AI (All In)

As the half year came to an end, many will have noticed that any stock that can demonstrate that it will benefit from Artificial Intelligence (AI), has had a good run. June was a muddling month that ended on a positive note but suffered bouts of negativity, notably after disappointing inflation data resulting in higher interest rates.

The reality may be that these are the same stocks that got beaten up in 2022 and that the strong returns of ‘big tech’ stocks was effectively a dose of mean reversion.

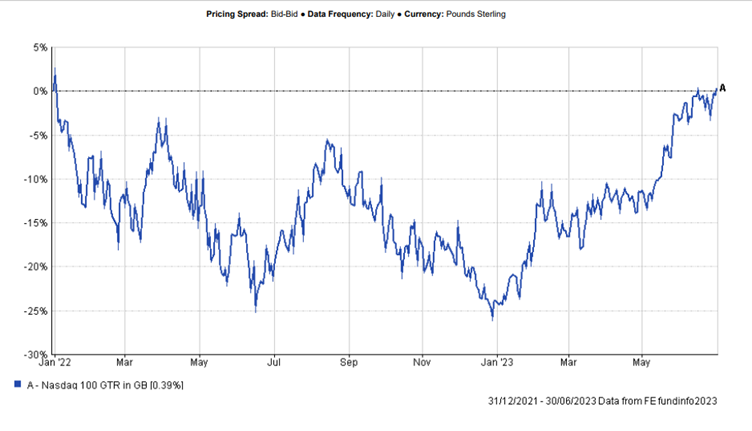

How many stayed the course? The following chart sourced from FE Analytics illustrates both the mean reversion of the Nasdaq 100 and the volatility en route to a marginal positive return from the start of 2021 to the end of June 2023.

FOMO

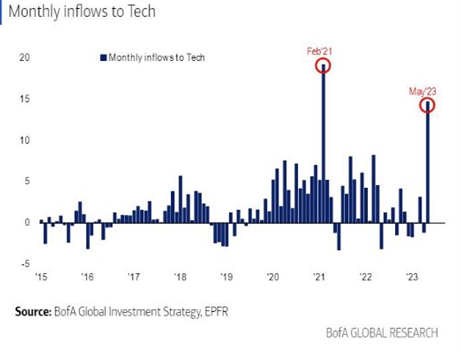

The AI ‘chat’ built up a head of steam for ‘big tech’ as investors feared missing out on the rally in stocks that said they would benefit from AI. Money flows into technology stocks in May, revealed in June, shows how substantial the flows were.

The largest flows coming in the month of May as the following graph shows.

Source: Marquee Finance

Bad Breadth

The Nasdaq was the best performing index in the first half of 2023 and June was another good month for the technology dominated index. Four companies represent 40% of the Nasdaq index, Microsoft, Apple, NVIDIA and Amazon. Respectively, up 42%, 62%, 190% and 46%. Much of that stellar Nasdaq index performance is in the hands of a few stocks that have bounced after plummeting in 2022.

False Dawn?

June 21st saw the summer solstice come and go. For many, it was important to be up at the crack of dawn to witness the sunrise on the longest day of the year. Anyone who has chosen to invest in the first half of 2023, may believe that we are in a new bull market, buoyed by AI. However, it is hard to recall a period when there was such a great dispersion of views from financial market strategists.

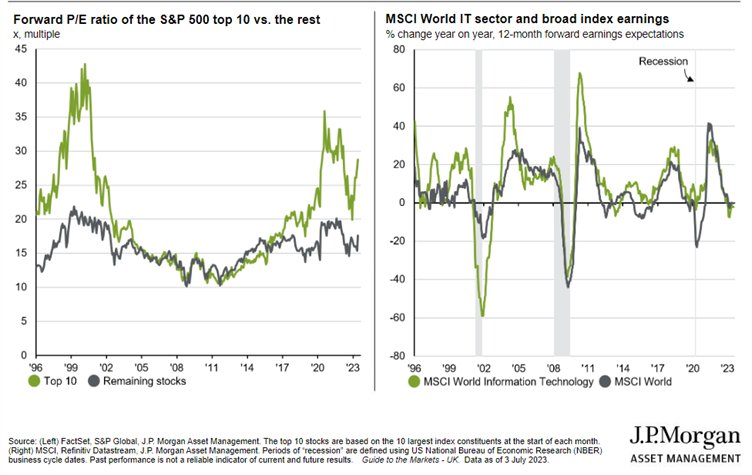

The second half looks like a tricky investing period, although not necessarily an unrewarding one. A number of asset classes, such as developed market government bonds, have continued to cheapen. The Nasdaq and the IT sector contain some lofty earnings expectations. Some will be met – some won’t. The top four of the Nasdaq are identical to the top four in the S&P 500 index albeit with half the collective weight.

The following charts sourced from JP Morgan Asset Management, highlight the earnings challenges ahead:

Source: J.P. Morgan

Rising Sun

Having spent much time being unloved, uncared for and in the doldrums, the Japanese stock market has continued to prosper in 2023 and June continued that run. The Topix index (total return) was up 7.5% in June, less so in sterling terms as the yen weakened 5% against sterling. Corporate governance reforms continue to bolster shareholder returns in Japan.

Higher and Higher

Another month and another raft of developed market central bank interest rate hikes.

