Deflating

The good news for central banks is that inflation is falling in developed markets. The energy picture in Europe, in response to a warm winter, will have a significant impact on lower inflation and be a boost for European businesses. China’s re-opening should be good for other markets too. Investors have become fixated by US employment and inflation data as financial markets dare to ‘fight the Fed’. Indeed, despite improving data (from an inflation perspective), central banks remain in tough-talking mode.

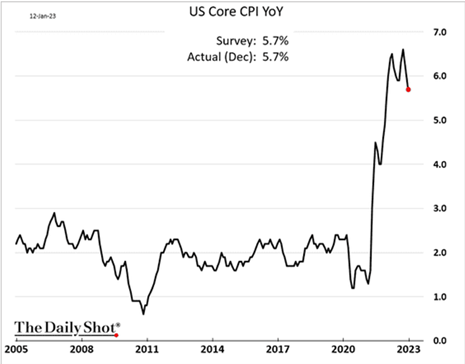

Double Top

While I did tune in to watch an epic world darts final, which featured a number of double top finishes, the chart below sourced from The Daily Shot is one for all you amateur chartists out there. What looks like a double top may encourage the US Federal Reserve; they would also point out, there’s some way to go to get inflation where they want it.

Source: The Daily Shot

Others might be more optimistic that US inflation will fall. The following statement from Alpine Macro discusses what its internal model is forecasting for 2023/4.

Source: Alpine Macro

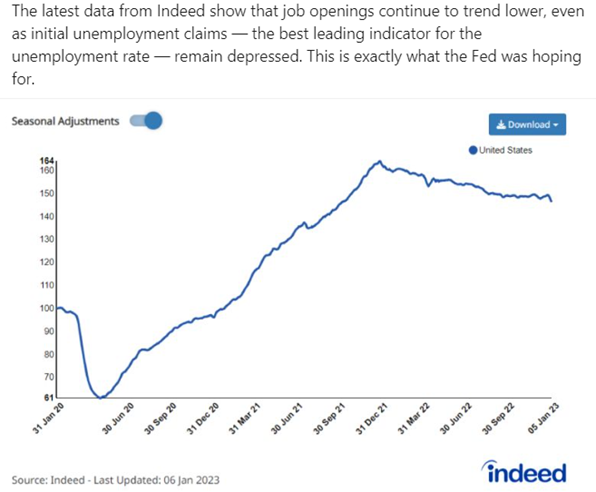

Unemployment remains low but there was encouraging news from US average hourly earnings in the employment report released during the first week of January. The following analysis from BCA Research illustrates and explains the point.

Source: BCA Research

The rude health of the US consumer has been highlighted as a reason why a US recession might be avoided. However, the following graph sourced from the US Bureau of Economic Analysis shows a concerning development in US savings.

Source: US Bureau of Economic Analysis

This and recent weaker economic data emphasise our focus on robust underlying businesses in long-term demand themes not dependent upon leverage (borrowing costs), labour availability or consumer discretionary spend.

Good news in Europe from a seasonally warmer winter and high storage levels of gas has resulted in plummeting gas prices as the following graph from Absolute Strategy Research illustrates. Good news for European inflation and for European economies and businesses. European equities have responded accordingly.

The Euro has recovered amid a weaker US currency reflecting weaker US economic data. The change in Japanese interest rate policy, via the yield control for ten year government bonds, has provided a significant boost to the Japanese yen.

UK equities recovered strongly in the face of a difficult economic and political backdrop. The cheapness of the market outside the FTSE100 has attracted buyers.

China’s abrupt reopening and end to its zero-Covid policy has given further fuel to Chinese equities. While the death toll officially reported is implausible, local research indicates that infections are topping out in the major cities.

In the short-term, financial markets have taken on much good news via bond and equity performance and caused cash to be invested by institutional investors.

Your Money

There were no meaningful changes to the funds in the first half of January. Cash invested in the final quarter of 2022 has added to the funds’ relative and absolute performance improvement.

We thank you for your continued support and are looking forward to a better year. It is now beyond the date to wish people a happy new year but we will not

miss this opportunity to wish all our investors and readers a happy, healthy and rewarding 2023.