedge, Marquee Finance

Is there a residual problem in the US banking system? Possibly.

Geopolitical risk did not abate but was largely ignored by risk asset classes. Gold was a positive influence in December, more due to a weaker US dollar and lower interest rates than regional conflicts. Copper was slightly up but oil, expected to be a beneficiary of middle eastern upheaval has been anything but. Brent crude finished the month of December roughly where it started and way below forecasts.

The debate for western developed economies is whether they will encounter a recession in 2024, or perhaps interest rate futures in those markets are already forecasting a weaker outcome. Are the UK and most of Europe already in recession?

In Asia, there is much less economic uniformity. China’s attempt to re-start its economic engine keeps stalling. In Japan, the debate is about when monetary policy normalises, with rates rising accompanied by an expected bounce in the yen which appears to have commenced against the backdrop of a weaker US currency. The Indian economy has been one of the few bright spots but its stock market looks stretched, which leads me to the following question.

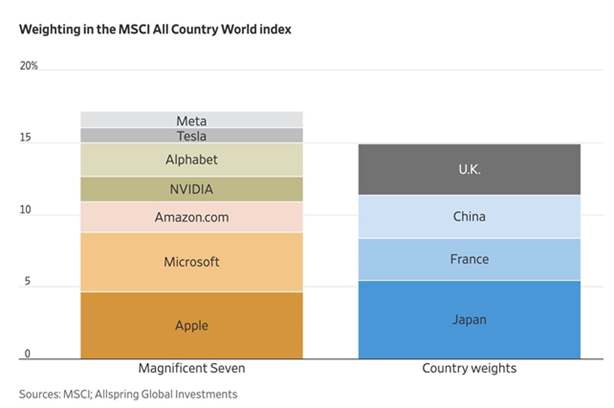

Too Big?

Source: Marquee Finance

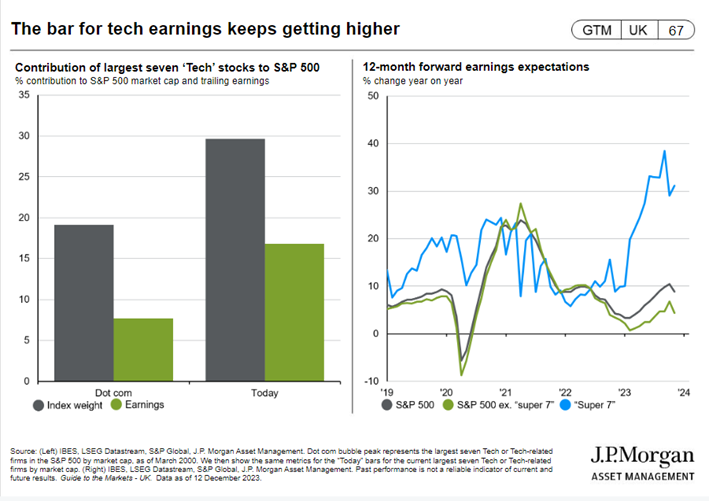

Ever higher earnings expectations translating into higher price/earnings multiples are reasons to be cautious.

Insensitivity

One of the by-products of large scale passive investing is that it leads to price insensitivity. Ultimately the price elasticity stretches to breaking point as valuations become unattainable. Consider that Vanguard, a leading passive investor has over USD8 trillion in assets under management, a sum that is USD1 trillion greater than the combined gross domestic products (GDP) of Germany and the UK. Essentially it feeds its own momentum.

Does a company represent a better investment because it is bigger?

Apple’s market capitalisation is USD3.1 trillion, greater than the UK’s GDP (the world’s sixth largest economy). In November, Apple posted its fourth consecutive quarter of revenue loss, Apple’s share price was up 54% in 2023, admittedly, it was down 28% in 2022.

Why Bother?

If you can garner spectacular returns through herd mentality, why bother with the peripheral investment opportunities? Investor focus or indiscriminate acquisition of a few large companies that make up a high proportion of stock market indices, means that many opportunities become unloved, after all, why bother with Japan and the UK (below the FTSE 100)? Japan was cast aside after many years in the doldrums but corporate governance reform has enabled the Topix index to deliver a 23% return year-to-date in 2023 in yen terms. The UK’s mid and smaller companies have become unloved as UK investors, or their agents, have gone global in their approach. Both Japan and the UK’s mid-sized companies remain attractive, offering value. The level of cheapness can be assessed by increased corporate activity (takeovers) and share buybacks. If you’re a company with cash on the balance sheet and a depressed stock price on a cheap valuation, buying your own shares can look like a great investment.

For investors not encumbered by being too big to only invest in large companies getting larger, there is increasingly good value to be had in areas/sectors/themes left behind by those too big to bother. Our own directly-invested UK Responsibly Invested Equity Fund, which invests in companies of differing sizes, is up 6.1% in December.

There’s a War On

Well, more than one. While the conflict in Gaza continues and dominates the headlines (Iran’s gameplan seems to be on track), the ongoing Ukraine fightback against the Russian invasion continues and with Putin raising the stakes with comments in his annual Christmas address. In case you missed it, Venezuela is threatening to venture into Guyana’s territory as it greedily eyes Guyana’s recently discovered oil reserves. Britain has dispatched a warship to the area in support of its former territory. However, none of these concerns can stand in the way (currently) of the anticipated lower interest rates’ fuelled rally in risk assets.

Looking Ahead

At the time of writing, the futures markets are pricing in the following changes to official rates:

US Federal Reserve -1.10%

European Central Bank -1.30%

Bank of England -1.00%

With ten-year UK Gilts yielding below 3.7% and their US counterparts yielding 3.9%, there’s a danger that bond and futures markets have got ahead of themselves, or they are forecasting a recession that is deeper than anticipated. It looks like the former presently.

Whether a hard-to achieve soft landing can be delivered in the US in 2024 remains to be seen. The resilience of the US consumer would indicate that any recession might be a shallow one. In Europe and the UK, a recession could already be underway. Importantly for US and UK central banks in particular, tight labour markets (a source of higher wage demands), appear to be loosening.

To put this another way, growth at a reasonable price (GARP aka Value) should deliver a decent return rather than growth at any price (GAAP). Valuation discipline is key and fortunately there are plenty of good businesses with good cash flow and strong balance sheets that are on attractive valuations, especially outside the US.

Reasons to be Careful

- Political uncertainty with elections – notably the US Presidential election in November and a General election in the UK, rumoured to be in May but before year end.

- Disappointed bond markets if interest rates do not fall as much as priced in to futures markets.

- Shipping routes – the Iranian-backed Houthis continue to disrupt shipping in the Red Sea enough to send ships the long way round Africa, avoiding the Suez Canal. Additionally, the Panama Canal has suffered from a drop in water levels and hence, a reduced capacity. Consequently shipping route times have lengthened and using the canal has become more expensive.

- Not just because of the above, but inflation improvement will ebb and flow before settling somewhere near official targets.

- Valuations need to be achievable. Fortunately, there are many companies on low valuations left behind by the passive herd.

- Military conflicts drag on or escalate whether they be in Ukraine, Gaza or Guyana.

- What sort of Northern hemisphere winter will there be? Last year’s mild winter was just what was needed to dilute some of the energy price increases.

- One Trick Pony – the size of budget deficits almost everywhere means that monetary policy will be the only lever authorities can pull to breathe life into faltering economies.