Are We Nearly There Yet?

Not the first time we’ve used this title but appropriate during school holidays and reviewing market optimism, or lack thereof, about official rate cut expectations in the UK, EU and US.

Good Friday’s release of US Personal Consumption Expenditure (PCE) Deflator was the last piece of the macro jigsaw puzzle for March and the first quarter of 2024. The US Federal Reserve’s favourite inflation measure was as forecast at 2.5% (2.8% Core). This proved sufficient to give markets belief that US rate cuts will probably still begin in June, as they are expected to do in the UK and EU. Recently, stronger US economic data has diluted the strength of conviction in a June US rate cut to a 60% probability from a 75% chance mid-March. Japanese rates have finally begun to move in the opposite direction, but a further notch higher isn’t expected until October, which may be a headwind for a weak, albeit extremely cheap Yen.

Landings

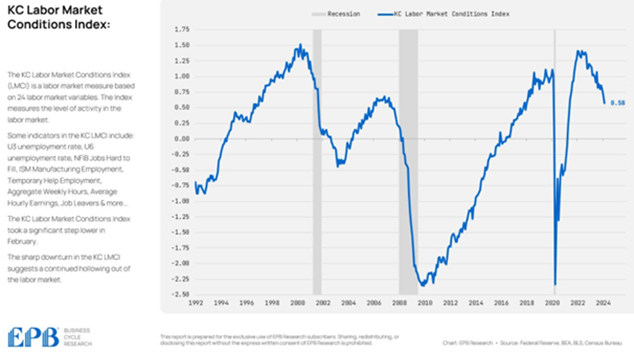

While the financial markets pontificate over whether the US economy will endure a hard, soft or no landing, our best guess is US economic activity is slowing from last year, along with inflation. Nominal growth looks like it could be around 5% for 2024, lower than 2023 but avoiding a recession. While significant government spending has helped economic activity, much market analysis revolves around the US labour market and the (lagging) employment data released on the first Friday of each month for the previous month. However, more predictive data is available and it is noticeable that the number of ‘Quits’ has fallen recently, suggesting a less tight labour market and importantly, lower wage pressure. Adding to the less tight labour market projection is the following chart sourced from Marquee Finance by Sagar on Labor (sic) Market Conditions illustrating a recent slowdown.

Latest PCE price data

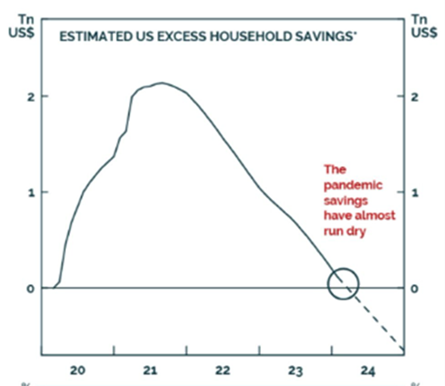

The US consumer has been an engine of activity but excess savings have been depleted as the following chart from BCA Research illustrates:

Source: BCA Research

The commercial real estate bad debt problem is an uneasy backdrop for US regional banks – the problem that started a year ago, has yet to be resolved. A tight labour market is also loosening in the UK where economic growth is gradually improving from a near-zero level.

Good news on UK inflation occurred at shop level with the news that shop prices continue to fall.

