Leap Month

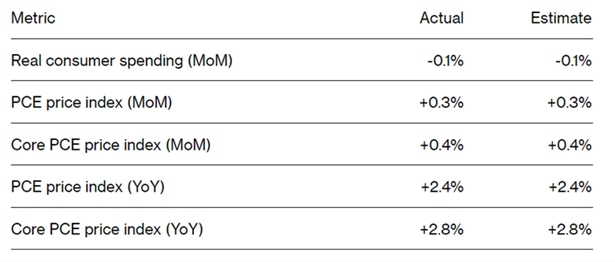

The final day of February 2024, this year it’s the 29th, brought the latest update on US inflation or, to be more precise, the US Federal Reserve’s preferred measure of US inflation – the core personal consumer expenditures (PCE) prices index, which was released for the month of January.

This is the last piece of this data that the US central bank will get to see before it meets on March 19th and 20th to debate, amongst other things, interest rates. No change in official rates is expected at that meeting and (over)optimism about the magnitude of rate cuts in 2024 has moderated from seven 0.25% reductions at the close of 2023 to a more plausible, three. Below is the latest PCE price data:

Source: Bloomberg

While the inflation and employment data released in February was either in line with or stronger than estimates, forward looking data on both those key inputs should give some comfort to the US Federal Reserve. In recent years, especially in winter months, the price of natural gas has been a key metric of concern. Its recent fall has been somewhat overlooked. The following chart from Schroders, illustrates the price decline:

Source: Schroders

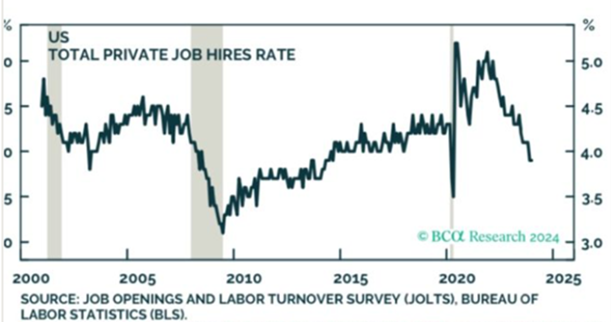

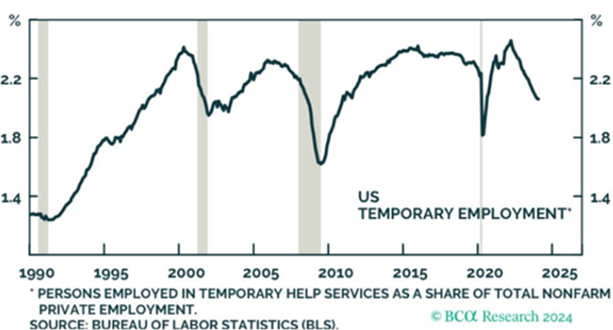

The following charts show that both temporary and permanent job hiring is on a downward path:

Source: BCA Research

The Federal Reserve will also be keeping a close eye on the size of the rapidly expanding US Government debt, leaving it as the sole lever to offset any economic ills as well as the level of consumer debt and drop in savings rate plus the level of commercial real estate exposure at regional banks.

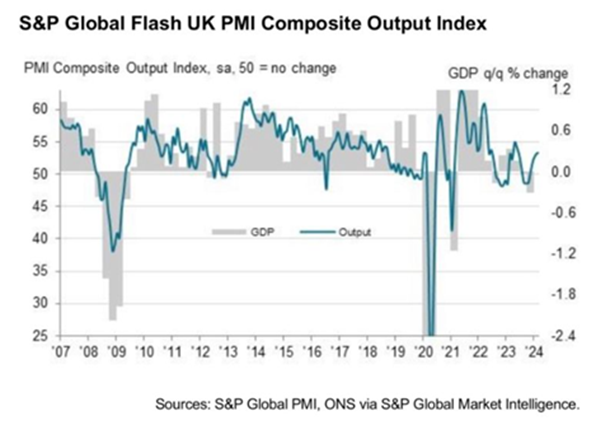

Green Shoots in the UK?

Better prospects ahead in the UK potentially according to the following chart:

Source: Bloomberg

China – The Year of the Dragon or Phoenix?

We are now in the Chinese year of the Dragon while Chinese authorities are belatedly attempting to kickstart the economy. February saw another weak manufacturing purchasing managers index reading of 49.1, a fifth straight decline. The property market overhang needs a radical solution.

Markets

Equity Regions

Despite no let-up in geopolitical concerns, conflicting economic signs in the world’s largest economy and ongoing disappointments from the second largest, equity markets have been buoyed by earnings from some of the increasingly dominant (in a stock market sense too) companies.

Nvidia’s earnings announcement on the 21st of February focussed investors’ attention and the chip manufacturer didn’t disappoint them or markets. Although much of the hype came from the accompanying bullish outlook from CEO, Jensen Huang.

Away from the US equity market, Japanese stocks continued their impressive run on the back of a corporate governance reform that has been long in the making and reaping rewards through upward momentum in share prices. The Nikkei 225 index finally exceeded its 1989 high in February.

Elsewhere in Asia, after a torrid time, Chinese stocks bounced on optimism of a turnaround in Chinese officials’ approach to their lacklustre economy. This rebound helped the region’s equity markets.

Europe’s disappointing economic performance with Germany at the fore did little to hamper a decent month for European equities. It should be noted that like the US, there are a number of leading global companies providing strong returns such as France’s Schneider Electric and Denmark’s Novo Nordisk, up 14.8% and 9.8% respectively in February.

Equity Themes

Perhaps unsurprisingly, artificial intelligence led the way followed by healthcare. Also delivering a strong month were climate change, insurance and materials. While insurance may seem an odd theme, the ability to annually re-price your market is a beneficial quality and the rise of bespoke insurance solutions adds to the price-making ability in a marketplace with fewer reinsurers. Beazley, held in our UK Responsibly Invested Equity Fund, is a good example and was up 19.7% in February.

Bonds

The optimism pervading developed equity markets didn’t crossover in to debt markets. The decline in rate cut expectations in the US, UK and Europe led to a sell-off in government bond markets as yields rose. The positive carry from high-yield credit markets helped to offset some of the negative performance from government debt.

Commodities

Industrial metals were a mixed bag with copper down 1.0% on the month. Nickel bounced continuing its volatile recent history. Agricultural commodities were weak overall.

Real and Digital Assets

Gold had a positive month seemingly supported by central bank purchases and ongoing demand as an alternative currency. Bitcoin continued its surge which started in earnest after it became available in exchange traded fund form on January 11th, giving would-be holders greater confidence.

Source: Bloomberg