Deflating – Slowly

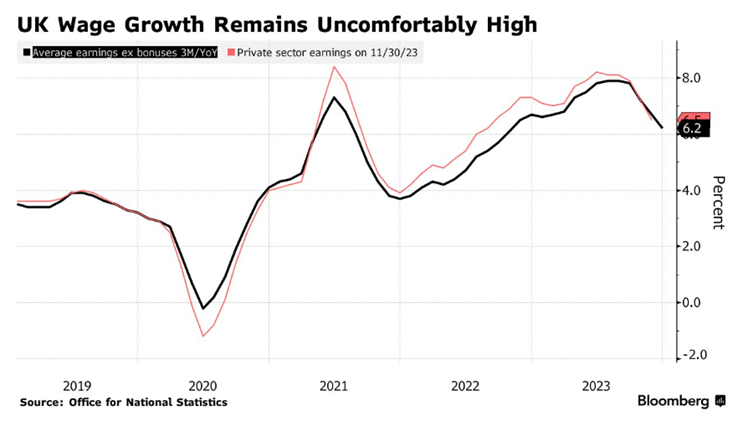

One of the problems for central banks on the path to lower interest rates is the tightness of the labour market and the effect on wages. The UK’s unemployment rate, updated to December 2023 on 13 February, ticked down to 3.8% and wage growth rose to 6.2% – down from its high and previous reading but still high enough to concern the Bank of England (BofE).

Source: ONS/Bloomberg

Note that wage growth slowed to an annualised 2.5% in December from 2.9% previously.

Real Love

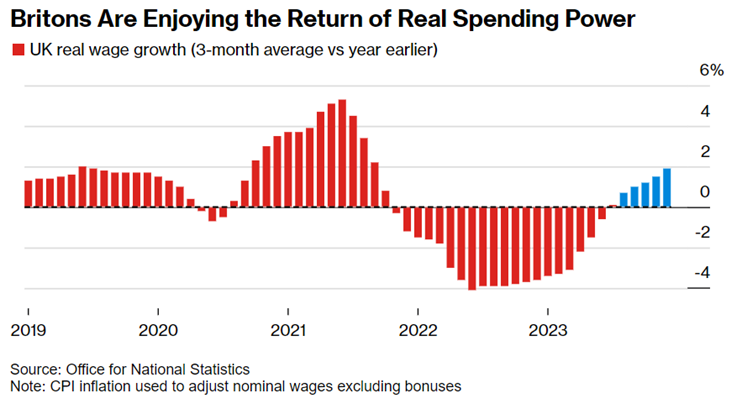

In a week that contains Valentine’s Day, households will be enjoying the real wage gain as wages exceed prices. This is good for economic activity, which endured a technical recession (two consecutive quarters of economic contraction), but is showing signs of an upturn according to BofE Governor, Andrew Bailey – speaking in our neighbourhood earlier this week.

Source: Bloomberg

Meanwhile, across the pond, US consumer price inflation for January was reported on 13 February and was well above expectations. Risk markets took a hit but it’s only one month’s data, and probably reflects risk markets in need of a breather from their recent upturn and a moderation of over-optimistic interest rate cut expectations.

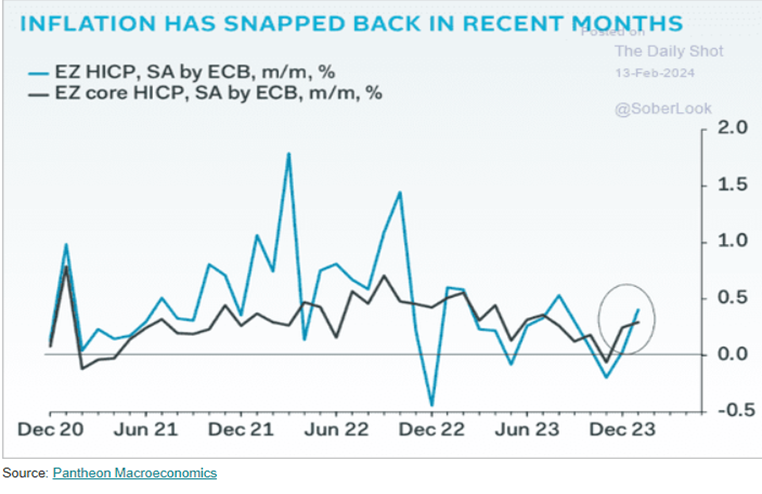

Nor has Europe’s inflation picture gone to plan.

Source: Bloomberg

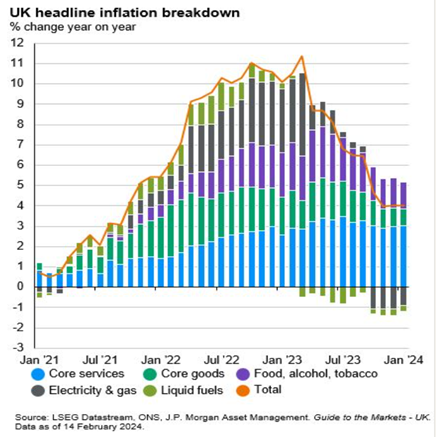

Although the UK stayed put at 4% inflation, expectations were bettered.

