Key Market Insights

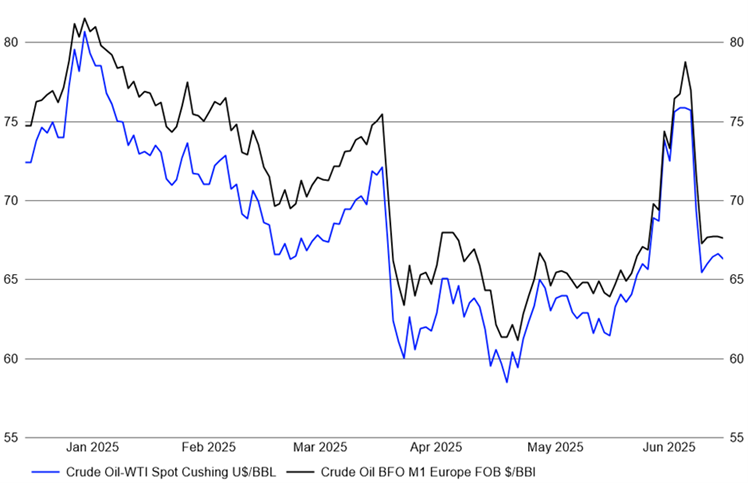

- Geopolitical shocks tested markets: June began with a sharp escalation in Middle East tensions, including US strikes on Iranian nuclear sites, sending oil prices higher. A later ceasefire helped stabilise oil prices and avoid wider financial market contagion.

- US policy uncertainty weighed on the dollar: Erratic tariff strategies, rising debt, and political pressure on the Federal Reserve have driven the US dollar to its weakest start to the year since 1973.

- Balanced positioning amidst uncertainty: The T. Bailey funds performed steadily over the month thanks to diversification and active management.

June proved to be a remarkably composed month for financial markets which continued their recovery in the wake of US President Trump’s “Liberation Day” sell-off.

Although the much-anticipated bite from US tariffs has yet to materialise, their cost will ultimately be shouldered by a combination of US consumers (through higher prices), US companies (not passing on the full burden of tariff costs), or foreign exporters to the US. For now, equity markets appear unfazed. Trump’s 90 day reprieve on many tariffs, announced in April, has provided some breathing space for markets.

The counterbalance to tariff pressures has been a weakening US dollar, reflecting mounting uncertainty surrounding the unpredictable implementation of tariffs which have seen inconsistent rollouts, pauses and adjustments. Other factors such as rising fiscal deficits linked to ambitious tax and spending plans and mounting political interference with the US Federal Reserve have also been contributors.

Weakening US Dollar

Source: Bloomberg. 1 July 2025.

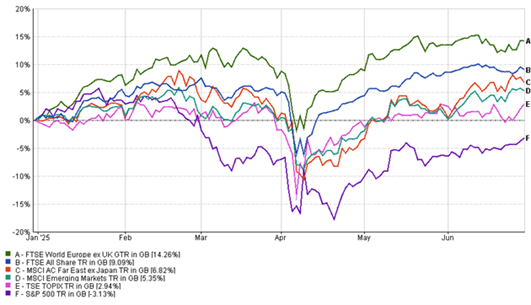

Thus, particularly when measured in common currency terms, the US equity market has significantly lagged global markets throughout the first half of 2025, reversing the exceptionalism narrative that has dominated investor sentiment in recent years.

Regional Equity Performance: Year to date

Source: FE Analytics. Total return, GBP terms.

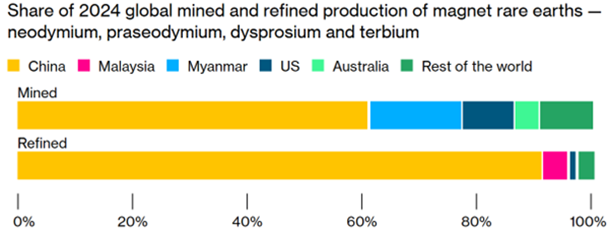

A softening of US-China trade relations provided one of June’s more encouraging developments following months of escalating tensions. High-level trade discussions between US Treasury Secretary Scott Bessent and Chinese Vice-Premier He Lifeng resulted in a breakthrough on the contentious issue of rare earth elements, a key point of leverage for China. China’s agreement to resume rare earth exports through six-month licences provided temporary relief to supply chain concerns threatening automotive, robotics and defence sectors. This couldn’t come soon enough for companies such as the Ford Motor Co. which was reportedly forced to idle US based factories for three weeks due to a shortage of magnets that contain rare earth minerals. China’s agreement to resume limited exports offered a short-term reprieve but underscores longer-term challenges and uncertainty in global supply chains.

China’s dominant supply of refined rare earth magnets

Source: Bloomberg and the International Energy Agency.

Nevertheless, the recent improvement in US-China relations was eclipsed as focus shifted to the Middle East, where significant escalations occurred, including Israeli airstrikes on Iranian nuclear facilities and a subsequent US-led operation targeting multiple Iranian sites under the codename “Midnight Hammer”. Oil prices initially surged on fears of supply disruptions, particularly around the Strait of Hormuz, but later fell as a US-brokered ceasefire took hold.

Oil prices – Year to date

Source: LSEG Workspace.

This fragility in global energy supply chains is a stark reminder of the importance of strategic diversification in asset allocation, especially when the traditional energy sector becomes a transmission mechanism for geopolitical risk. Remarkably financial markets remained composed, with the VIX volatility index remaining contained.

CBOE Vix Index – Last 6 Months.

Source: CBOE

The swift rise and fall in oil prices provided little cause for concern on inflation which continued its gradual decline. Nonetheless, the US Federal Reserve held interest rates steady at 4.5%, signalling a cautious stance amid conflicting pressures from persistent price levels and political demands for stimulus. Meanwhile, in the UK, inflation printed at 3.4% in May – remaining well above the Bank of England’s 2% target – leading to a similar decision to hold rates at 4.25%. Other central banks took divergent paths. The Swiss National Bank cut rates to zero to counter deflationary risks and currency strength, while the Bank of Japan reaffirmed its ultra-loose stance, opting to slow the pace of its bond purchases.

The impact of artificial intelligence as a secular deflationary force came sharply into view with Amazon announcing sweeping workforce reductions on the back of AI driven efficiencies. Similarly, it was reported major accountancy firms in the UK have scaled back graduate recruitment in favour of automation. The economic consequences of such shifts are just beginning to be felt, but for investors, it reinforces the case for targeted exposure to innovation. Our allocation to the Polar Capital Artificial Intelligence Fund, the best-performing equity fund across the T. Bailey fund of funds portfolios this month with a 8.8% gain in GBP terms, continues to validate this conviction.

Elsewhere, in the T. Bailey multi-asset funds, we took steps to further refine our portfolio positioning. In particular, narrow spreads in high yield debt have prompted us to reallocate towards an absolute return approach through the newly launched Man Credit Opportunities Alternative Fund. Its flexible mandate – allowing for both long and short exposures – offers a more adaptive risk profile for an environment where static positioning offers little reward. This is part of a broader commitment to preserving capital while remaining opportunistic.