Ups & Downs & A Soft Landing?

Source: Wikicanadashawn, CC BY-SA 3.0, via Wikimedia Commons

July was a month when US and European interest rates went up and inflation continued its descent from recent highs but remained some way off target. The Bank of England, likely to follow suit with its own 0.25% increase in the first week of August, also welcomed better and much-needed inflation data. Signs of labour markets becoming less tight are encouraging but wage growth needs to decelerate faster for those central banks’ peace of mind.

US consumer confidence rose as did US gross domestic product (GDP) for the second quarter of 2023 at 2.4% annualised; above expectations and the fourth consecutive quarter in excess of 2%. Recession in the US is now deemed to be unlikely by US Federal Reserve economists.

The US Federal Reserve’s favoured inflation data point, the Personal Consumption Expenditure (PCE) deflator showed a year-over-year gain of 3%, a year ago that number was 7%.

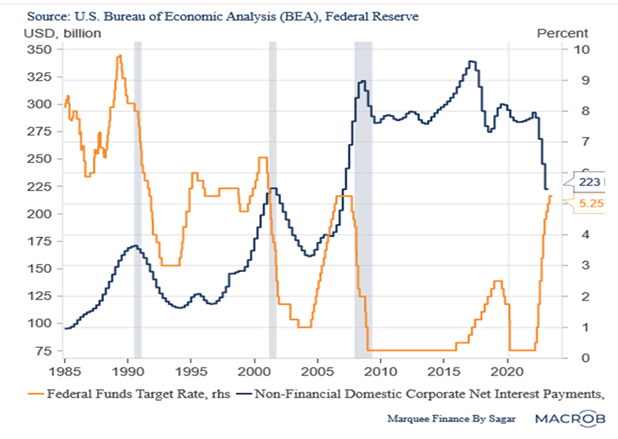

The fall in US corporates’ net interest charge in the face of rising interest rates has been a strange phenomenon as depicted in the following graph sourced from Marquee Finance by Sagar:

Source: Marquee Finance by Saga

The above is a probable contributor to generally better-than-expected US earnings. By the end of July, 58% of the S&P500 had reported second quarter earnings and 73% of those had beaten expectations.

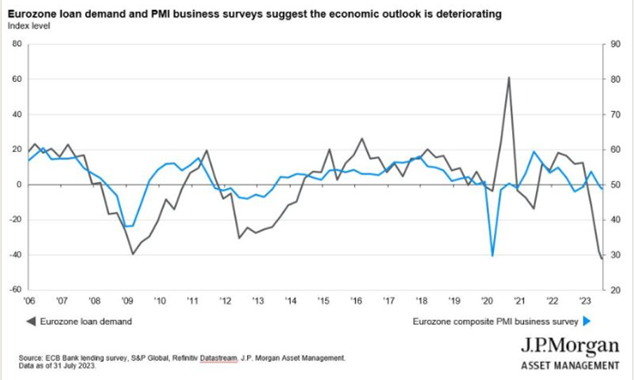

European business surveys were decidedly downbeat as the following graph sourced from JP Morgan Asset Management illustrates:

Whether Europe and the UK can match the US in a soft landing looks doubtful with the European Central Bank (ECB) and the Bank of England in tightening mode, albeit with softer rhetoric after better (from their perspective) data on inflation. At one point in July, base rates were forecast to peak above 6.5% before subsiding below 6% later in the month. If base rates got to 6.5% a UK recession would be inevitable.

