Happy Landings

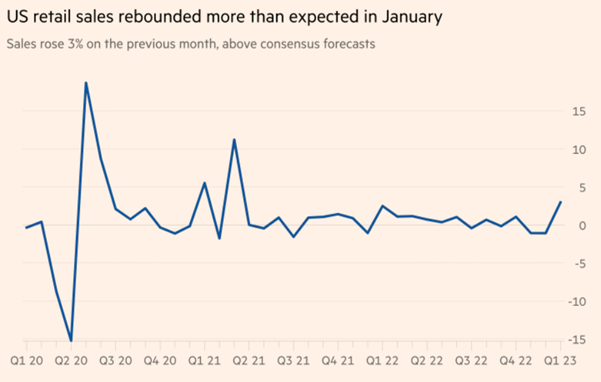

After a strong month for most financial assets in January, the final three weeks of February proved to be more of struggle. While the month started with expected rate hikes from the US Federal Reserve, Bank of England and European Central Bank, the turning point for financial markets came early in February with the release of the US monthly employment data for which was much stronger than expected. Although a lagging indicator, the data’s surprise element was enough to halt the rally in risk assets prevalent from the start of 2023. Further signs of US economic strength emerged mid-month when US retail sales data was released as the figure below sourced from Bloomberg shows.

Source: Bloomberg

Stronger inflation data in the US and parts of the European Union coupled with stronger economic data in the US caused investors to become more defensive after the rally in risk assets that started in mid-October 2022 began to peter out after the first week of February. The change in sentiment revolved around the potential for central banks of the US, UK and the European Union needing to raise official rates by more than previously anticipated in order to quell inflation.

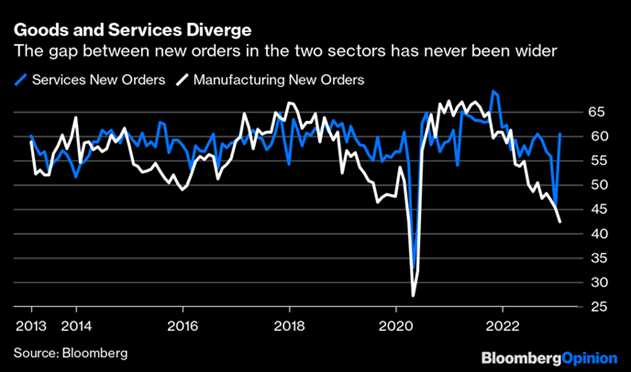

The pace of interest rate hikes already effected is rapid by historical standards, partially reflecting monetary policy being too loose previously. Time will tell whether central banks have been over-zealous in tightening monetary policy, but the robustness of the US services sector and employment has led to debates about what sort of landing the US economy will endure in 2023 – hard, soft, or no landing. Adding to the policy dilemma, there is a marked difference between manufacturing and service sectors in the US as the following chart from Bloomberg illustrates:

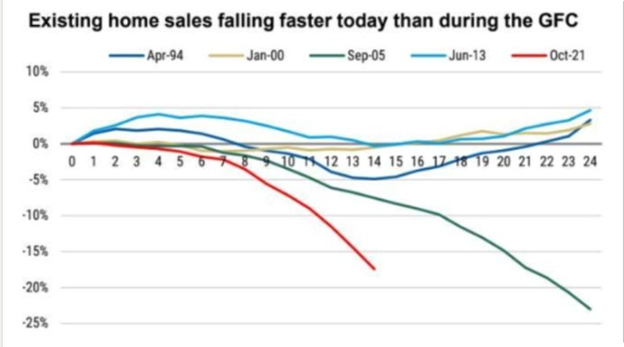

Housing markets in the UK and US have been impacted by higher interest rates. Existing home sales depict a problem for US house prices (see below).

Source: Alfonso Peccatiello, The Macro Compass

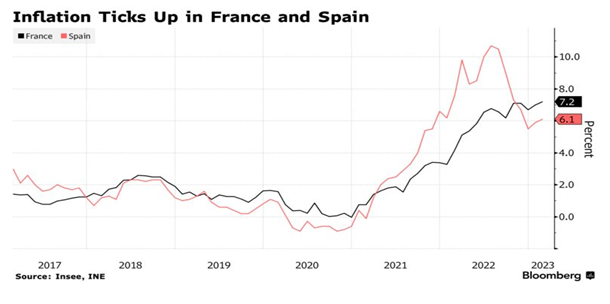

But financial markets were primarily concerned about inflation in February:

Source: Bloomberg

And was higher than expected in the US:

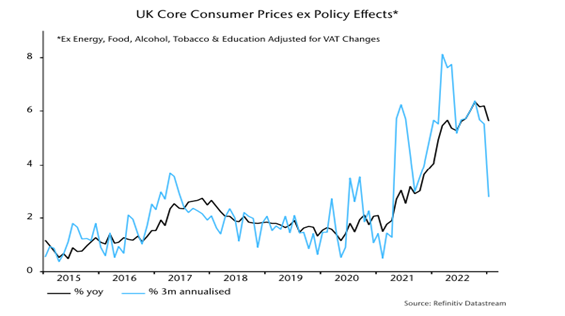

But improved in the UK (note the following chart shows core consumer prices not headline):

