March continued the story of significant market turbulence, a feature of 2025 so far, as geopolitical and policy shifts, largely emanating from the US, drove a souring of sentiment and increased financial market volatility.

In Washington, President Trump has continued to escalate trade tensions by drip-feeding announcements of new tariff plans. This haphazard approach has dented economic confidence, with immediate negative effects on markets while any perceived benefits remain distant. US equities swung into correction territory mid-month before a late rebound, and the US dollar also weakened on the uncertainty. The longer this persists the greater the permanent damage to economic growth.

The Atlanta Fed’s GDPNow model suggests the US economy is experiencing a significant slowdown, with the index having abruptly fallen into contraction territory, even after technical adjustment for gold imports driven by tariff concerns.

Source: Federal Reserve Bank of Atlanta, Latest Estimate 1 April 2025.

By contrast, Europe’s outlook has improved: Germany unveiled a massive fiscal stimulus in defence and infrastructure spending – headlined by a €500 billion infrastructure investment fund. This helped bolster optimism across the continent, buoying European markets even as the US retrenched from its international role. However, the outlook for Europe is not without caution, as new US trade threats hang overhead.

Central banks have been vigilant in their response to policy risk as inflationary pressures remain stubborn and present an ongoing challenge in the face of a weakening global growth outlook. The Federal Reserve, Bank of England, and Bank of Japan all held interest rates steady in March, citing rising policy uncertainty and caution around the inflation outlook. In the US, core PCE inflation surprised to the upside at 2.8% year-on-year, stoking worries of stagflation amid the tariff increases. Meanwhile in the UK, Chancellor Rachel Reeves’ Spring Statement struck a cautious tone. She highlighted spending cuts alongside downgraded growth forecasts, as the Office for Budget Responsibility projects higher near-term unemployment and inflation. With little fiscal headroom to stimulate, the UK economic outlook remains subdued despite still-elevated inflation.

Markets

Equities

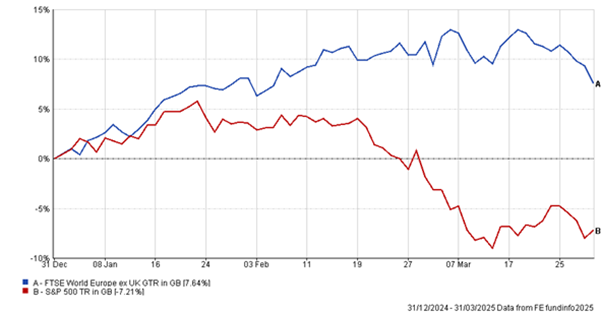

March 2025 capped off a particularly challenging start to the year for US equity markets, which experienced their worst first quarter since 2022. US stocks stumbled under the weight of trade disputes and policy uncertainty, whereas European equities climbed on hopes of fiscal stimulus.

Year-to-date: US and Europe ex UK equities

Source: FE Analytics. Total return, GBP terms.

The divergence was striking: by mid-March, the S&P 500 had fallen almost 10% in GBP terms year-to-date, while the MSCI Europe ex-UK Index was up over 10%. This performance gap underscores a shifting geopolitical balance – after years of US market dominance, its leadership is diminishing. Notably, sectors tied to US economic exceptionalism (such as big US technology names) lagged, whereas European cyclicals outperformed. A late-March rally rescued US indices from deeper losses, but volatility persists as investors grapple with each new tariff headline.

In general, international diversification has paid off so far this year. A notable development was the significant rotation between market segments. While US technology stocks endured their worst first quarter since 2020, value stocks outperformed considerably. Of note was the Ranmore Global Equity Fund, a value fund held across the T. Bailey fund of funds portfolios that has returned +8.6% year-to-date.

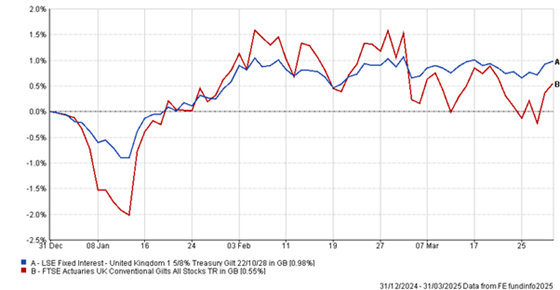

Bonds

Debt markets have been torn between the cross-currents of inflation and growth concerns. Spending restraint in the UK’s Spring Statement tempered worries of a supply surge. The T. Bailey Multi-Asset funds hold a shorter-duration UK Treasury gilt (Oct 2028) instead of the broad gilt index, to mitigate risk from potential rate rises. This positioning proved prudent – the 2028 gilt delivered a modest positive return in Q1, outpacing the overall UK gilt market.

Year-to-date: UK Gilts

Source: FE Analytics. Total return, GBP terms.

Corporate credit spreads remain tight by historical standards, so we continue to favour a selective, active bond strategy over broad exposure.

Commodities

Commodities provided both bright spots and warnings in March. Gold shone as a safe-haven asset, with the spot price hitting record highs around $3,130/oz.

Gold

Source: The Daily Shot, 31 March 2025.

The metal’s dual role as an inflation hedge and geopolitical risk guard has come to the fore amid the tariff battles and economic uncertainty. Exposure to the metal in the T. Bailey Multi-Asset funds is via the iShares Physical Gold ETC which is up almost 16% year-to-date in GBP terms, contributing positively during equity drawdowns.