The Land of Rising Yields

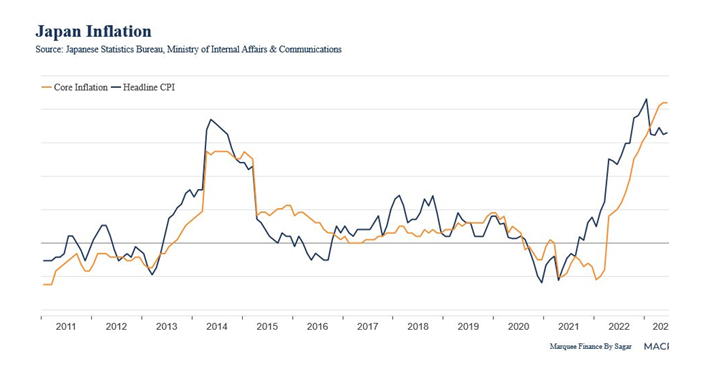

Towards the end of July, the Bank of Japan did the unexpected and widened the band on ten-year Japanese government bonds (JGBs) to 1% from 0.5% causing an unsurprising rise in yields. There was a knock-on effect in other government bond markets in fear of Japanese repatriation and therefore selling of non-Japanese bonds as JGBs now look relatively more attractive. These fears look overdone in the short-term. Japanese monetary policy is still loose. Inflation remains above target (see below).

Source: Marquee Finance by Sagar

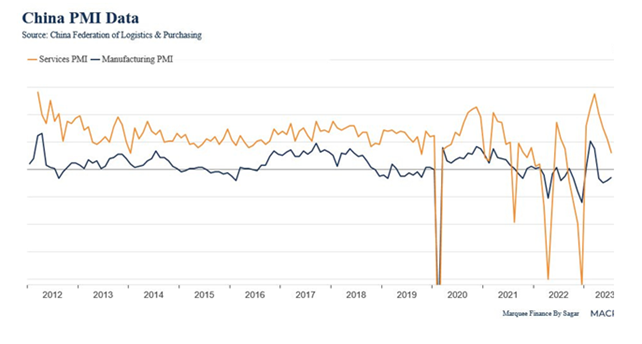

Cracked China

One country where inflation is not an issue is China. Rising youth unemployment and weak economic data will ensure substantial stimulus aimed at consumption will be forthcoming; the prospect of which enabled Chinese equities to finish July strongly.

Source Marquee Finance by Sagar

Asset Classes

Equities

It has taken a while but smaller companies continued their recent improvement by having a good July. Overall, it was a positive month for equity markets, irrespective of geography, theme or size.

Government Debt

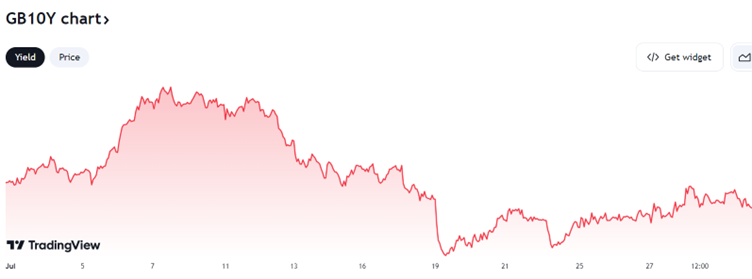

Government bond yields in developed markets were generally lower in July giving investors some price appreciation. However as the following picture from TradingView for ten-year gilt yields illustrates, it was a bumpy ride. I have omitted the Y axis deliberately to itemise the highs and lows.

Start: 4.39, High: 4.70, Low 4.16, End: 4.30. The oscillations being a result of changing perceptions of inflation and where base rates would peak.

Source: TradingView

Credit

Credit spreads ground tighter on the month and now look relatively tight versus their respective government bond yields. They might tighten further but have much good news priced in.

Currency

Having soared to 1.31 against the US Dollar mid-month, Sterling fell back to end July barely changed on the month as the prospect of much higher UK short-term interest rates faded. The US currency was marginally weaker against most currencies over the month of July with the trade-weighted index (DXY) being 1% lower. Sterling was also little-changed against the Euro and Japanese Yen although the latter’s end of month bounce on the Bank of Japan’s policy tweak arrested the Yen’s weakness.

Commodities

Had a good month, aided by a weaker US dollar. Grain prices increased due to the termination of the grain shipments from Ukraine ports, metals supported by the perception of increased Chinese demand and oil by the expectation of increased demand.