Source: NS Partners

Markets

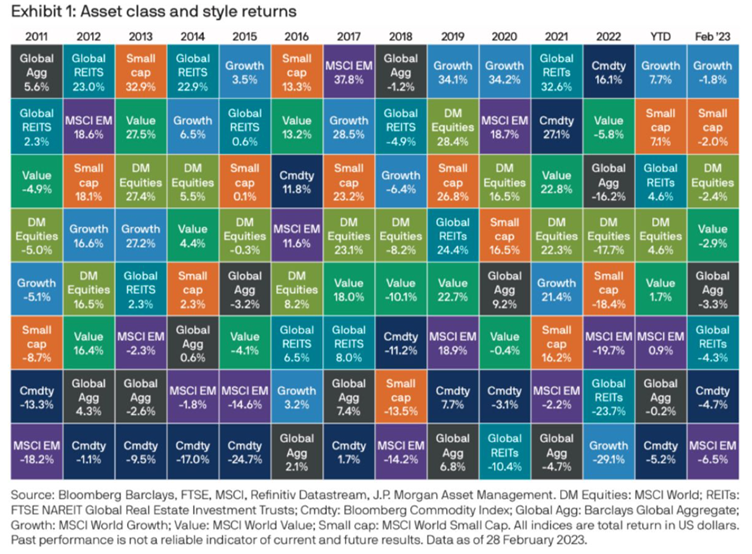

Equities

Source: JP Morgan Asset Management

Over in the far east, China’s reopening-led surge in equity prices faded in February due to profit-taking taking. The region was among the worst performing geographies in February. China’s dominance of the emerging market equity index operated by MSCI led to emerging market (EM) equities being bottom of the style table in February which was headed by growth, albeit with a negative return.

Regionally, the UK was the place to be in February, highlighting the cheapness of growth stocks beyond the FTSE 100. Europe also attained positive territory as the tailwind of substantially lower gas prices underpinned the benefit to costs and margins.

Source: JP Morgan Asset Management

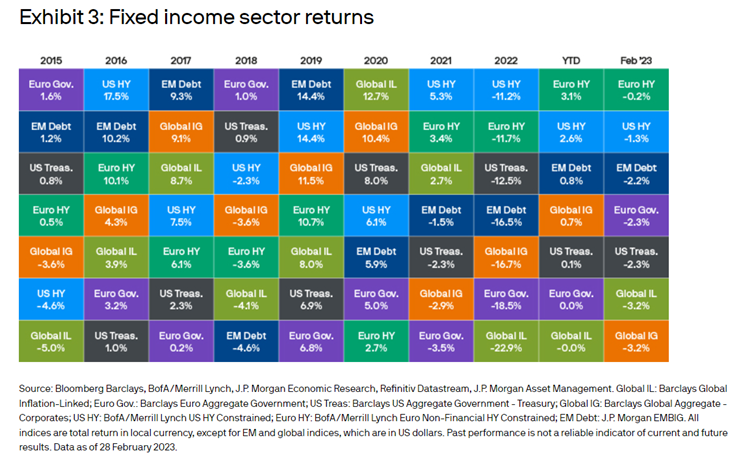

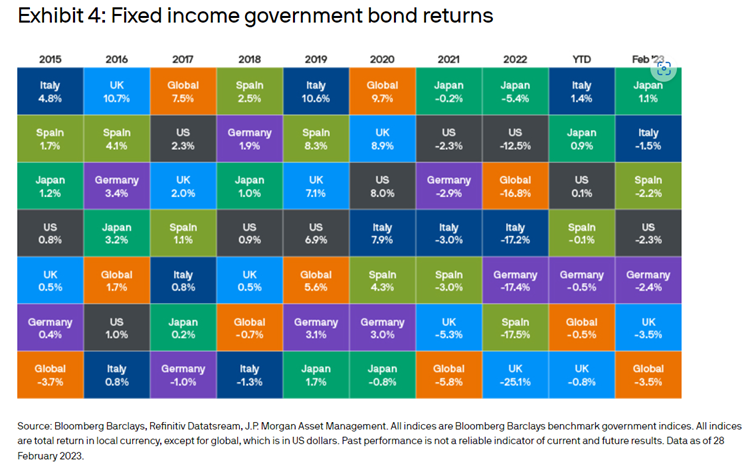

Bonds

Bond markets were the most reactive to the ‘higher for longer’ interest rate likelihood as the following graph of ten-year gilt yields demonstrates From a low of 3.00% on the second of February, yields rose throughout the month and closed out February at 3.83%.

Source: FT.com

Ten-year US Treasury yields performed similarly rising over 0.50% from a low at the start of February to close out February at a yield of 3.95%. German government bonds, a barometer for European government yields, also rose sharply to finish at the month’s high of 2.68%. Bond markets in general suffered from rising interest rates with the income element of high yield helping to offset some of the negative capital returns.

Source: JP Morgan Asset Management

Currency

Firmer than anticipated US economic data helped the US currency to perform well against most currencies in February. Versus sterling, the US dollar increased by over 2% in February. The Japanese yen was the weaker of the major currencies as it oscillated due to speculation over the successor to the retiring Kuroda-san. The academic Ueda-san’s selection should result in a more pragmatic Bank of Japan going forward.