Higher for Longer?

The month of February started with key anticipated rate increases from the US Federal Reserve on the first and from the European Central Bank and the Bank of England on February 2nd. All three were keen to re-emphasise their inflation-fighting zeal.

Stronger than anticipated US employment data, followed by higher than forecast headline US inflation data, have brought about a questioning of the rally in global bonds and equities that has been the feature of the start to 2023. This has been best reflected in the change in both the terminal rate and future path of Fed Funds as depicted in the graph below sourced from Bloomberg. Whereas the peak in Fed Funds was expected to be below 5%, that has now risen to well above.

Pause for Thought

Bond yields in developed markets have risen in response as evidenced by the rise in US Treasury ten-year yields to 3.75% from a low on February 2nd of 3.40%. UK government bonds or ‘gilts’ moved in similar fashion as ten-year yields rose to 3.40% from just above 3%. Equities have appeared to be more resilient, albeit buffeted by earnings reports. While the FTSE 100 flirts with 8,000, the broader based FTSE All Share Index has improved by over 2% in February, although not in a straight line. European and Asian equity indices have been largely flat to up a touch.

Two Economies

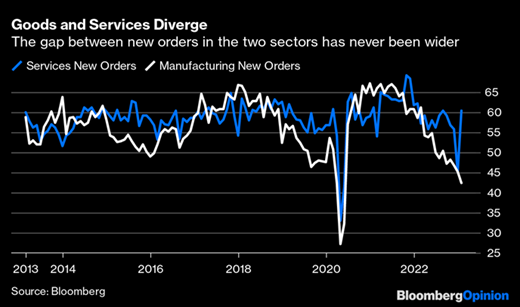

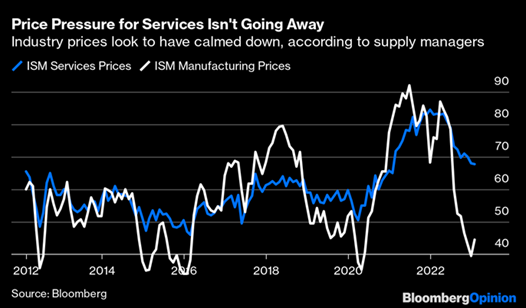

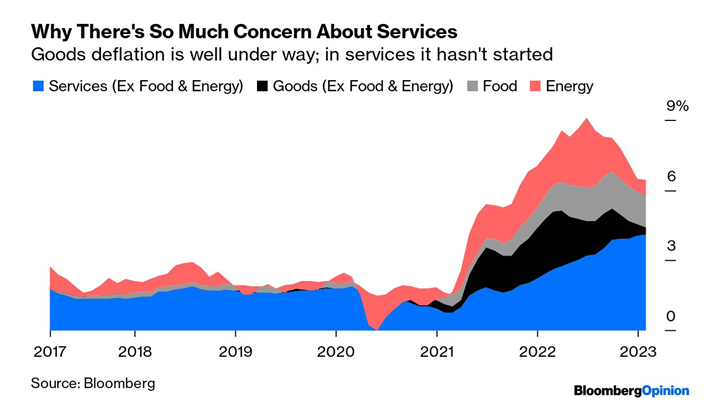

Goods and services. The debate about whether there will be a US recession this year and how deep/shallow it would be somewhat masks the substantial difference between the goods and services sectors of the US economy. The following graphs sourced from Bloomberg, demonstrate the stark difference in respective demand and price pressures. This is also a factor in the employment data strength.

Or as John Authers put in his daily column for Bloomberg:

Mixed Messages

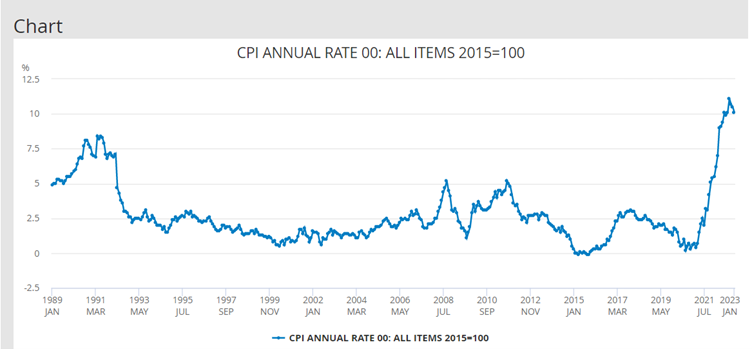

In the UK, wages rose at a 6.7% annual rate in the three months to end December 2022, no doubt unnerving the Bank of England. Better news came the day after the wage data release with UK Consumer Price Inflation (CPI) falling to 10.1% (change over 12 months) in January from 10.5% in December. Still high but a step in the right direction. For context, here is the longer term picture sourced from the Office for National Statistics (ONS).

Your Money

There were only minor tweaks to the funds in the first half of February.

As always, we thank you for your support.