Turning Points?

With inflation headed lower although not yet at the pace central bankers would like, encouraging economic growth signs emerged from both the UK and Eurozone last week. Nothing to get too excited about at 0.4% for the UK in March but exceeding expectations. A softer tone from the Bank of England at last Thursday’s Monetary Policy Meeting, gave optimism of a base rate cut this summer after Governor Andrew Bailey spoke of progress on inflation. Unemployment ticked higher in the UK although average earnings remain above 5%.

The Japanese Yen also witnessed a turning point when the Bank of Japan intervened to shore up the Japanese currency at 160 vs the US Dollar. The rebound to the mid-150s has held for now but the Yen remains speculators’ favourite funding currency as the chart below from NS Partners illustrates with bullish sentiment at its highs:

Source: NS Partners

NS Partners also show the relationship between Japan’s trade balance and the exchange rate between the Yen and US Dollar. The following graph would suggest Yen strength:

Source: NS Partners

Higher Japanese bond yields and currency concerns have led the Japanese equity market to be May’s laggards amongst positive returns elsewhere. It could be argued that after its stellar run to achieve record highs, the Japanese stock market is pausing for breath. It isn’t an expensive market and the corporate governance reform continues to drive returns to shareholders. In our view, the relationship between the Japanese currency and its stock market is not as pronounced as recent moves might suggest.

Inflated Expectations

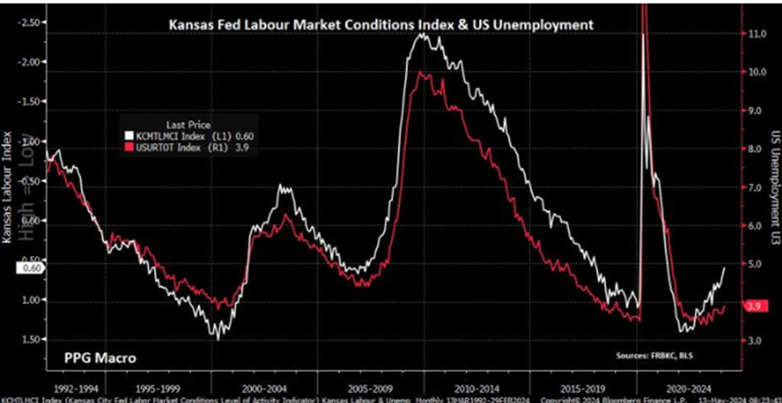

What might make for great headlines, doesn’t necessarily translate into noteworthy macro-economic inputs. Financial market headlines will focus on US Consumer Prices, released today (15/5). This isn’t the preferred inflation barometer of the US central bank which comes later in the month. However, the lower inflation trend remains. Yet, as US Federal Reserve Chair, Jerome Powell, espoused in Amsterdam this week, more progress is required on inflation before rate cuts are made. What might help make their minds up is a turn in the employment market where labour market tightness has been a concern as has its translation into wages. As we have pointed out previously, the monthly data release on US unemployment is notoriously volatile and a lagging indicator. Better, more leading indicators suggest that unemployment has turned higher. The following graph shows the turn in the Kansas Fed Labour Market Index and its relationship with US unemployment:

Source: Marquee Finance by Sagar

While the US central bank waits for more evidence on lower inflation, the European Central Bank looks set to lower official rates in June and the Bank of England may join them. The prospect of a turn in UK and Eurozone official rates has helped their equity markets in recent weeks.