The Hangover

Financial markets began 2024 like markets that have enjoyed themselves too much in the run up to Christmas. As we indicated previously, over-optimism was in play with regard to futures markets’ official rate reductions forecast for 2024 in the US, UK and Europe. Consequently, bonds and equities both sold off before recovering somewhat in the second week of January.

Markets were perturbed by stronger than expected US unemployment data and Consumer Price Inflation (CPI) in weeks one and two of January respectively.

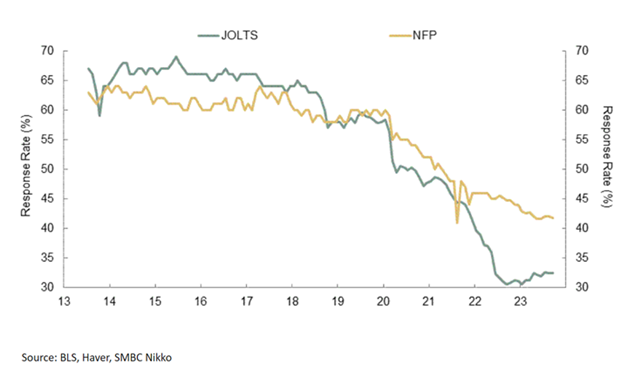

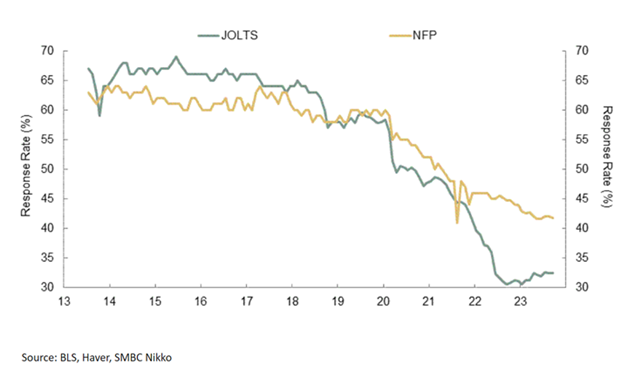

Usually released on the first Friday of the month, US unemployment data is given too much attention. It is, after all, a lagging indicator. Courtesy of Bloomberg’s John Authers, further dilution of its importance has been highlighted by the significant drop in the number of respondents that make up the survey behind the data – as the chart below clearly demonstrates. The data may still move markets, but should it?

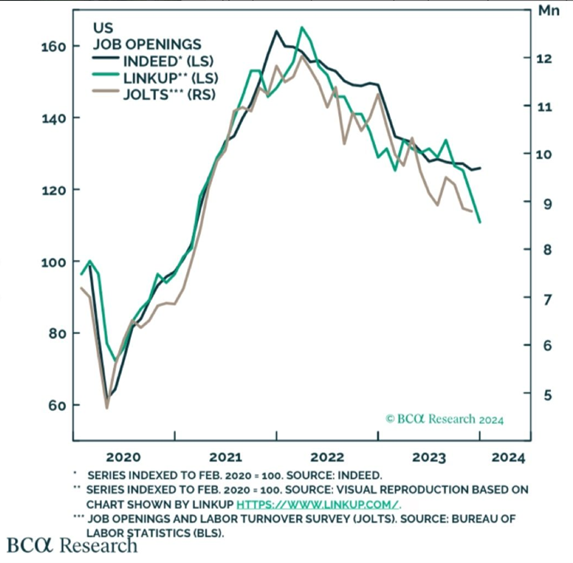

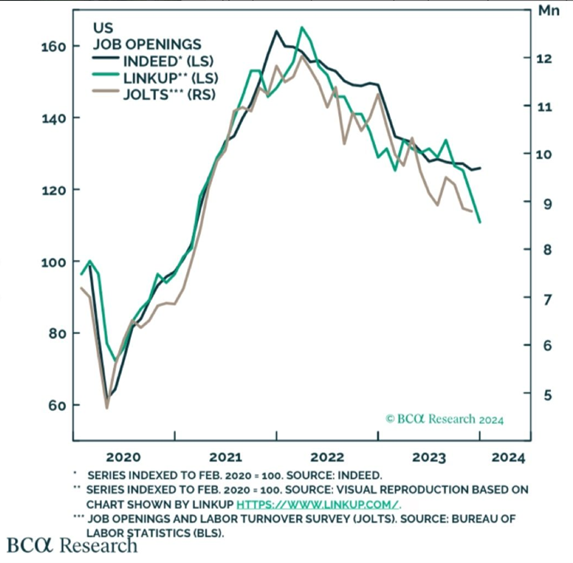

A better view of the employment/unemployment trend can be seen from the following chart from BCA Research:

