The Road to Transition

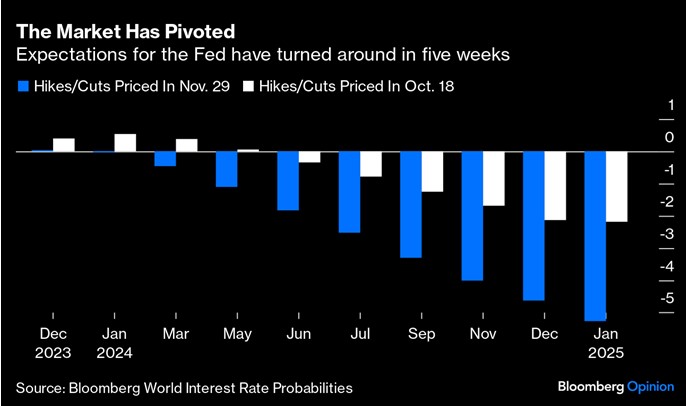

November has been about a bounce in developed markets’ equity indices on the belief that the central banks of the US, Europe and the UK were through with tightening monetary policy and Japan wasn’t moving towards any meaningful change to its overly accommodative stance. Indeed, as November progressed and slower economic activity was evidenced through data releases, expectations of official rate cuts in the first half 2024, increased, not least in the US as the chart below from Bloomberg, illustrates:

Source: Bloomberg

The release of the US Consumer Price Index (CPI) on 14 November showed a more moderate and better than expected outcome for inflation, proving to be the catalyst for renewed upward momentum for equities to bounce again and US Treasury yields to plummet.

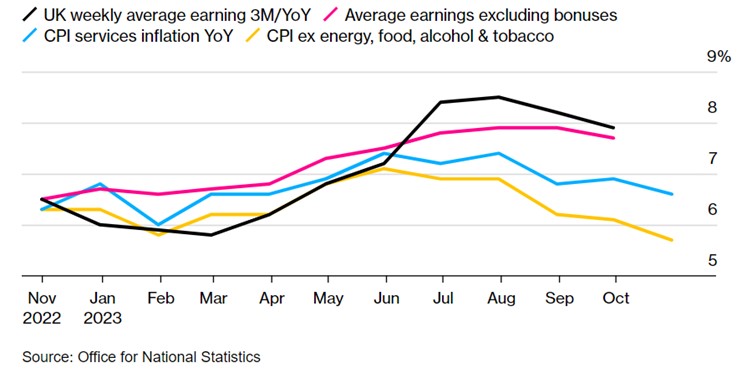

The following day, UK CPI followed suit by both being lower and lower than consensus forecasts. However, the UK employment report published the day before showed wages growing at a 7.7% annual rate. A tight labour market continues to vex Bank of England Governor, Andrew Bailey and his colleagues but inflation is heading in the right direction although still some distance above target. The top two lines in the following graph sourced from Bloomberg highlight the Bank of England’s concerns:

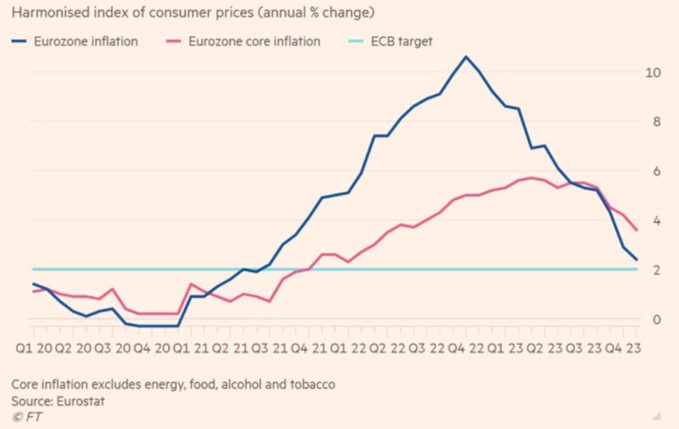

Bloomberg also reports that expectations for Euro official interest rates are for a 100 bps or 1.0% fall. The European Central Bank (ECB) thinks that’s optimistic, although Eurozone inflation released towards the end of the month, was better than expected as shown below. Perhaps, inflation was transitory after all, although the road back towards lower inflation was longer than anticipated.

