The opening months of 2025 have underscored the transformational forces reshaping the global market trends of recent years. Hot on the heels of DeepSeek, a Chinese entrant to advanced AI models, February began with the announcement of yet another model, called S1, but this time developed by Stanford and Washington University researchers. Designed to compete with OpenAI’s o1 model, it was reported that S1 was trained for less than $50 in cloud computing resources on 30-minutes of runtime using 16 Nvidia H100 GPUs. This highlights a critical shift: AI development is no longer confined to tech giants with vast resources. Such commoditisation of AI technology lowers entry barriers but raises the stakes for differentiation. Companies with proprietary datasets, such as healthcare providers or logistics firms, are increasingly positioned to outpace competitors relying solely on generic AI tools.

The security that surrounds valuable datasets is crucial however, and companies such as CrowdStrike and Palo Alto Networks, which provide security assurances to their customers, have been relative performers year to date as the AI story bifurcates between commoditised product and high value software solutions. Nonetheless, mindful of the lofty valuations that are a feature of the AI theme, we trimmed exposure to the First Trust Nasdaq Cybersecurity UCITS ETF (held in the T. Bailey Multi-Asset Growth and T. Bailey Global Thematic Equity Funds) at the end of the month.

Whilst innovation will continue to accelerate in AI beyond the domain of the resource rich technology companies, international relations are contending with a turning point through an unprecedented shift in US policy. President Trump’s tariff threats, along with his inconsistent follow-through, caused financial markets to show signs of instability in February, despite their resilience earlier in his presidency.

Year-to-date relative performance of selected US equity sectors

Source: FE Analytics. Total return relative to the S&P 500 index.

Tariffs are one factor driving inflationary pressures that will likely define a very different decade ahead for investors. In this context, US inflation has picked up again, rising to 3% as of the last reported data point, surpassing economists’ predictions and putting additional pressure on interest rates. This favours sectors less sensitive to borrowing costs, such as healthcare and insurance, which have shown resilience compared to the highly valued information technology and consumer discretionary sectors. These latter sectors are underrepresented in the TBAM funds of funds, despite constituting a significant portion of US equity market indices.

On the US domestic front, its recently created Department of Government Efficiency (DOGE) led by Elon Musk has issued an ultimatum to federal employees to document their weekly productivity or face termination. Already thousands of probationary federal workers have been laid off. Whilst the numbers are small in comparison to the US economy (even with economic multiplier effects) this does little for wider worker confidence.

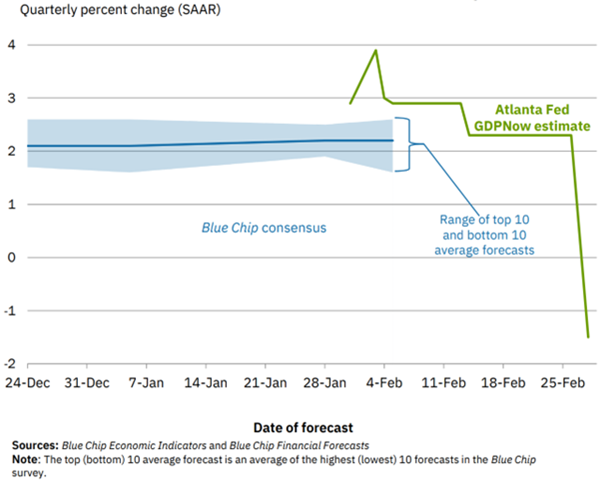

Thus, contrary to the prevalent “Make America Great Again” rhetoric, the Atlanta Fed’s GDPNow model, a running estimate of real GDP growth using currently available economic data, estimates for Q1 that US GDP growth violently plunged from +2.3% to -1.5% by the end of February, largely on the back of a huge increase in imports during January and a sizeable drop in consumer spending during the month. As of the time of writing this report the estimate has fallen further to -2.8%.

Atlanta Fed GDPNow real GDP estimate for 2025: Q1

Source: Federal Reserve Bank of Atlanta, 28 February 2025.

