ICYMI (In Case You Missed It)

Two things that grabbed market attention in the first half of March:

- The UK budget on 6 March which had little to no impact on financial markets (no Truss moments).

- The US employment report released on 8 March which commands more attention than it warrants given the huge revisions to previous data. However, as a lagging indicator of what is happening in the US labour market, it did support our previously espoused view that the tight labour market is loosening.

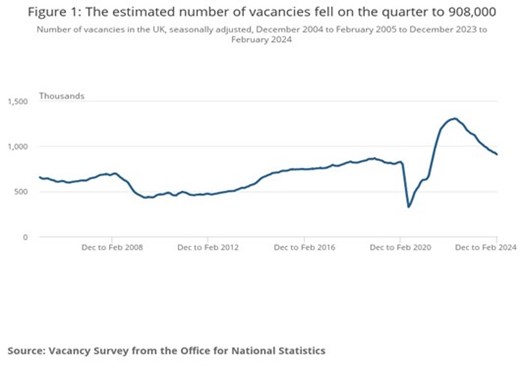

The same situation appears to be occurring in UK employment although while the rate of increase in average earnings has reduced, it is still too high for the Bank of England’s Monetary Policy Committee. Estimates from the Office for National Statistics (ONS) indicate that February median monthly pay increased by 5.5% compared with February 2023. Vacancies continue their decline from the peak making labour easier to acquire.

Also encouraging was news that the UK economy grew by 0.2% in January. This following on from the UK budget where the independent Office for Budget Responsibility (OBR) forecast growth in UK gross domestic product (GDP) to be 2% this year and next. The OBR also issued some encouraging forecasts for UK inflation, notably that the Bank of England’s 2% target will be reached in Q2 2024.

The first half of March also witnessed encouraging comments on interest rates from the US and European central banks.

One of the problems for central banks on the path to lower interest rates is the tightness of the labour market and the effect on wages. The UK’s unemployment rate, updated to December 2023 on 13 February, ticked down to 3.8% and wage growth rose to 6.2% – down from its high and previous reading but still high enough to concern the Bank of England (BofE).

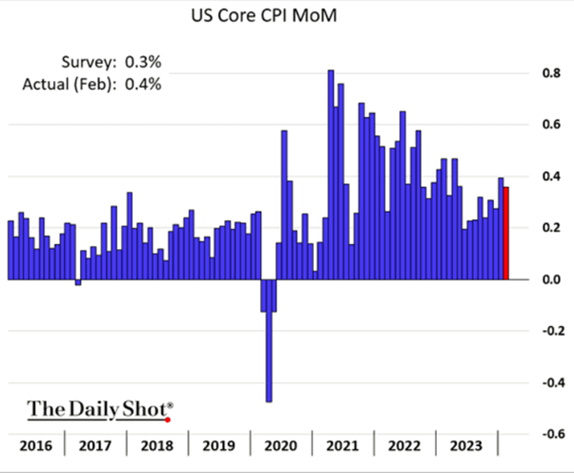

A dampener on the positivity for lower official rates came via a higher than expected US inflation report on 12 March. Core Consumer Price Inflation (CPI) fell month-on-month but topped expectations:

Year-on-year CPI was 3.2% in February, higher than the expected 3.1% and still some way from the US Federal Reserve’s 2% target.

However, while the interest rate optimism that commenced in mid-December last year has rightly abated from its peak to a more moderate expectation (from 7 cuts of 0.25% in the US to 3 during 2024), better underlying economic performance has helped equity markets do well in 2024 and in the first half of March. While US economic output appears to be slowing, corporate results have been better than anticipated in aggregate. In the UK, better than expected economic output (positive not negative) has helped as has the continued M&A activity and share buybacks, illustrating the continued attractiveness of UK equities.

Rising Sun

There has been much debate both inside and outside Japan, on when the Bank of Japan (BoJ) will cease its negative interest rate policy (NIRP). The catalyst for that change may well have emerged via the higher wage awards from companies such as Toyota. Higher wage awards at the annual wage negotiations (aka Shunto, meaning spring wage offensive), have the ability to embed some inflation into an economy that has lacked inflation for many years. While local stock market indices slipped as the Japanese yen appreciated, it was after a strong period for Japanese stocks where the Nikkei225 has outgunned the Nasdaq100 over the past year.

Japanese equities have been the mainstay of our funds’ exposure to a corporate governance reform theme that started under Prime Minister Abe and continues under the current administration. Additionally, our multi-asset funds have additional Japanese yen exposure through forward foreign exchange contracts from US dollars, recognising the attractiveness of the Japanese currency and its potential to appreciate against its US counterpart.

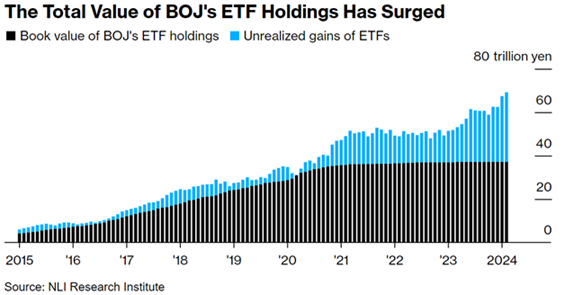

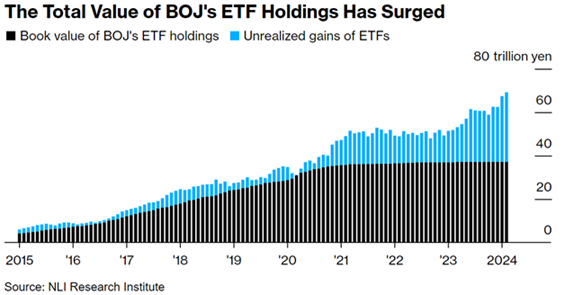

Fair play to the Bank of Japan for buying into and supporting a then unloved equity market back in 2015. As the following chart sourced from Bloomberg shows, the BoJ is sitting on a substantial unrealised gain of over 30 trillion yen – equivalent to around £160 billion (as of mid-February 2024).

Copper

One of our long-term themes is copper where we see long-term demand for the metal – not least, in its role to aid the massive electricity demands of data centres, amongst other users.

Wednesday’s melt-up (pun intended) was caused by an agreed production cut by Chinese smelters, processors of half the world’s mined copper.

Our preference is to hold direct exposure to copper through an ETF rather than take on equity risk through a fund.

Source: The Daily Shot