Source: JP Morgan Asset Management

Building Blocks

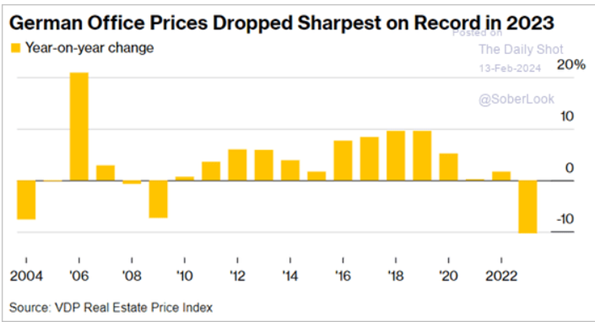

Commercial real estate loans are continuing to blight the prospects for US regional banks, as previously mentioned in our recent communications. As well as having to pay more deposits and adversely affecting their net interest margins, regional banks are once again in the spotlight ahead of the end of the Bank Term Funding Program (BTFP) constructed a year ago by the US Federal Reserve to alleviate funding difficulties. The problem is not constrained to the US; German office prices fell the most on record in 2023 with German Landesbanks feeling the pain.

Source: The Daily Shot

Geopolitics

Have got worse but as yet, no real impact on financial markets. A watching brief.

Your Money

So what does the macro picture above mean for financial markets and the T. Bailey Funds? Official rates are headed lower but the over-optimism that marked the end of 2023 has been diluted to more reasonable levels, e.g. four 25bps cuts are now expected in the US rather than seven. US Treasuries are becoming more interesting to add to (on currency-hedged basis) with ten-year yields above 4.25% and offering a margin of real yield (above inflation). UK Gilts look too skinny with inflation at 4%, albeit going lower, with yields below their US counterparts.

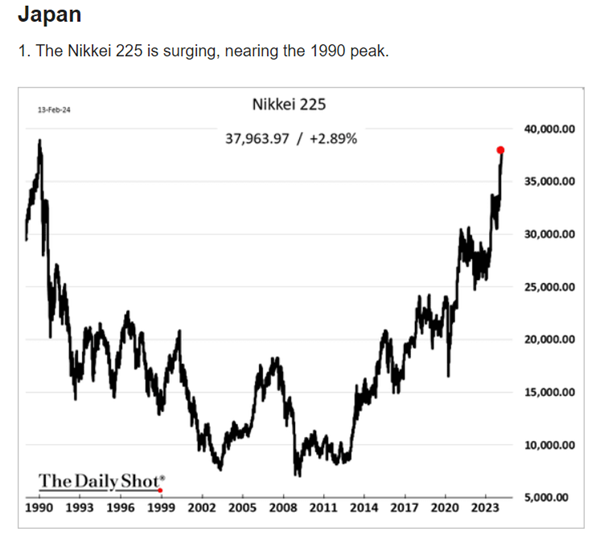

While inflation improvement has stalled, it is likely to show lower levels in the months ahead. Our focus for equities remains on thematic exposures to robust, profitable businesses that are attractively priced supported by exposures to cheaper markets such as the UK and Japan.

Our longer-term belief in corporate governance reform in Japan, and increased exposure last year, has helped performance as the Nikkei 225 index has ascended to levels not seen in over thirty years.

Source: The Daily Shot

We continue to believe in Japan as the corporate governance reform remains the driver of Japanese equities and the market remains inexpensive.

China is something of a mess, the bazooka has come too late and needs a bigger bazooka to turn the economy round. We have minimal exposure to China (less than 1%) and it is likely to stay that way for the foreseeable future.

One holding which continues to prosper and rise from last year’s lows, is the Chrysalis Investment Trust held across the three multi-manager funds. The prospect of a public offering for one, maybe two, of their holdings has seen Chrysalis rise 28% over the past month and is still undervalued in our opinion.

Two Years On/Timing

The critical path to launching a new fund is a long one before the regulator gives the green light. Our desire to launch the T. Bailey UK Responsibly Invested Equity Fund – a directly-invested responsible UK equity fund seeded by T. Bailey’s founding family and in line with their long-term investment objectives, got the go-ahead to launch on 14 February 2022. A few days later, President Putin invaded neighbouring Ukraine. Timing isn’t everything and as investors should know time in the market is better than trying to time markets.

It was not a great time to launch a new investment product, especially as the sectors doing well for most of 2022 were those largely excluded by the fund’s responsible aims, fossil fuel companies and miners being good examples.

The attractive values of UK companies with strong cashflows and balance sheets, the kind that meet our quantitative financial metrics, have given a significant bounce to the UK Responsibly Invested Equity Fund since October 2023.

Companies held in the Fund must also meet our proprietary CleanScreen qualitative metrics to ensure investments are in responsibly run businesses conscious of their societal role. This has helped the Fund enjoy a meaningful bounce of 10% over the past three months. Fourteen of the Fund’s twenty five holdings have risen in double-digit percentages with five of those up in excess of 20%. This coincides with a change in UK Interest rate expectations and inflation moderation, which we see continuing.

Finally, you will have seen our emails regarding a change to the structure of our Authorised Corporate Director (ACD), Waystone Group. Investors have also received a letter about this. We would like to emphasise again that this change is purely administrative within the Waystone Group and has no impact on the investment management team or how the T. Bailey Funds are managed. T. Bailey Asset Management’s investment strategies, expertise, and commitment to delivering value to our clients remain unchanged.