Source FT.com

Fed Talk

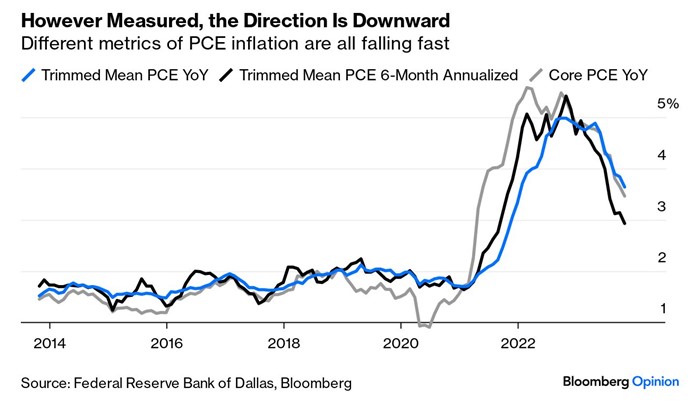

On the final day of November, the US Federal Reserve’s favoured measure of inflation was published. PCE or Personal Consumption Expenditures to give its full name, delivered a picture that will please the US central bank:

Slowing Down

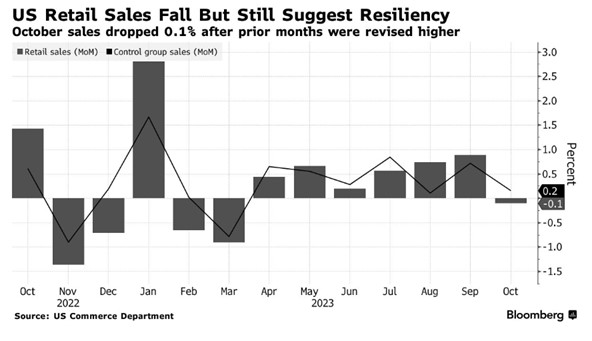

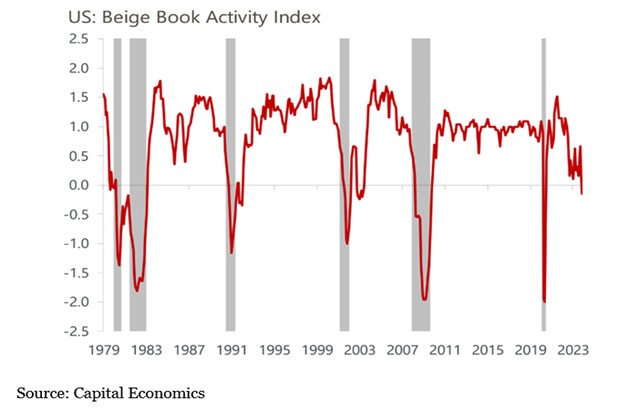

The following two slides are just two examples of a slowing economy, there are more but for the sake of brevity, I kept it to this pair of exhibits. For some strategists, the concern is that a slowdown will result in a recession, forcing the US Federal Reserve to reverse course on monetary policy. The bigger question is how deep and long any recession might be. For now, the majority believe in a hard-to-achieve soft landing for the US economy:

In the UK we received the ‘good’ news that the UK economy hadn’t fallen into recession, it had flatlined between July and September 2023.

China has been disappointing economically as the much-awaited post-Covid recovery has failed to materialise. Signs of improvement in November though, in response to monetary and fiscal stimulus. Both retail sales and industrial data for October, announced in November, were ahead of expectations. Stimulative policy moves have caused the International Monetary Fund (IMF) to raise its 2023 growth forecast for China to 5.4%. However, data remains patchy in terms of economic strength.

The Israel/Hamas war and its potential to spread in the region bringing other players into the arena of conflict was not sufficient to detract from the lower inflation backdrop. Anticipated lowering of official interest rates in 2024, led to a rally in debt and equity markets. The Qatar brokered ceasefire in the final week of November may have provided some reassurance to financial markets.

The geopolitical situation along with lower bond yields helped gold to maintain its recent ascent.

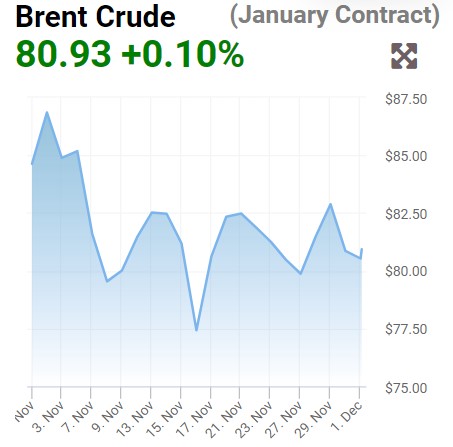

There would appear to be a complacency that the northern hemisphere is in for another warm winter like last year’s which staved off the worst of an energy crisis a year ago. Oil, which might have been expected to have risen on supply concerns, endured a soft November. Following is a chart of Brent Crude in November:

Source: Oilprice.com

The US dollar had a weak month as the following chart of the US dollar’s trade-weighted index (aka DXY) from TradingView, illustrates:

Sterling was one of the beneficiaries, rising over 4% against the US currency, also improving against the Euro by 1% in November.

