November has been characterised by a continuation of the rally in risk assets that started in October. The month started with official interest rate increases from the US Federal Reserve and the Bank of England.

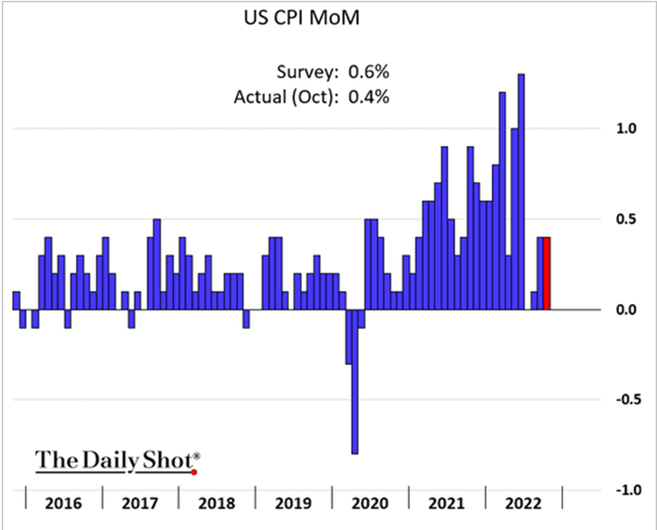

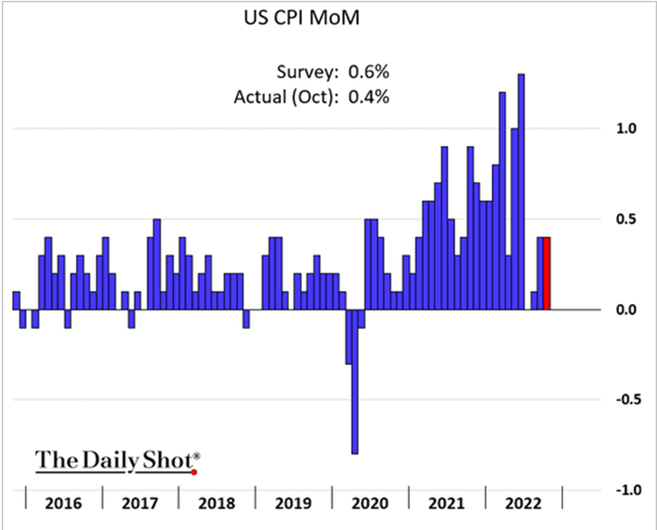

More recently, a surge in bond and equity prices was triggered by a much awaited undershoot in inflation expectations when the US consumer price inflation (CPI) for October was released last Thursday. Previously in 2022, quality growth stocks from large to mid-caps, had been the unloved equities as was anything with a growth tag.

The possibility that official short term interest rates do not rise as much as previously expected in the US and UK has increased.

Source: The Daily Shot

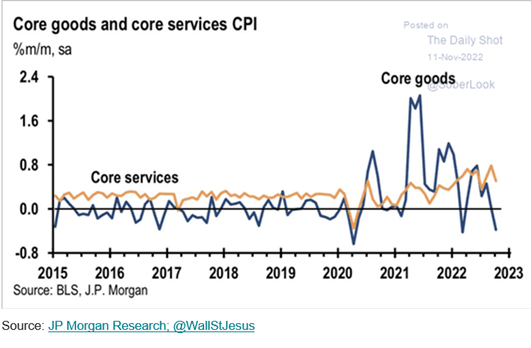

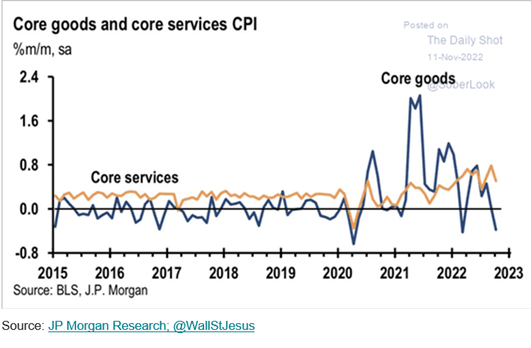

Importantly, goods and services prices are falling as the following chart illustrates:

Chinese equities enjoyed a robust rebound as hopes of an end to the zero covid policy manifested themselves. Support for the property market was also a large positive.

One of the other effects of a weaker than expected CPI was a weaker US dollar. Sterling’s bounce has been enhanced by a relatively more stable government under PM Rishi Sunak.

The start of November also witnessed a cryptocurrency meltdown with the collapse of FTX, a cryptocurrency exchange having assets of one tenth of its liabilities.

In the UK, last quarter’s growth dipped into negative territory. With fiscal tightening on top of further monetary tightening, a recession looks hard to avoid. Chancellor of the Exchequer Jeremy Hunt delivers his Autumn Statement on Thursday.

Bonds yields nosedived but have a lot of good news priced in at a time when central banks like the Bank of England will be sellers rather buyers of bonds as they transition from quantitative easing (QE) to quantitative tightening (QT).