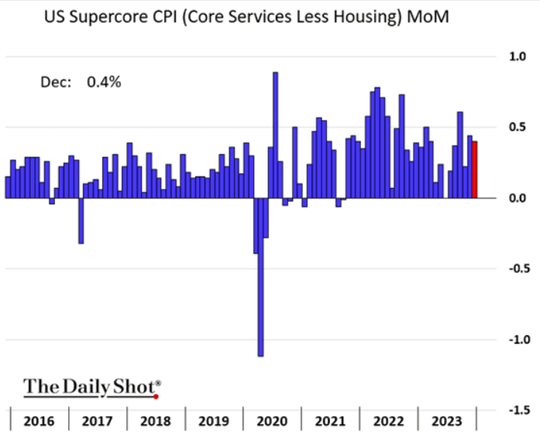

The US inflation picture continues to improve – slowly. The chart below sourced from The Daily Shot, shows the latest improvement (in red) in the Federal Reserve’s closely watched inflation barometer:

Canals

Less use of the Suez and Panama canals, resulting in longer and more expensive routes, is raising concerns over a potential supply side inflation pick-up. Comparisons with the post-pandemic era lack the input of a much lower demand side of the equation this time. It’s too early to make long-term calls on the inflationary impact of Houthi rebel activity in the Red Sea below the Suez Canal or the El Nino impact of lower water levels in the Panama Canal.

Polls Apart

Half the world’s population will head to the polls in 2024. They also represent half the world’s economic output. The first of those elections has occurred with Taiwan electing William Lai in their Presidential election, announced on 13 January. Lai’s victory may cause concern in the region as he was the candidate disapproved of by the Chinese. Financial markets may fret about rising tensions between China and Taiwan, the prospect of Donald Trump returning to the White House after November’s US Presidential election, the spread of conflict in the middle east and war-mongering elsewhere such as on the Venezuela/Guyana border.

Globally, economies are either slowing or struggling to grow. Futures markets may still be at odds with US, European and UK central banks, having been poles apart as 2023 concluded. Caution is warranted in asset allocation.

In Case You Missed It (ICYMI)

In the latest UK Business Insights published on 11 January by the Office for National Statistics (ONS):

- Fewer than 1 in 10 (7%) of businesses experienced worker shortages in late December 2023; this is down one percentage point from mid-December and down from the 12% reported in late December 2022.

- More than 1 in 10 (11%) of businesses reported that employee hourly wages had increased in December 2023 compared with November 2023.

- In December 2023, 69% of trading businesses reported that they were able to get the materials, goods or services they needed from within the UK, up two percentage points from November 2023; in contrast, 3% were unable to get the materials, goods or services they needed from within the UK, broadly stable over the same period.

- The percentage of businesses with 10 or more employees that reported global supply chain disruption in December 2023 remained broadly stable from November 2023, at around 5%.

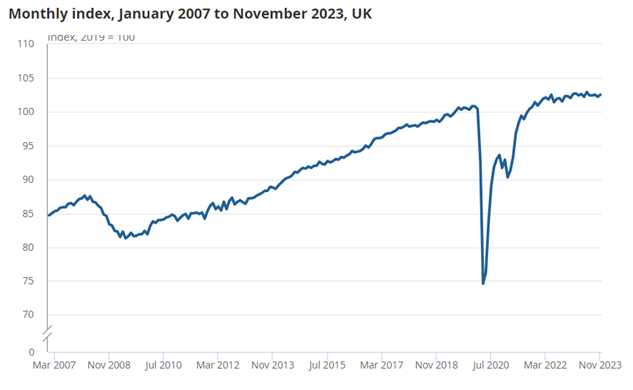

And, also from the ONS, the UK economy as measured by Gross Domestic Product (GDP) is estimated to have grown by 0.3% in November 2023 after a similar fall in October. Green shoots?

Source: ONS