Good News/Bad News

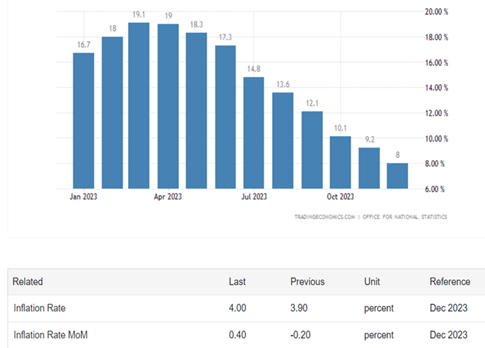

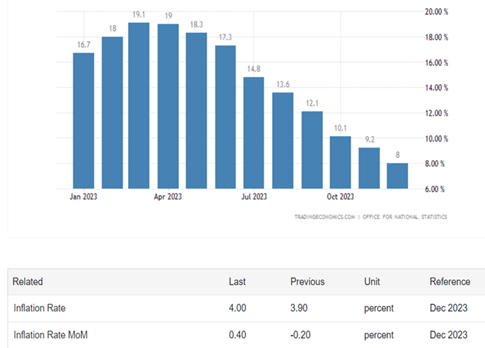

Inflation in the US improved, in the UK it faltered yet the trajectory remains downward; food inflation was the lowest since April 2022 on a year-on-year basis when data was released in January.

Source: TradingEconomics.Com/Office for National Statistics

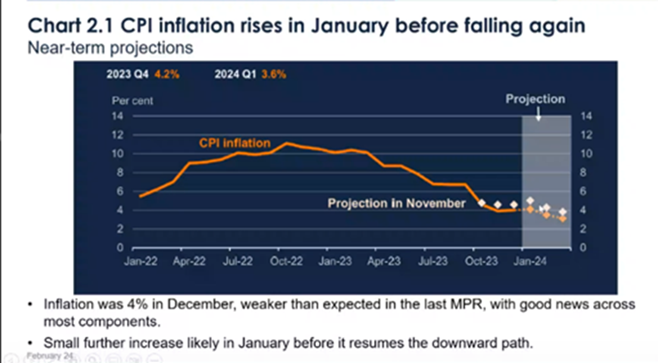

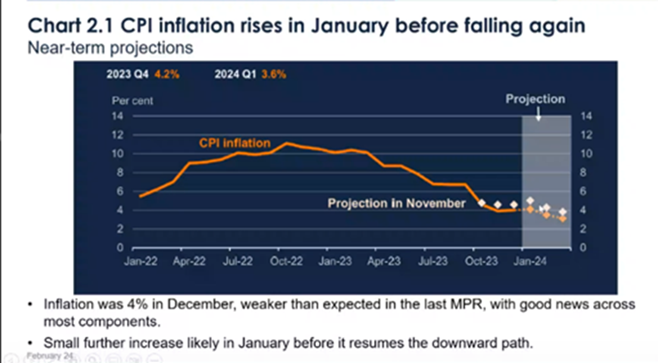

According to the following graph from the Bank of England’s National Survey of Regional Agents, inflation may tick up again before falling.

