Key Market Insights

- Markets demonstrated resilience: Despite escalating US tariff threats and geopolitical tensions, equities strengthened through the month.

- The UK economy faced fiscal and inflationary pressures: Chancellor Rachel Reeves encountered limited fiscal room following welfare reform reversals, coupled with rising inflation and a softening labour market.

- Alternative sources of portfolio performance: Chrysalis Investments posted strong performance, driven by its core fintech holdings.

In July 2025, financial markets were significantly influenced by actions taken by US President Donald Trump. His “One Big Beautiful Bill” was introduced early in the month and is projected to increase the US national debt by approximately $3.4 trillion over the next decade. Despite this fiscal largesse, debt markets remained stable, while the enactment of the bill and its associated fiscal measures contributed to higher US equity valuations, with the S&P500 index reaching new highs during the month.

Recent confidence in equity markets has primarily been reflected in the sustained growth of the Artificial Intelligence sector, which has notably benefited the largest corporations.

Bloomberg Magnificent 7 Price Return Index – Year to Date

Source: Bloomberg.com (https://www.bloomberg.com/quote/BM7P:IND)

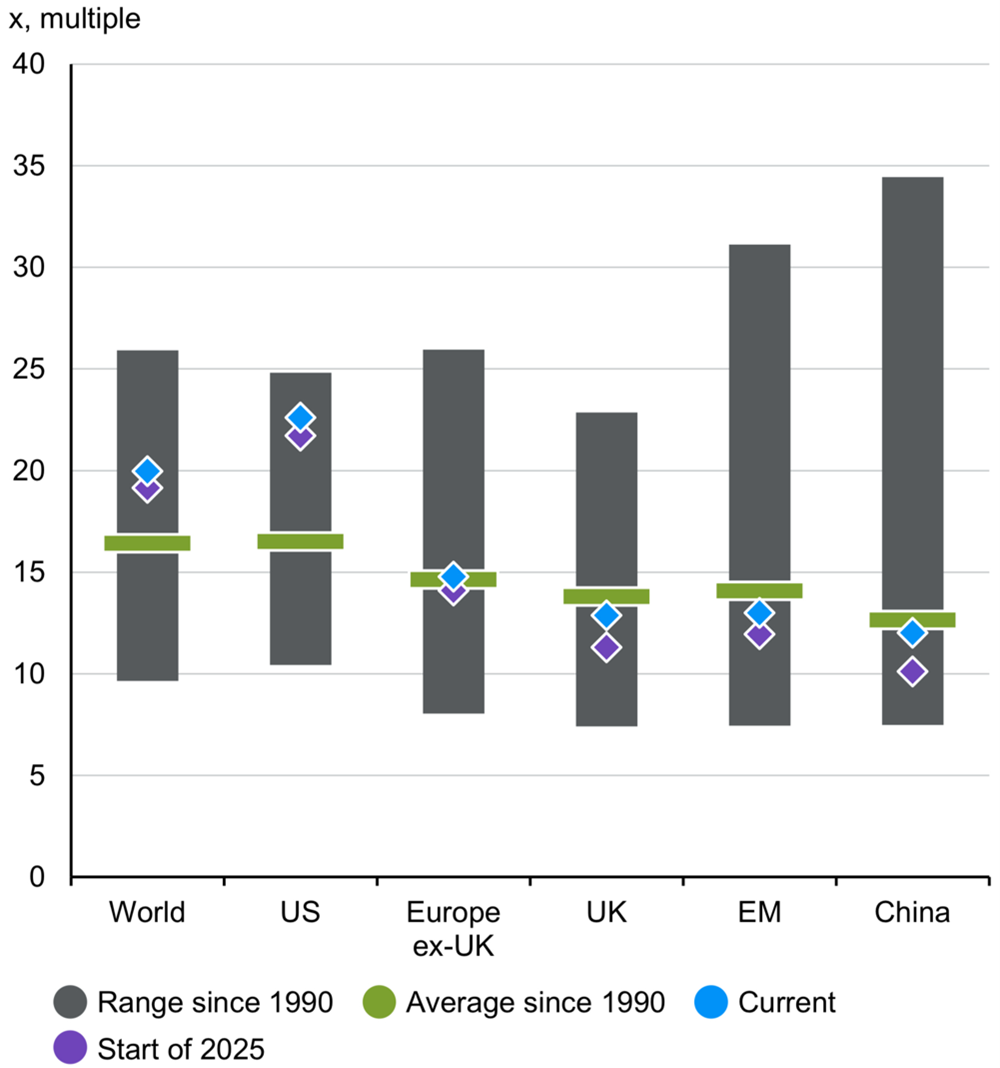

This was exemplified by Nvidia becoming the first publicly traded company to achieve a $4 trillion valuation. As a result, market breadth has once again narrowed with the performance of larger cap companies making new highs relative to the wider market and in the process has taken the valuation of large cap US stocks towards the upper end of their historic ranges.