In contrast, and in response to the US administration’s shift in its foreign policy, other nations have begun to doubt their reliance on the US. Friedrich Merz, Germany’s chancellor-in-waiting, has questioned the commitment of the US towards Europe and has emphasised the need for Europe to boost its own defence capabilities. For Germany this could represent as much as 1% of the nations GDP. The scale of European potential, should it speak with one voice, should not be underestimated.

Relative Economic Size of the EU

Source: Fulcrum, 28 February 2025.

As President Trump continues to leverage the US exceptionalism narrative towards political ends, financial markets have, so far in 2025 at least, voted in favour of non-US assets. Breaking with the trend of the last 10 years, US equities have begun this year lagging in performance relative to other major equity markets.

3-month performance of US and Europe ex UK equities

Source: FE Analytics. Total return, GBP terms.

Markets

Equities

Over the last decade, the value equity markets have placed on a dollar of US earnings has grown from around 1.2 times that of the rest of the world to over 1.6 times. In the case of comparison with the UK, US earnings are valued nearly double.

US Equity Market Premium over Non-US Equities

Source: LSEG Datastream.

Bonds

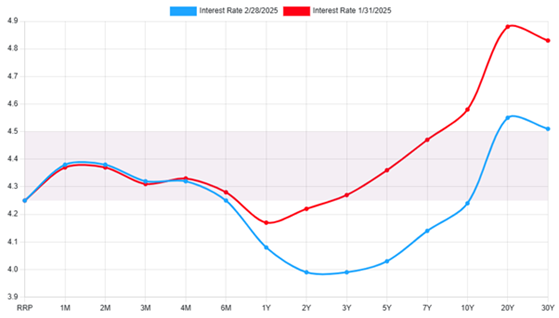

The US Federal Reserve’s “wait-and-see” stance on further interest rate cuts has seen short-term yields anchored whilst the longer end of the curve has declined as US treasuries have rallied.

US Treasury Yield Curve

Source: www.ustreasuryyieldcurve.com

Longer term yields face tension between concerns over slowing growth, skepticism surrounding fiscal sustainability and inflation uncertainty. The increasing inversion of spreads in the middle of the curve over the month reflected the bond market’s increased anxiety over weakening economic growth data. The allocation to US treasuries in the T. Bailey Multi-Asset funds contributed to their performance over the month.

Commodities

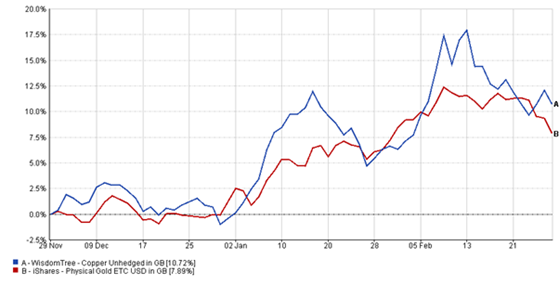

Performance of Gold and Copper ETCs held

Source: FE Analytics. Total Return, Sterling Terms

Gold has rallied almost 9% year-to-date in US dollar terms, buoyed by its dual role as an inflation hedge and safe-haven asset. The T. Bailey Multi-Asset Funds’ 4.5% allocation to the iShares Physical Gold ETC has provided meaningful portfolio diversification during February’s volatility and contributed to performance.

However, the standout, albeit somewhat volatile, performer so far this year has been copper, which has continued to reach new record highs and is up 10% year to date in sterling terms.

Your Money

Whilst the monthly factsheets for the T. Bailey funds of funds provide asset allocation information for the thematic and regional focus of each of the underlying funds held, a more detailed description involves looking through those portfolios to the underlying assets held by each of these sub funds.

Asset class exposure of T. Bailey funds of funds

Source: T. Bailey, underlying third party manager portfolio data.

In doing so, we continue to maintain broad diversification across regions, sectors and asset classes alongside a focus on relatively cheaper non-US assets.