Source: Bank of England

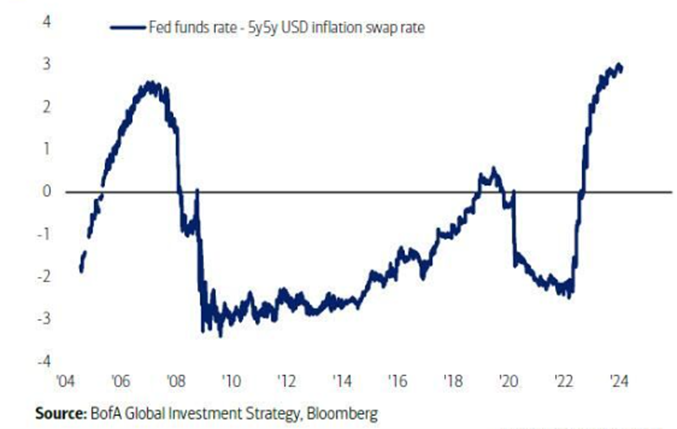

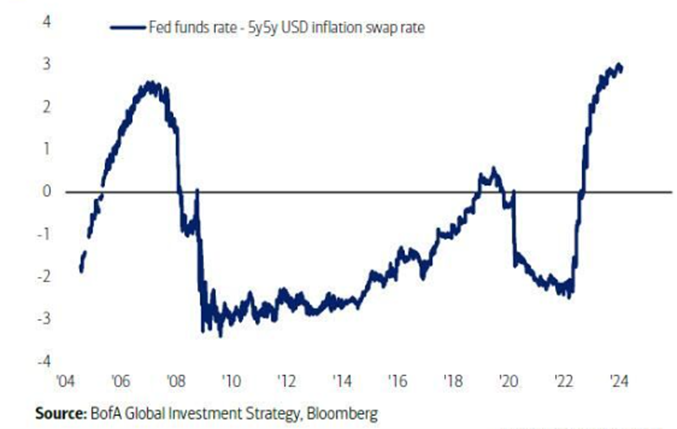

The US Federal Reserve’s favoured measure of inflation reached its 2% target while economic growth in the world’s largest economy surpassed expectations in 2023 by growing at a 3.3% clip in Q4 2023 and at 2.5% for the whole of 2023.

With Fed Funds at their recent peak and yet to commence falling, real Fed Funds (Fed Funds minus 5year forward inflation swaps) is at an elevated level.

Source: Syz Group

Rate Expectations

Performance across asset classes was mixed in January. Stronger US growth data, coupled with pushback from central bankers on the market’s dovish outlook for rate cuts, proved a less positive environment for bond markets. Equities were aided by economic data that further fuelled hopes for a ‘soft landing’. This optimism was slightly tempered on the last day of January when the Federal Reserve (Fed) struck a less dovish tone at its January meeting.

China Cracks

Developed market equities were up 1.2%, while emerging market equities, heavily influenced by China, were down 4.6%. Despite more stimulus from the People’s Bank of China (PBOC), it looks like they left it too late to get the economy going having expected a post-Covid demand surge which never materialised. The bankruptcy of Evergrande highlights the parlous state of the Chinese property market.

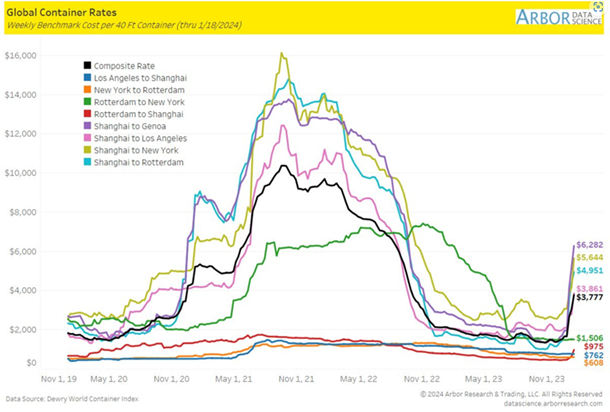

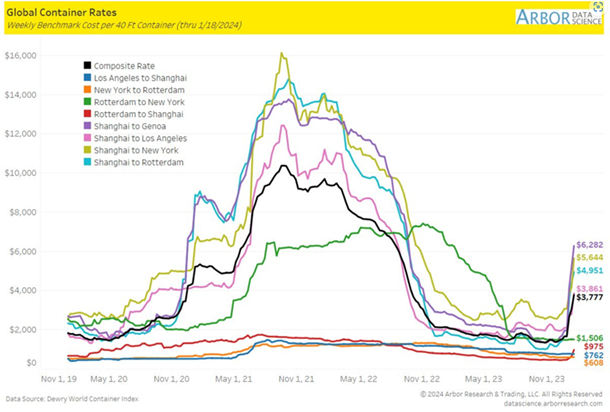

Commodities rose in aggregate, with the broad Bloomberg Commodity Index rising 0.4% over January. Oil prices rallied as tensions in the Middle East worsened and disruption to shipping through the Suez Canal continued. Drone attacks on Russian energy infrastructure added to the uncertainty in the global oil market. It has also raised container rates and insurance rates for shipping goods as the following chart from Marquee Finance and Arbor Data Science illustrates. Although this time the post-pandemic demand surge is absent.

