Data Independent

Financial markets’ fixation with US unemployment data, despite its poor construction and large revisions, brought about a tough start to June. Later, inflation data in the US calmed markets when the US Federal Reserve’s favoured inflation measure, the Personal Consumption Expenditure (PCE) price index, was released in line with expectations at 2.6%.

More accurate data shows a softening labour market in the US. Similar conditions exist in the UK with inflation hitting the Bank of England’s 2% target. However, the negative sentiment emanating from US labour market data was sufficient to set government bond yields in the US (and UK in sympathy) on a higher yield trajectory. The US ten year government bond yield rose 0.15% to 4.45% with UK gilt yields moving upwards in sympathy by 0.12% to 4.30%. By mid-month, and after the release of the first set of US inflation data, those same yields were 4.23% and 4.05% respectively before rising again into month-end on political instability in the US.

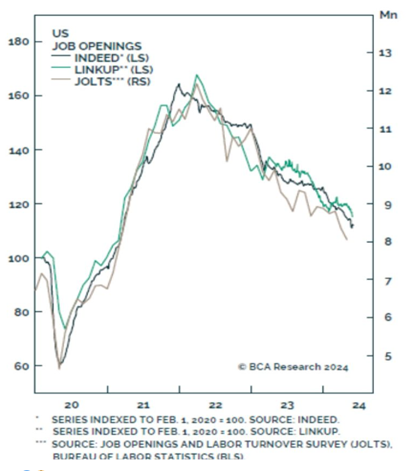

Of course, there is another US labour report on the first Friday in July. Our preference is for more reliable leading indicators to determine the health of the US labour market. The following chart from BCA Research tells a story of declining job opportunities as reported by LinkedIn (recruiter) and LinkUp (accurate job market data provider) in addition to the JOLTS (Job Openings and Labor (sic) Turnover Survey).

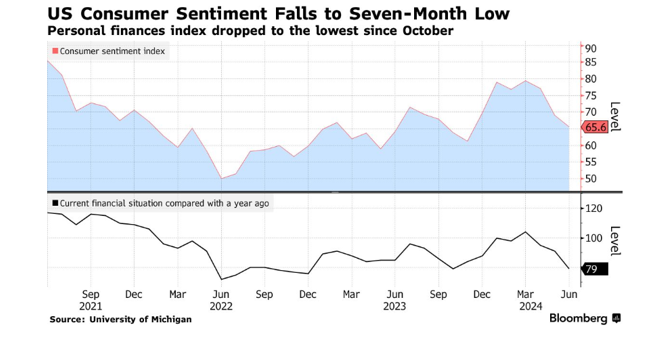

Nonetheless, the US economy is slowing while the UK economy is showing some green shoots. The following charts illustrate the downturn in US consumer confidence from the University of Michigan Consumer Sentiment Survey.

Source: Bloomberg

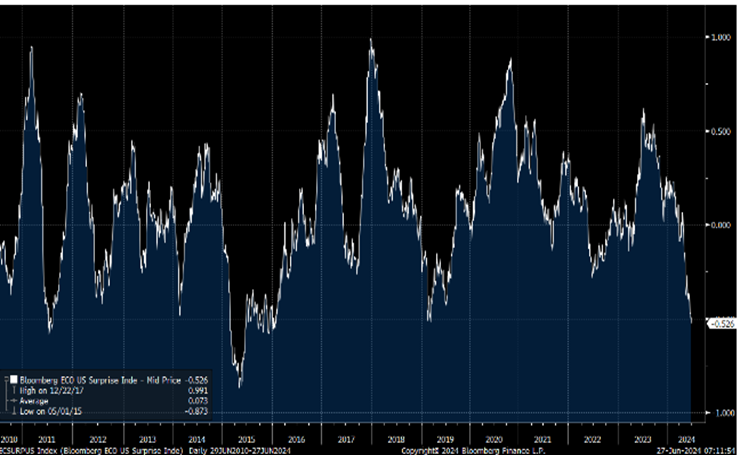

Plus the plunge in the Bloomberg US Economic Surprise Index:

Source: Bloomberg

Electioneering

For much of June, various elections caused added volatility to financial markets. Towards the end of June, the prospect of a right-wing victory in France for Marie Le Pen’s RN party, put President Macron’s gamble of calling a snap election into focus. French government bond yields widened their spread over their German equivalents; French equities sold off too reflecting the increased political risk. Election outcomes didn’t go completely as expected in India, Mexico and South Africa leading to volatility in those markets. The UK election on July 4th seems like being less of a surprise as far as markets are concerned. Donald Trump’s chances of a return to the White House got a boost when his opponent, incumbent Joe Biden, put in a poor performance in their televised debate at the end of June. US bond markets are nervous about a Trump victory and its impact on borrowing. As a consequence, the US yield curve steepened with long rates rising more than short-term rates.