Source: The Daily Shot

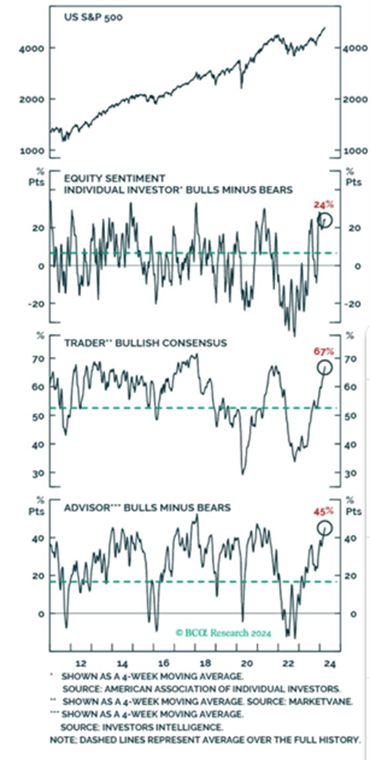

Financial markets’ risk assets have had a good first quarter of 2024 but might need a pause for breath given the levels of positive sentiment evident among US market participants as the following charts from BCA Research illustrate:

Source: BCA Research

Markets

Despite no let-up in geopolitical tensions, risk assets continued to enjoy a positive environment as they have done since the end of October last year and despite a distinct reduction in interest rate optimism since year-end. Official rate cuts did occur in Switzerland, Mexico and Brazil on lower inflation in their countries which helped general sentiment.

However, the removal of over-optimistic forecasts for rate reductions caused bond yields to rise in the first quarter of 2024 and oscillate in March to deliver a flat to positive outcome in March.

While some larger US tech companies dominated the headlines, not always for the right reason (Tesla and Apple), Japanese equities were also grabbing the headlines as the Nikkei index bested its past peak set over forty years ago. Other indices reached new levels, notably the S&P 500 index in the US.

Equities

After a stellar period, Japanese equities did well in March but were not the market leaders. Demand for cheap UK companies with strong, cash generative balance sheets translated into more merger and acquisition activity plus buybacks in the UK.

Chinese equities have been in the doldrums for some time compared to other markets. Until the nuclear option (phrase not reality) occurs and unwinds the property overhang, they are likely to remain at the low end of the investment league table.

US shares were less about the big five as the market broadened out. US equities were buoyed by better economic data and a central banker keen to reassure investors of his desire to cut interest rates in 2024.

European equity performance has been reasonably good given the backdrop of slower growth, recognising that Europe contains its own global company thematic leaders.

Thematically, climate change and energy transition performed well.

Bonds

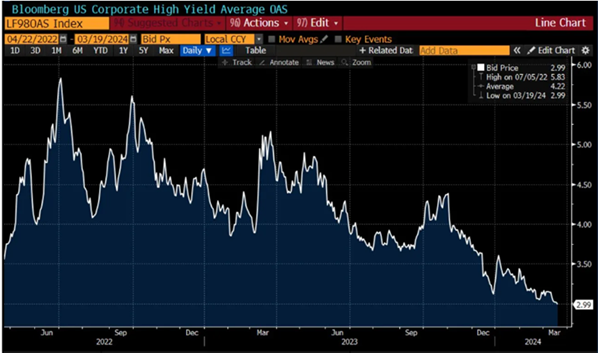

While bond issuance has been high in the US, much of the deficit financing has come through cheaper treasury bill issuance. Developed market government and corporate bonds had a moderately positive month to round out a difficult quarter as interest rate reduction optimism faded, primarily in the US. As a consequence, Euro and UK bond markets fared better than their US counterparts with UK gilts enjoying a decent March to offset a negative quarter. Credit spreads managed to grind lower in general. There are some concerns that spreads are historically too low (see US high yield chart below) which is why we adopt a credit specialist and do not want broad market exposure.

Source: Bloomberg

Japanese government bond yields paradoxically fell after the Bank of Japan’s historic ending of Japan’s negative interest rate policy.

Commodities

Gold continued its 2024 upward trend and closed the March quarter at an all-time nominal high aided by significant central bank purchases, notably China’s.

Copper increased after nineteen major copper smelters in China agreed on production cuts during March. The longer-term picture for copper is underpinned by supply constraints.

Oil also performed strongly in March on supply concerns.

Currency

Relatively stronger economic data helped the US dollar but currencies were little changed over the month although the Japanese Yen weakened after the move into positive territory for Japanese official interest rates.