Source: Marquee Finance and Arbor Data Science

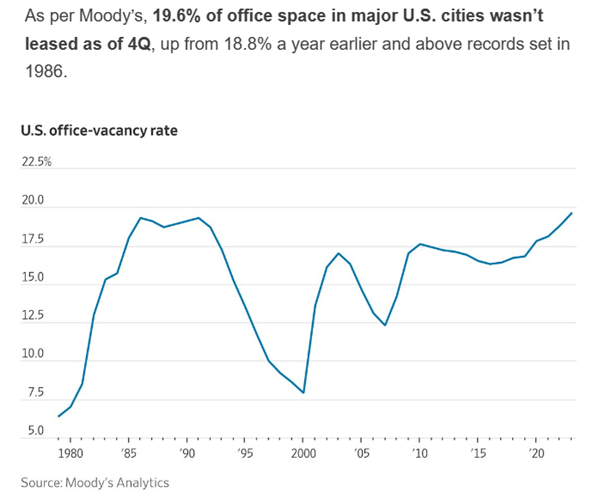

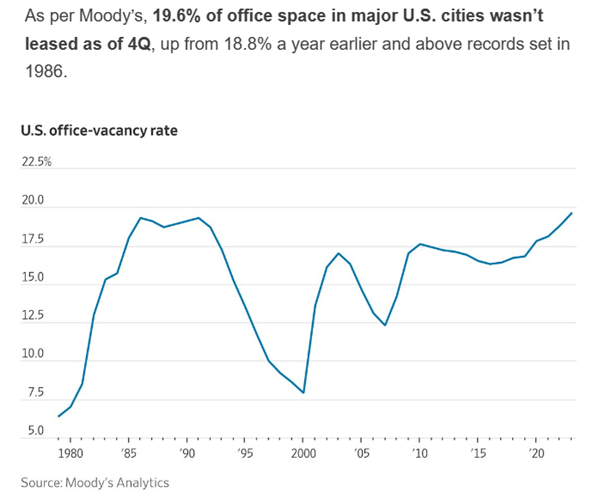

CRE & Regional Banks

Commercial real estate (CRE) exposure remains a problem in the US. The big money center banks posted good results in January, notably JP Morgan feasting off the free lunch handed to them by the Fed – where it was possible to borrow from the Bank Term Funding Program (BTFP) and deposit that money back at the Fed at a higher rate!

The BTFP will cease to exist on March 11, one year after its implementation – as announced on January 24th. It was put in place to provide access to funding post the failures of Silicon Valley Bank and Signature Bank last March. The acquirer of Signature Bank, New York Community Bancorp, saw its shares fall 40% on the last day of January after it cut its dividend and posted a loss. The increased costs of retaining deposits have reduced net interest margins and concerns remain about regional banks exposure to an ailing commercial real estate market. Has last year’s regional banking crisis been dealt with? Does the Fed know something we don’t?

Source: Marquee Finance by Sagar

Rising Sun

The best performing major equity market in January was the TOPIX Index, up 7.4% on the month (in Yen) , continuing the strong performance seen last year on the back of cheap valuations and continued corporate governance reform. Debate remains over when the negative interest rate policy (NIRP) is removed.

In the US, the S&P 500 Index reached record highs in early January as optimism around a ‘soft landing’ scenario continued the rally in the ‘Magnificent Seven’ stocks. A number of data releases pointed to the ongoing resilience of the US economy. A GDP print of 3.3% annualised for the fourth quarter was significantly above consensus expectations. Following a strong start, the S&P Index closed the month on a weaker note, as the hawkish tone at the Fed’s January 31 meeting was not taken well by risk markets. The Fed explicitly noted that a March cut seems unlikely.

The MSCI Europe ex-UK Index delivered positive returns of 2.1% in January. The European Central Bank (ECB) kept rates on hold at its January meeting and re-iterated its commitment to remain data-dependent. The composite purchasing managers’ index (PMI) rose 0.3 pts to a preliminary 47.9 in January, its highest level since July. The manufacturing measure beat expectations by 1.8 points, suggesting that activity in the sector bottomed out in the third quarter.