For the US and UK, the upward shift was double what it has been via a 0.50% hike. In the US, the Federal Reserve Chair, Jerome Powell, stated that they would pause to wait and witness the impact of the ten rate hikes since March 2022 when the Fed Funds rate was raised to 0.25% to 0.50%. Only a year ago it was 1.50% to 1.75%.

The pause is likely to be more of a skip as subsequent stronger than expected economic activity and stickier than expected inflation prompted Powell to view a further two more 0.25% hikes as likely.

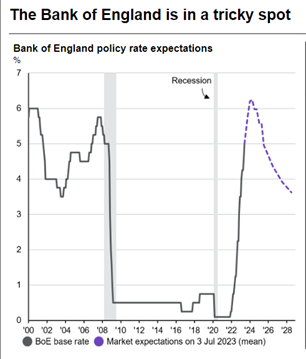

Higher than envisaged UK inflation numbers released in June for May 2023, led to the Bank of England upping the ante with its 0.50% hike. At the time of writing, futures markets are pricing in base rates peaking at over 6%.

Whether the UK economy can withstand that level of interest rates is open to question. Additionally, there is a school of thought that believes that with a tight labour market, higher base rates stimulate further wage demands – exactly the opposite of what the Bank is aiming to achieve.

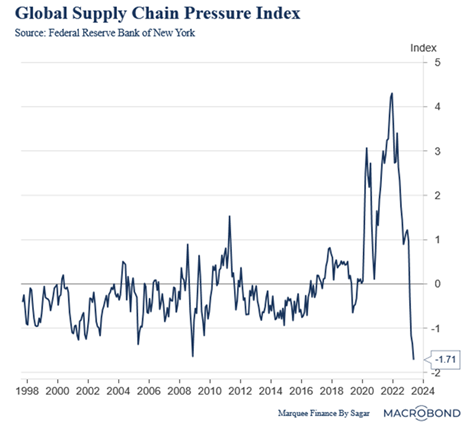

One key input that is helping inflation come down outside of wages, is the Global Supply Chain Pressure Index which spiked on Covid-related demand and post the Russian invasion of Ukraine.

Source: Macrobond

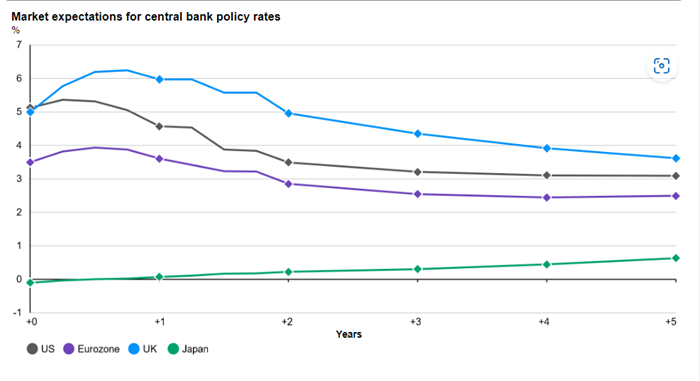

Nonetheless, financial markets have taken some comfort from predicting when and by how much interest rates will subsequently fall. The following two graphs, sourced from JP Morgan Asset Management, highlight the Bank of England’s predicament followed by official interest rate predictions from futures markets for other developed market economies.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

The perception that the Bank of England will engineer a recession to curb inflation sent UK mid and small cap stocks down sharply in the week of the Bank’s rate hike.

Quality

It is important at a time of higher interest rates to focus on quality business with strong cashflows and robust balance sheets with minimal financing needs. This is very much the core of our investment style within long-term demand themes.

Other Asset Classes:

Debt (Bonds)

Higher short rates took their toll on debt markets in general with yield curves further inverting – indicating that future inflation won’t be as high as current inflation and that monetary policy may be too tight in this cycle. Non-government spreads were generally narrower over the month, easing the discomfort for bond investors.

Currencies

Higher rates helped sterling against a weaker US dollar given the expectations that UK rates would peak at a higher level than in the US. However, sterling was little changed on the month against the euro. As noted earlier, the Japanese yen was weak in response to its continued adoption of a loose monetary policy in the face of rising inflation, the latter being something that Japan has sought for many years.

Commodities

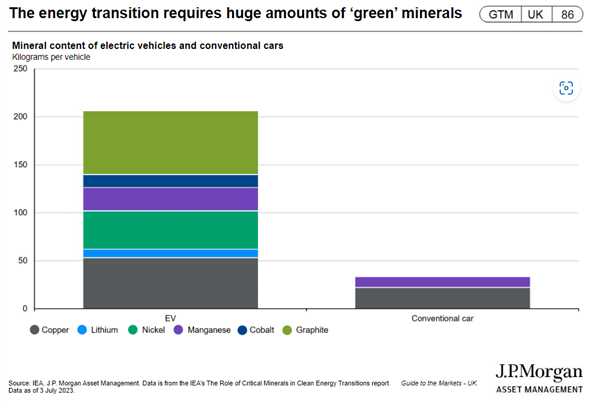

Industrial metals have had a hard time, possibly impacted by the perception that a weaker Chinese economy will reduce demand. In contrast to that view, the following chart from JP Morgan Asset Management, shows what the demand framework looks like just referencing the energy transition for electric vehicles.

Source: JP Morgan Asset Management