Are We Nearly There Yet?!

For many, October means half-term and a trip somewhere with children, the familiar cry from the back seats being ‘are we nearly there yet?’ For investors wondering whether the central banks of the US, Europe and UK are done with tightening monetary policy, the answer is quite possibly. In the US, the increase in Treasury bond yields will have done much of the tightening the US Federal Reserve might have thought they needed to do. Most recent data in the US, UK and Europe points to lower inflation, weaker economic activity (the US third quarter gross domestic product or GDP, was an aberration as the jobs report at the beginning of October is likely to be too) with personal consumption and consumer confidence softening.

However, most of October was dominated by geopolitics following the October 7th Iranian-sponsored Hamas strike on Israel and the latter’s retaliation. The potential for this situation to escalate and broaden geographically has led to even greater uncertainty in financial markets than was already in existence beforehand after the ‘higher-for-longer’ narrative from the aforementioned central banks plus the disappointing economic output from China.

Consequently, in a challenging month for investors, most asset classes posted negative returns in October, the exception being a small positive outcome for commodities, represented by the Bloomberg Commodity Index, as the following column from JP Morgan Asset Management illustrates.

Source: J P Morgan Asset Management

Changes

The Palestinian-Israeli conflict that commenced on 7 October when Hamas struck in Israel, and the potential ramifications of a wider conflict developing – involving other regional nations and superpowers – has led us to be more defensive in our asset allocations given the prospects for slower global economic growth and disruption to energy and possibly, food supplies.

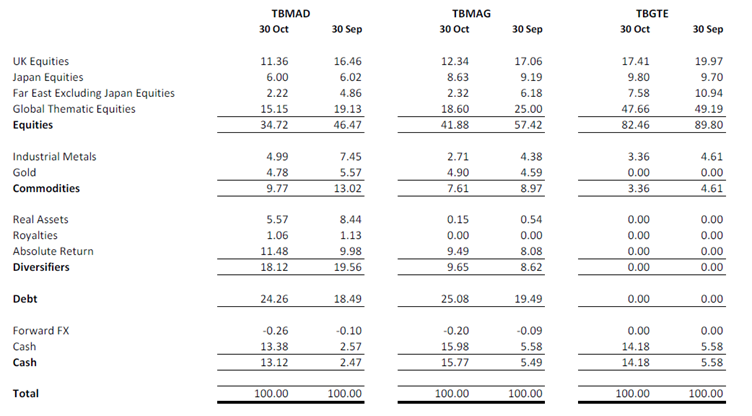

The table below shows the changes made in October by detailing the asset allocations across the funds, T. Bailey Multi-Asset Dynamic (TBMAD), T. Bailey Multi-Asset Growth (TBMAG) and T. Bailey Global Thematic Equity (TBGTE) as at 30 September and 30 October.

Source: T. Bailey Asset Management

Asset Classes

Equities

The US S&P 500 index proved to be the least worst of the equity markets/indices in October, down just over 2%. The best equity market year to date, Japan was soft too, down 3% as represented by the TOPIX index. The consistent improvements in corporate governance leading to improved shareholder returns has been a key factor for Japanese equities.

China has continued to disappoint investors through lacklustre economic performance and a problematic real estate sector. China was the main reason for a disappointing outcome for Asia ex-Japan equities in October, down 3.9% as measured by the MSCI Asia ex-Japan index; the same outcome as their broader Emerging Markets index.

Despite a significant energy representation, the FTSE All Share illustrated the weakness of the UK equity market, down just over 4%. Within equity markets, sentiment towards smaller companies deteriorated further as the ability to access or pay for financing is deemed to be more difficult for smaller businesses. The exposure that the T. Bailey funds have is to companies with strong balance sheets and low levels of leverage. Nevertheless, the perception that a liquidity squeeze does more harm to smaller companies was indiscriminately detrimental to their share price performance. The long-standing cheapness of UK equities has attracted some merger and acquisition activity.

Some global themes have suffered from poor sentiment. That would certainly apply to energy transition, where funds exposed to that theme suffered a double-digit reverse. Cybersecurity fared best of the themes, besting all the regional equity indices. Insurance almost managed to deliver a positive outcome – the ability to re-price your book of business upwards on an annual basis is good for shareholders, although not so good for motorists or householders.

Government Debt

The safe-haven status once attached to selective government debt has given way to volatility as governments issue more debt at the same time as interest rates are rising. Yields rose in western developed government bond markets, notably in the US and Japan. The fourth quarter funding requirements for the US Treasury, to be announced in early November, are sufficiently large to concern ‘bond vigilantes’.

Japanese authorities continue to attempt to let the yield genie out of the bottle, gently. Artificially suppressing government bond yields at ten year maturities while inflation rises has become a one way direction of travel to higher yields. Japanese government bonds were the weakest of the major government bond markets.

Credit

With the cost of capital continuing to rise, it is unsurprising that credit markets took a hit in October as evidenced by wider yield spreads to respective government bonds. Default rates are likely to increase which highlight the need for credit specific strategies over a broad exposure to investment grade, high yield or crossover credit.

Currency

Tighter monetary policy alongside an expansionary fiscal policy usually results in a firmer currency for the country that adopts that policy mix. That has helped the US dollar in recent months and did so to a lesser extent in October. The Japanese yen continues to be under pressure due to its accommodative monetary policy with some speculating Bank of Japan intervention around 150 to the US dollar.

Commodities

With events at the eastern end of the Mediterranean to the fore for most of October and the potential for escalation, it is not surprising that gold posted one its best months for some time, up nearly 8%.

The expected bounce to continue the oil price rally since July, failed to materialise as the chart below demonstrates.

Source: Trading Economics

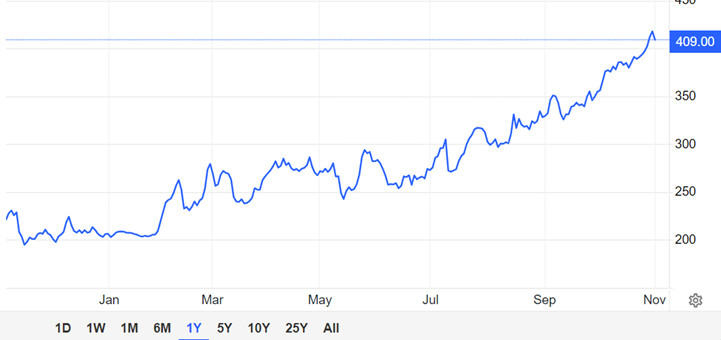

Industrial metals were softer in October as weaker demand is expected globally. Within foodstuffs, there was little price action of note. Wheat was marginally higher whereas orange juice and cocoa have seen strong upward price movements. Below is the price of orange juice over the past year – shades of the film ‘Trading Places’.

Source: Trading Economics