Bond Villains

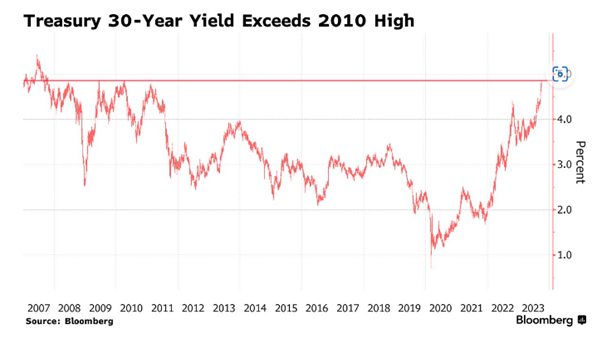

Rising government bond yields in North America, Europe and the UK were the result of the hawkish rhetoric from their respective central banks despite the US Federal Reserve and Bank of England opting to pause hiking official interest rates. The impending shutdown (subsequently averted but only for a few weeks) of the US government, as Republicans play politics ahead of US integrity, didn’t help the upward trajectory of US Treasury yields:

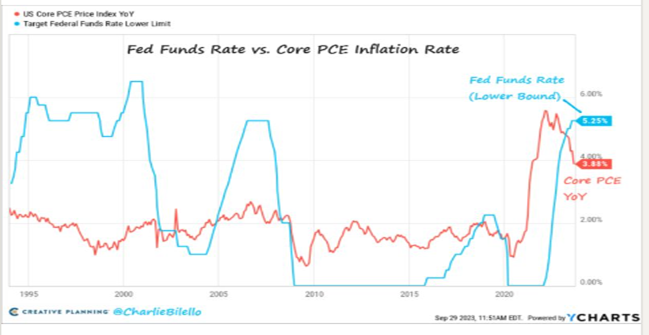

Inflation improved in the US, Germany and the UK. The UK and US central banks chose to pause their interest rate hikes in September, the European Central Bank (ECB) elected to raise their official rate by 0.25% to 4.50%.

Nevertheless, longer dated bond yields rose. The following chart is the UK ten year gilt yield for the past year:

Source: Trading Economics

The following two charts sourced from The Daily Shot and Bloomberg respectively illustrate the inflation improvement in the US and Germany:

Source: The Daily Shot

Source: Bloomberg

Wage pressure needs a weaker employment picture to ease in the west. The US auto workers strike and the size of their wage claims being a current manifestation of it. Rising oil prices added to wage pressures are making central banks hesitant about declaring inflation has been conquered. The rhetoric of higher for longer, or not done yet, has unnerved bond and equity markets alike.

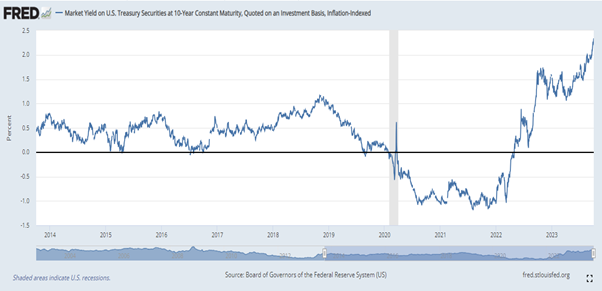

Further unnerving markets has been the increase in US real yields which presents a bigger hurdle for other asset classes to beat. The following chart shows the acceleration in US real yields:

Source: Federal Reserve of St Louis

In Asia, bond yields are at different levels in Japan and China but not necessarily for the same reasons. Japanese government bonds’ yields rose; ten year yields manipulated by the Bank of Japan are now at 0.80%. The persistence of an accommodative monetary policy in Japan is taking its toll on the yen. China’s economy continued to disappoint which conflicting signs on monetary stimulus. Property companies flirted with bankruptcy.

Asset Classes

Equities

The magnificent seven stocks that powered equity indices in 2023 subsided in September to the extent that an equally weighted S&P 500 is essentially flat over the year to date. That index had its worst month of the year. Rising nominal and real yields took their toll on equities across the board. The FTSE All World was in negative territory in September whereas the FTSE All Share in the UK posted a positive return. This marked a reversal of previous months and highlighted the UK’s relative attractiveness as an equity market.

Government Debt

As mentioned previously, bond yields rose significantly in western developed markets in the latter half of September post hawkish commentaries from respective central bankers. The rise in real yields caused capital losses in index-linked and US TIPs.

Credit

Concerns about the financial strength of lower grade companies caused high yield spreads to widen. Investment grade spreads fared better but widened as well towards the end of the month.

Currency

Higher bond yields in relative and real terms, helped the US dollar to strengthen over the month against most currencies. Japan’s continued adoption of an accommodative monetary prompted further yen weakness causing the Bank of Japan to intervene – 150 yen to the US dollar would appear to be their line in the sand. The Chinese yuan was similarly weak and seemingly was supported by their central bank.

Commodities

Oil was the commodity headline in September. Aided by reduced supply from Saudi Arabia and Russia combined with inventory drawdowns in the US, oil posted a rise of over 10% in September as measured by West Texas Intermediate after a steep ascent in prices saw them back to levels not seen since a year ago:

Gold was weaker on higher US bond yields. Copper was one of the better industrial metals but nickel was soft.