Downs and Up

As inflation continued to subside in western developed economies, so the inevitable official interest rate cuts’ debate swelled. More on that below. China belatedly cut rates in an attempt to boost its ailing economy. In contrast, the Bank of Japan finally grabbed the moment to raise interest rates.

Breadth

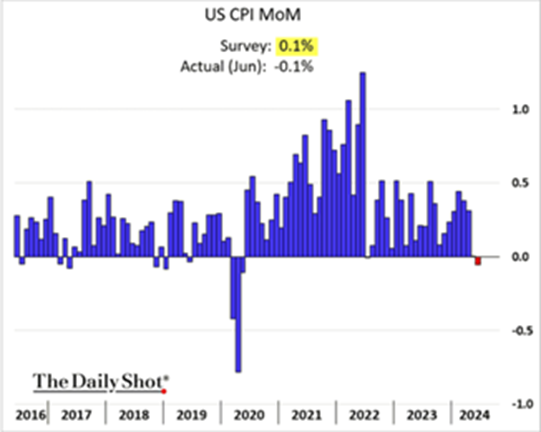

The publication of US consumer price inflation (CPI) data at the start of July proved to be the catalyst for a savage rotation from US tech darlings to smaller companies, aided by the prospect of lower interest rates. The following chart shows the road to lower inflation.

Source: The Daily Shot

The release of mega-cap tech company earnings later in July added to the rotation out of those names as investors sought evidence of artificial intelligence (AI) delivering positively to earnings. That AI payback failed to materialise in sufficient quantities, prompting increased share price volatility and lower share prices as the chart illustrates. Nvidia doesn’t report until August:

Source: Bloomberg

In the space of twelve days, the smaller companies Russell 2000 index outperformed the S&P500 index by 12% as the following graph illustrates:

Source: FE Analytics

How much is more relevant than when – slower for longer?

The following chart sourced from Bloomberg shows the increase in jobless claims in the US in 2024. It is one of many US data releases (more accurate than the closely watched non-farm payrolls employment data) that point to a slower economy into 2024:

Source: Bloomberg

The US Federal Reserve (Fed) chose not to cut interest rates on the last day of July. The Fed Chair’s rhetoric was noticeably more dovish and it is not unrealistic to expect a 0.5% cut in the Fed Funds rate at the next meeting in September. In contrast, the Bank of England felt that recent inflation numbers at their target of 2% gave them the opportunity to cut the Bank rate by 0.25% on the first day post the end of July.

Both US and UK central banks will hope that wage inflation continues to fall as it is still too high for their liking. Additionally, both central banks will keeping a close eye on spending plans by their respective governments. In the UK, the new Labour government has been keen to demonstrate its fiscal responsibility. In the US, that will hinge on who gets into the White House.

Markets

Equities

UK equities were a definitive beneficiary of the political certainty emanating from the UK election result. The better showing for Sterling proved a boost for small and mid-cap UK equities which were cheap to start with. Elsewhere, the major story was the abrupt shift from tech mega-caps to the smaller and mid-cap stocks in the US as mentioned previously.

Bonds

Government debt was a beneficiary of lower inflation and the prospect of lower official interest rates in western developed markets. Credit spreads began to widen as their government yardsticks moved to lower yields.

Currencies

Sterling, like most UK assets, was given a boost by greater political certainty post the election. Initially going above 1.30 to the US dollar before retreating below. The bigger story in July was the Japanese yen. What had become a one-way bet for speculators – a weaker yen and cheap funding currency, became the opposite at the end of the month as the Bank of Japan finally raised interest rates causing a sharp reversal in the yen’s fortunes having previously stopped falling due to intervention.

The de-leveraging of positions funded by cheap yen borrowing is causing knock-on effects across risk assets in a number markets. The following chart gives a good illustration of the impact of the yen’s swift appreciation.

Source: Bloomberg

Commodities

Copper was the weak commodity of choice as a soft Chinese economy is deemed to reduce demand for copper. It should be noted that copper had an excellent first half of 2024 and its longer-term demand as a conductor of electricity remains intact and in excess of supply for years to come. Gold had a positive month but oil was softer despite an increase in middle-east tensions.

Your Money

All T. Bailey funds had a positive month in relative and absolute terms. The funds’ exposure to the large US tech names is limited and had little negative impact on performance whereas their broader, diversified equity exposure to attractively valued themes and companies was beneficial to July’s outcome. Yen exposure was also a positive contributor.

Thank you for your continued support, it is much appreciated.