Fortunately, less expensive opportunities exist outside of the US and, in common currency terms, have been outperforming US equities this year, favouring the more globally balanced equity allocations of the T. Bailey funds of funds.

Regional Equity Valuations: Global Forward P/E Ratios

Source: J.P. Morgan Asset Management Guide to the Markets, 31 July 2025.

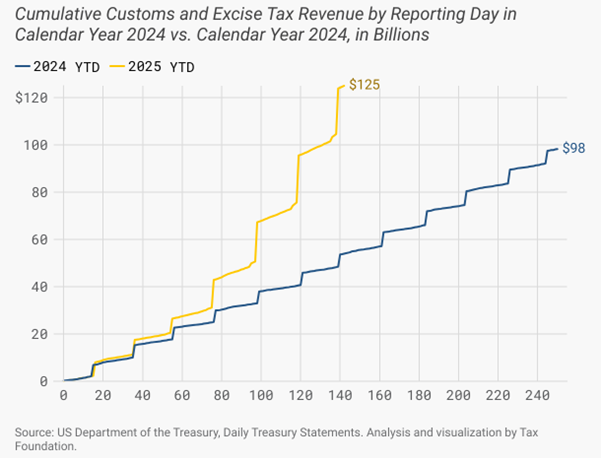

A small offset to US fiscal spending is the US’s tariff policy which has been used for both fiscal and political ends and, in the process, has created uncertainty in global trade relations.

US Tariff Revenue start to climb

Source: Tax Foundation. (www.taxfoundation.org)

Globally, economic indicators released in July painted a varied picture. China exceeded expectations with substantial tax revenues of over 85 trillion yuan from 2021-2025, underpinned by robust private-sector growth. The US reported solid second-quarter GDP growth at an annualised rate of 3%, helped by lower import activity following earlier tariff-driven stockpiling. However, the Eurozone faced headwinds, registering modest economic expansion of just 0.1%.

UK economic conditions also presented notable challenges. Chancellor Rachel Reeves faced heightened fiscal pressure after backtracking on welfare reforms shortly ahead of a 1 July parliamentary vote, significantly narrowing the government’s financial flexibility. Furthermore, unexpectedly high inflation, rising to 3.6%, coupled with a weakening labour market, has complicated monetary policy decisions. Nonetheless, UK equity markets demonstrated strength, with the FTSE 100 index surpassing 9,000 points for the first time.

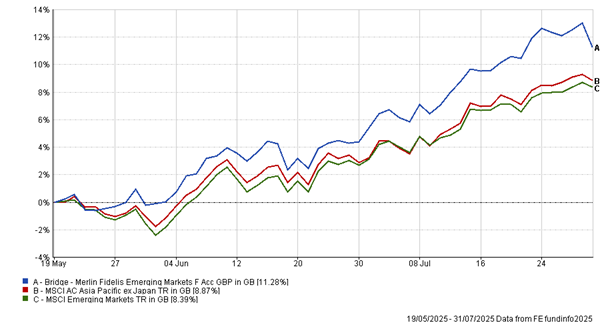

In terms of portfolio activity, July provided an opportunity to strengthen our exposure to emerging markets through additional investment in the Merlin Fidelis Emerging Markets Fund. Our confidence in emerging economies stems from favourable valuations, robust growth prospects, and exposure to significant global trends like energy transition and artificial intelligence advancements.

Merlin Fidelis Emerging Markets Fund – Since Launch

Source: FE Analytics.

Chrysalis Investments, another prominent holding within the fund of funds portfolios, reported strong quarterly performance. Its net asset value per share rose impressively by 13.7% over the quarter, driven by successful investments in innovative digital finance companies such as Starling Bank, Klarna, and Smart Pension.

As we look forward, the persistence of US tariff policies and global geopolitical risks will have an impact and requires continued vigilance. Our portfolios are well-positioned, emphasising diversification, risk management, and identifying compelling global investment opportunities. July’s developments reaffirm our strategic approach of balancing thematic conviction with prudent risk management, aiming to deliver sustained long-term outcomes for our investors.