Between a Bank and a Hard Place

The UK Bank Rate was raised by the Bank of England by 0.25% to 4.5% as expected in the face of recent inflation figures. Despite expectations, the UK economy grew by 0.1% in Q1 2023. Although this might not sound like much, it confounded the doomsayers – although March was the weakest month for economic activity in Q1. Strike action will also have acted as a drag.

The Bank of England’s Monetary Policy Committee raised their projections for UK economic growth but …

The UK Consumer Price Index (CPI) stands at 10.1% for the twelve months to March 2023, coming down but still too high especially with a tight labour market. April’s number announced shortly, will be closely watched by the Bank and financial markets alike. UK Government bonds (gilts) and corporate bonds priced off them, haven’t enjoyed a good past month, gilts being the worst of all developed country government bond markets.

Glass Ceiling

Dire warnings were issued by Janet Yellen and Jerome Powell of what might happen if US Congress fail to raise the debt ceiling which might be needed as early as 1 June. The prospect of the US defaulting is being taken seriously by markets as the Democrats negotiate with the Republicans in what is becoming a game of chicken.

Another One Bites the Dust

First Republic Bank’s failure served to remind us that the US regional banking issue has not gone away. Probably another cheap pool of assets acquired by JP Morgan but depositors in regional banks will continue to seek safer havens in too-big-to-fail banks or higher rates in money market funds.

Fed Aid

Two statistics that will please the US central bank and related to the US employment picture are as follows:

Room for Optimism

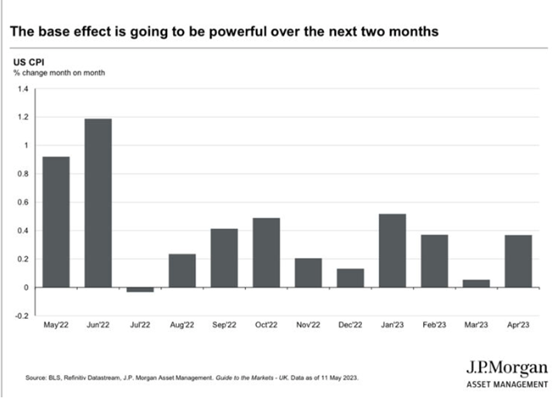

While inflation has continued to edge down in the US, that pace hasn’t been fast enough to appease a number of Fed Governors. The next two months, when May and June 2022 drop out of the year-on-year inflation data, could see significant drops in year-on-year inflation. May’s inflation, reported in mid-June, and June’s, reported in mid-July, could see year-on-year inflation at 4.4% and 3.5% respectively.

Equity markets have been mixed to generally positive so far in May. While Chinese stocks have been soft, Japanese equities have led the positive market returns.

Concern over the debt ceiling not being raised led the dollar lower with sterling one of the stronger currencies. Unsurprisingly in the current climate, gold has been firmer whereas industrial metals have been soft.