Munger Games

The end of November witnessed the passing of legendary investor, Charlie Munger, one month short of his 100th birthday. Along with now 93 year old Warren Buffet, they transformed Berkshire Hathaway from a shell company into an investment behemoth but one that stood for a long-term way of investing based on patience from buying into financially robust businesses at the right price. Some investors like to call that ‘value’ investing but is more like GARP than GAAP – growth at a reasonable price rather than growth at any price. While Charlie would baulk at such acronyms, he leaves a formidable legacy in Berkshire Hathaway (market cap: USD780 billion) and a library of notable quotes. Here are some of those on investing:

- “You don’t have to be brilliant, only a little bit wiser than the other guys, on average, for a long, long time.”

- “We have three baskets for investing: yes, no, and too tough to understand.”

- “The big money is not in buying or selling, but in the waiting.”

- “Lifelong learning is paramount to long-term success.”

- “If I can be optimistic when I’m nearly dead, surely the rest of you can handle a little inflation.”

- “Every time you hear EBITDA, just substitute it with bulls–.”

- “Knowing what you don’t know is more useful than being brilliant.”

- “We have a passion for keeping things simple. If something is too hard, we move on to something else.”

Your Money

Portfolios have benefitted from their interest rate sensitivity as bond yields have descended. This has helped those investment themes such as energy transition plus mid and smaller companies where reduced financing costs will aid the bottom line.

November was also a month where investors paid greater attention to those previously unloved, almost forgotten markets that became too attractive to ignore.

Additionally, that attention also focused on companies below large-caps where a lot of value in cash generative business can be found, especially in the UK. An example of how strongly those companies reacted to renewed interest is the 7.4% return generated from the WS T. Bailey UK Responsibly Invested Equity Fund. The fund has a multi-cap approach, investing in large, medium and small yet robust businesses with strong balance sheets.

The multi-asset funds allocation to five year UK gilts and 7-10 year US Treasuries benefited from price appreciation as yields fell without taking on longer duration risk.

Conscious of protecting investors from US dollar weakness, much of the multi-asset funds’ US dollar exposure is hedged back to Sterling – a process that helped in November.

The multi-asset funds topped up their allocation to the Man GLG High Yield Opportunities Fund. Although credit spreads are quite tight in an uncertain backdrop for corporate credit, this fund’s credit specific expertise avoids buying the broader high yield market in favour of attractively priced, improving credits. With a yield of around 12%, it is an attractive investment proposition.

During the first half of November, the investment team here at T. Bailey, conducted some of it regular reviews of funds held across the T. Bailey portfolios. There was one special event that Assistant Portfolio Manager, Siobhon Becker took part in. Siobhon attended the 25th anniversary of the Polar Capital Global Insurance as one of the limited number of long-term holders of the fund. It is a rather unique fund we have supported for a number of years from its initial fund manager, Alec Foster to the current manager, Nick Martin. There aren’t many strategies that enable the fund’s holdings to re-price their book on an annual basis – i.e. increasing insurance premia – a bit like an equity version of a floating rate note.

Latterly the investment team met with Pieter Busscher CFA, manager of the Robeco Smart Materials Fund. The fund has an increased exposure to insulation materials in response to the demand to cut emissions from buildings (40% of European emissions are from buildings).

The big thematic winners and rebounders in thematic exposures came from cybersecurity, artificial intelligence (both held in Global Thematic Equity), smart materials and the previously out of fashion, energy transition/climate change. Funds held in those five themes were up between 7% and 12%.

At the final day of November, there was some welcome good news for the UK Investment Trust sector on cost disclosures. Our largest holding in that sector is Chrysalis which benefited from a management restructuring earlier in November. Consequently, Chrysalis was up 24.5% in November.

Valuation discipline remains a key part of our investment process and not overpaying for good businesses where the earnings estimates have been extrapolated from prior earnings releases to sky-high valuations, is paramount. While the so-called ‘Magnificent Seven’ have done well, reversing 2022’s losses and more, the valuations look stretched in aggregate for those stocks which represent 30% of the US S&P500 equity index. The more sanguine inflation and interest rate environment has created a solid platform for previously unloved yet cheap themes and markets. The UK and Japan are two of those markets as are the themes related to healthcare, energy transition and climate change.

Our focus remains on underlying financially robust, strong balance sheet, free cash flow businesses. While interest rates may have halted their ascent, the wreckage from their rapid ascent may only just about to become apparent for businesses relying on cheap labour and financial leverage.