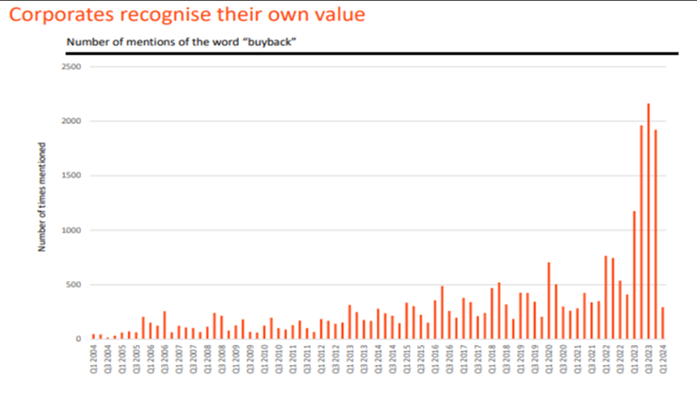

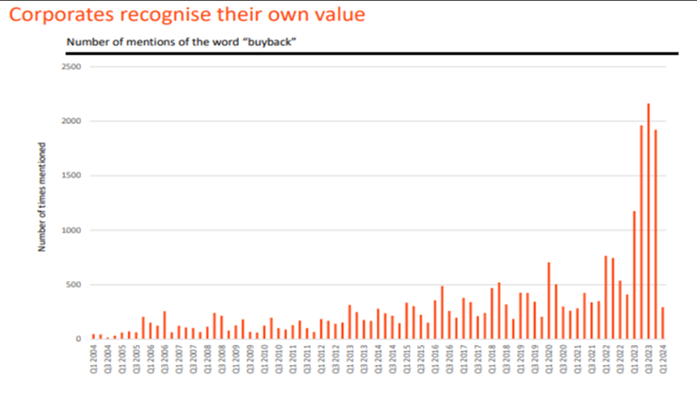

UK equities stalled in January, with the FTSE All-Share falling 1.3%. On the one hand, there have been signs of growth momentum accelerating in the UK, with the flash composite PMI increasing 0.4 points to 52.5, and consumer confidence hitting a two-year high in January. This optimism was tempered by the latest retail sales print, which fell sharply by 3.2% month-on-month, although possibly weather-related. There were signs of optimism that the cheap valuations for well-run profitable businesses were getting noticed. Increased corporate activity and evidence that buying your own stock back was an attractive use of capital. The following chart illustrates the increased reference to buybacks in company statements over recent months.

Source: Bloomberg/Investec

In China, the domestic economy continued to struggle, with disappointing retail sales and further deterioration in housing activity. Fourth quarter GDP grew 5.2% year-on-year, in line with expectations, but still historically weak. Although the PBOC announced a number of stimulus measures, they remain behind the curve in the quest to re-ignite activity.

Global government bonds were down 1.8% over the month with UK Gilts lagging, due to still elevated wage growth making the prospect of imminent rate cuts from the Bank of England (BoE) look unlikely.

Within credit, the European high yield bond market was the outlier in posting positive returns, delivering 0.9%, while its US counterpart delivered flat returns over the month. Global investment grade credit, meanwhile, posted negative returns in January despite spreads tightening. Credit spreads look tight so pursuing a credit specific approach as we have chosen, makes logical sense. A stronger US dollar was a headwind for emerging market debt, which fell 1.2% on the month.

Summary

Following the risk asset lift-off seen at the end of last year, January offered mixed results for investors. While equity markets were initially boosted by the strength of recent activity data, the edge was taken off by the hawkish tone at the Fed’s January meeting. Bond markets were volatile, as strong growth data did not justify the magnitude of rate cuts priced in at the end of last year supporting the view that futures markets had become over-optimistic about the pace and magnitude of rate cuts in 2024.

Funds’ Japanese equity exposure helped performance in January as did the thematic exposures to Healthcare and Insurance – held across all the multi manager funds. Energy Transition was the disappointment among the themes after a strong bounce in the final two month of 2023.

There’s Still a War On

The escalation of middle-eastern tension has yet to be taken on board to any great extent by financial markets. That might be changing and worth keeping an eye on.

GARP not GAAP

Our focus remains on being exposed to Growth at a Reasonable Price (GARP), sometimes referred to as ‘Value’, rather than Growth at Any Price (GAAP). Holding attractively valued companies in themes we like, offers some defensive qualities as opposed to those on high valuations. There was little change to portfolios in January with the exception of an addition of a global equity value or GARP fund for Multi-Asset Growth and Global Thematic Equity. Like most other funds we own, it is index agnostic and evidences conviction through fewer holdings than a conventional global equity fund.

How much AI?

A question we often get asked about. The answer isn’t that straightforward. While we have exposure to a fund with Artificial Intelligence in its title, there is a broader influence worth noting. The challenge is to have exposure to the user beneficiaries of AI not only the facilitators which are increasingly expensive. Picking those businesses not just referencing AI to appear in a search, but actually using AI to build a better more profitable business, is the goal. One such business is a UK company held in one of our larger holdings across the multi-manager funds and also in our UK Responsibly Invested Equity Fund. Computercenter has evolved into such a company on a global basis but wouldn’t be easily identified as an AI company.