SVB Takes Centre Stage

A week ago, I was wondering what content I could deliver for this month’s mid-monthly update. I came up with the title, ‘Dancing On The (Debt) Ceiling’,

as it appeared that most investors had overlooked the political brinkmanship that has enveloped raising the debt ceiling in the US. The emphasis on the requirement for higher interest rates in Federal Reserve Chair, Jerome Powell’s testimony before Congress earlier in the week caused a rise in bond yields. The rise pushed ten year US Treasury yields above 4%. Ten year gilt yields closed in on 4% in sympathy. For the first time in ten years plus, government bonds entered the investible phase on our radar.

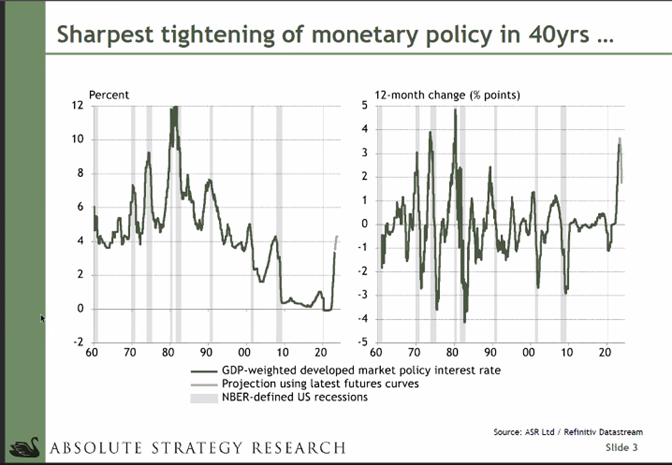

The pace of rate rises in developed economies, in part to make up for monetary policy that was too loose, was bound to exert a slowdown in economic activity and inflation when those rate increases had had time to have an effect. As the chart below from Absolute Strategy Research shows, the level of nominal interest rates isn’t historically significant but the pace of monetary tightening is:

Source: Absolute Strategy Research

When the tide (QE) comes in, it floats all boats. When the tides goes out (QT), we find out who has too much leverage or bad risk management. Additionally, banks are struggling to retain deposits when investors can buy Treasury bills or Money Market Funds that can access the Fed’s Reverse Repo Facility (4.75%) yielding far more than banks are willing to pay for deposits. Unsurprisingly, there has been a significant move away from deposits into Money Market Funds.

By now you will have had the chance to read plenty about Silicon Valley Bank (SVB), so we won’t overdo the commentary here. One could question the accounting rules which permitted the misalignment of risks but the question investors want answers to is:

“Is this a one-off or is this the tip of the iceberg?”

Having moved quickly over the weekend to make all depositors whole, the precedent has been set and should pacify deposit holders at all US banks. Whether it will or not is another matter. Bank stocks have been hit to reflect lower profitability. The terminal rate for Fed Funds has already adjusted lower and it’s a fair bet that lending standards and criteria will be tightened. Economic growth should moderate and so should inflation. Conjecture will be how much will the Fed temper its previous interest rate path? As the following table, sourced from Reuters, illustrates, three of the seven participants have made a change to their expectations for the next meeting:

Source: Reuters

Meanwhile

The inflation picture hasn’t improved enough to help the Fed. February’s consumer price index (CPI) was a little stronger than hoped for. The following chart, sourced from Bloomberg, shows the month-on-month changes:

Impact

As a thematic investor with a focus on quality well-run businesses built on strong balance sheets with low levels of leverage, banks are not a natural investment space for our funds and are not a feature of them on a look-through basis. The impact from the SVB failure is currently from a negative market reaction in risk assets and largely emanated on Friday the 10th of March.

Swiss Cheese

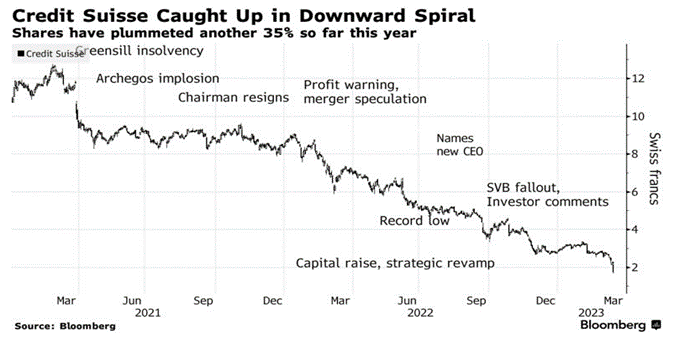

Credit Suisse’s latest trouble, when its biggest shareholder ruled out further support for the beleaguered Swiss financial institution, caused a re-emergence of risk asset mark downs on the 15th. Credit Suisse’s problems are not a new news story but the latest comes at a time of extreme sensitivity for banks, post SVB, Signature and Silvergate in the US. Indeed, looking at the graphic history of Credit Suisse in the following chart ,sourced from Bloomberg, it is one of an institution with as many holes in it as a piece of Emmenthal cheese:

Inevitably, the Swiss National Bank came to the rescue.

Elsewhere

Asia has held up better than other markets, not least Japan. Japan has a new Bank of Japan Governor which will grab attention while China had its National People’s Congress. A summary of that event is below.

- At the last day of the National People’s Congress in China, PBoC Governor Yi Gang was unexpectedly reappointed for another term, as were the finance and commerce ministers. These are positive developments which point to policy continuity and a desire to ensure financial stability as the economy recovers. This is in contrast to the expectation that all major roles would go to relatively untested and less economic-savvy individuals.

- Meanwhile, hiring intentions rose to their highest in China for eight years in February, as businesses grow more confident about the sustainability of the nascent recovery. This reaffirms our positive view on the economic outlook for China (in contrast to Developed Markets) for 2023.

- The government also recently announced a GDP growth target of “around 5%” for this year (vs. 3% in 2022), which should be readily achievable given the strength of the reopening bounce in activity. Encouragingly, recent inflation data confirm that price pressures remain well contained, giving ample room for policymakers to provide more support measures if they are needed to ensure the continuity of the recovery.

In that context, the next event to look out for is the Politburo meeting in late April, following the release of the first quarter GDP data. Officials could unveil specific economic measures at that meeting if the recovery looks to be losing momentum.