Oil prices were choppy. US tariffs on Canadian energy exports created initial supply concerns, but global demand worries have kept the price in check. The standout performer, however, has been copper. Often seen as a barometer of global growth, copper continued the strong rally it began earlier in the year. In sterling terms, the WisdomTree Copper ETC climbed over 20% in Q1, supported by optimism around European and Chinese industrial activity. We acknowledge the long-term drivers (electrification and renewable energy infrastructure) that bolster copper’s outlook. Even so, given copper’s sharp run-up and the murkier short-term growth picture, we chose to trim our copper exposure late in March. This locks in some gains and reduces risk should economic activity cool. Overall, a balanced commodity exposure – with gold for defence and industrial metals for growth – has added value and diversification to portfolios.

Your Money

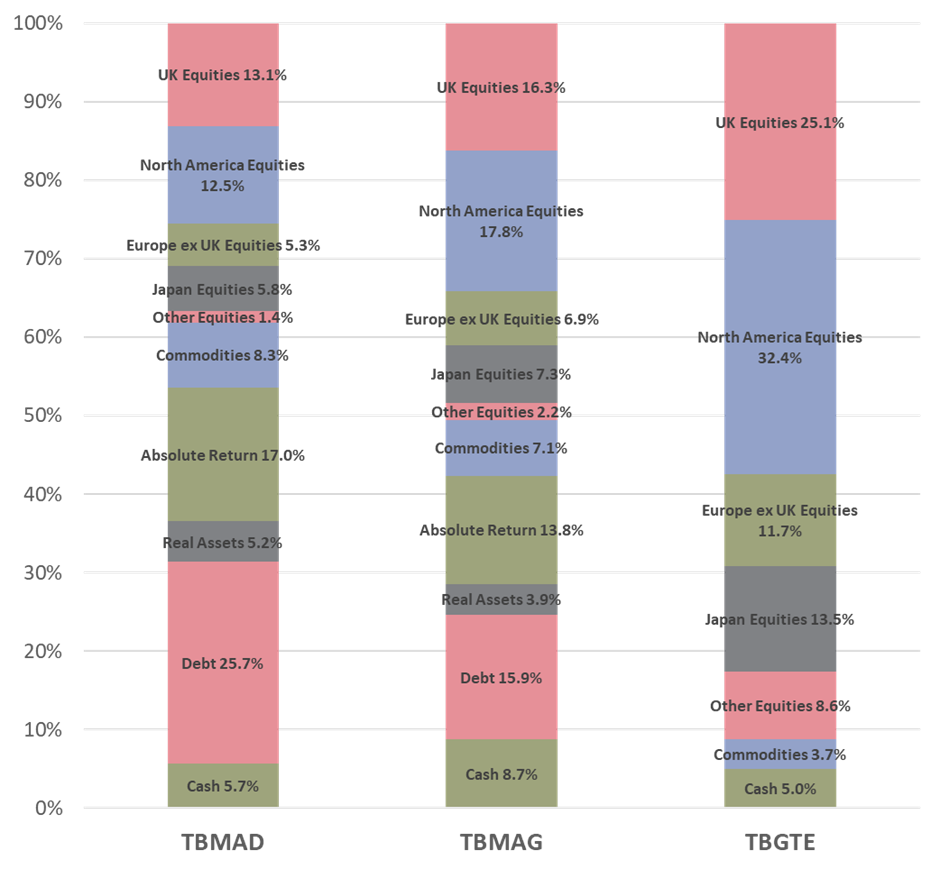

Amid these macro shifts, we made targeted adjustments to the T. Bailey funds to protect capital and capture new opportunities. Early in March, we increased our allocation to European equities, reflecting our confidence in Europe’s improving outlook. Specifically, we introduced the L&G Europe ex UK Equity ETF across the

- Bailey funds of funds portfolios.

To fund the position, we trimmed two funds with heavier US exposure. We reduced our holding in the First Trust Nasdaq Cybersecurity ETF, a US-centric technology theme, and also pared back the Royal London Sustainable Leaders Fund. The latter, while an excellent UK equity fund, has a bias toward large-cap companies with substantial US dollar earnings. These reallocations tilt our equity mix further toward continental Europe and other undervalued markets, in line with our view that global leadership is broadening beyond the US.

Closer to home, we are managing UK interest rate risk carefully. With the Chancellor’s Spring Statement reaffirming fiscal discipline but only a thin margin against borrowing limits, we anticipate continued pressure on longer-term UK bond yields. To guard against this, we favour short-to-medium maturities which should help preserve capital if yields rise.

In addition, we maintain a healthy allocation to diversifying strategies. These holdings (now roughly mid-teens percent of our Multi-Asset funds) act as a cushion in volatile periods.

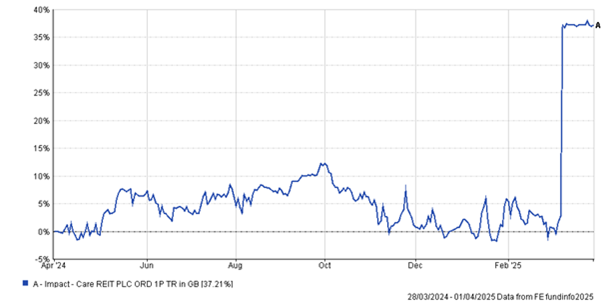

For the T. Bailey Multi-Asset Funds, notable news this month was that of a takeover bid for Care REIT (a UK real estate investment trust). The bid was made at a c.33% premium to Care REIT’s prior share price.

Care REIT

Source: FE Analytics. Total return, GBP terms.

The net result of portfolio adjustments in March is that the T. Bailey portfolios are more globally diversified and tilted toward areas of value and resilience. As we enter the spring we look to maintain well-balanced portfolios to navigate the evolving geopolitical landscape and to seek opportunities that align with the T. Bailey funds’ long-term objectives.

Look through asset class exposure of T. Bailey funds of funds

Source: T. Bailey, underlying third party manager portfolio data.