Easing Agenda

The Bank of England’s Monetary Policy Committee chose to keep rates unchanged at their meeting in June. The decision to keep rates on hold was closer than at past meetings – no doubt due to signs of moderation in wage growth, albeit still too high.

Source: NS Partners

While an initial UK rate cut is on the horizon (and perhaps two later on in 2024) the US, Canada, Switzerland and the European Central Bank (ECB) chose to lower official rates. The UK and US central bank authorities will want to keep an eye on post-election fiscal policy.

Markets

Equities

Equities were a mixed bag in June. UK equities, which had done well since the start of 2024, gave a little back with the FTSE All Share down over 1% over the month of June. The US S&P 500 index and Asian equities led the positive outcomes in June. Europe, like the UK, gave some of its recent positive performance back. In global thematic equities the key beneficiaries were artificial intelligence (AI), cybersecurity and healthcare. The first two of those three themes being wind-assisted by the performance of US tech stocks. That tech stock outcome hides the volatility within, as demonstrated by Nvidia’s share price oscillations in June. While it delivered a 12.7% uplift in June, the price move from 109.63 to 135.58 intra-month was followed by a downturn to 123.5 at month end. Energy transition was a disappointing theme in June.

Bonds

Despite the see-saw action and volatility surrounding economic data releases, mainly from the US, bond markets posted a positive month including corporate spread markets, although there was evidence of spread widening from historically tight levels.

Commodities

While gold had a small positive month with silver and copper the opposite, the commodity in demand was oil with Brent crude up almost 6% in June.

Currencies

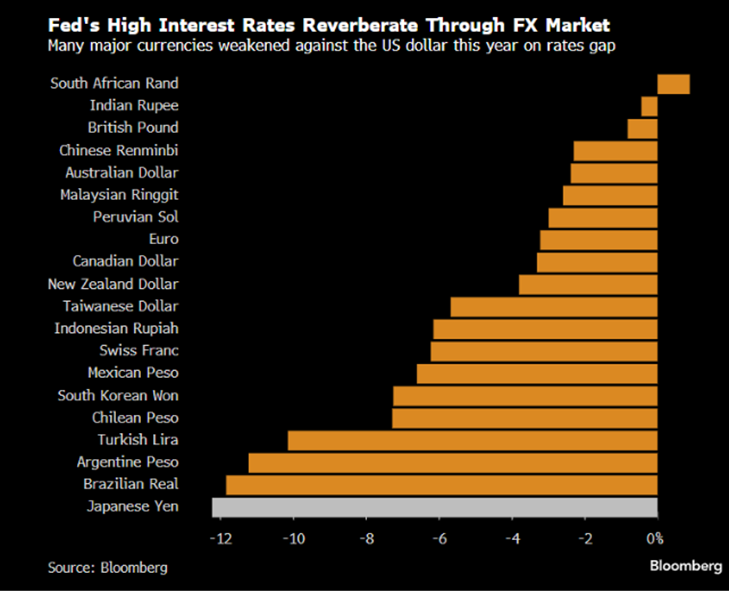

Japanese yen weakness is a reflection of the Bank of Japan’s reluctance to raise interest rates despite higher inflation – partly imported via a weak yen. Despite bouts of foreign exchange intervention by the Bank of Japan to support the yen, the Japanese currency remained weak and is weaker than the Argentinian peso and the Turkish lira year to date as the following graph of currencies against the US dollar from Bloomberg, shows. Sterling, aka British Pound, looks like a haven of stability and hasn’t taken on any political concerns ahead of the UK General Election.

Your Money

There was modest activity in June. The three multi-manager funds have bought into a fund that gives exposure to listed UK infrastructure assets at attractive discounts. This has been funded by trimming either equity assets that have performed well in recent months or trimming gilts exposure in Multi-Asset Growth. Those same funds that have done well from earnings and multiple expansion in recent months were the funding vehicles to top up an existing global value (non-index) equity fund investing in good companies on reasonable or cheap valuations. Japanese equities were also trimmed to fund that change in allocations.