Three Peaks Challenge

The challenge for investors is whether the lower inflation report for the US means the peak of US inflation is passed? And, whether the double-digit reports for UK and European inflation represent the peaks there. At least European inflation softened towards the end of November.

The US Consumer Price Index (CPI) for October, released mid-month, provided the catalyst for the rally in risk assets from the third week of October to continue at an increased pace. The 7.7% increase from a year earlier was the smallest 12 month US CPI advance since January 2022 (source: US Bureau of Labor Statistics). This key piece of data gave financial markets hope that the US central bank, the Federal Reserve, would moderate its intended path of interest rate hikes to deal with inflation. In other words, official short-term interest rates would still rise further but by not as much as had been feared. Similar sentiments, echoed in the UK and Europe, helped bonds and equities.

Grey Friday

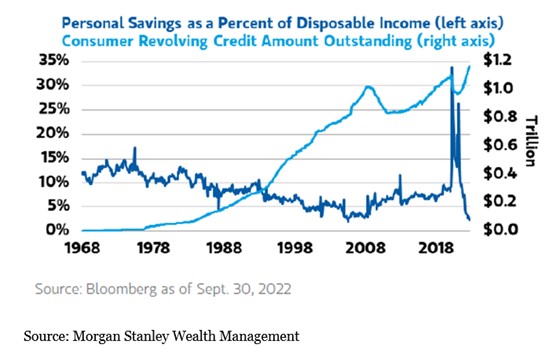

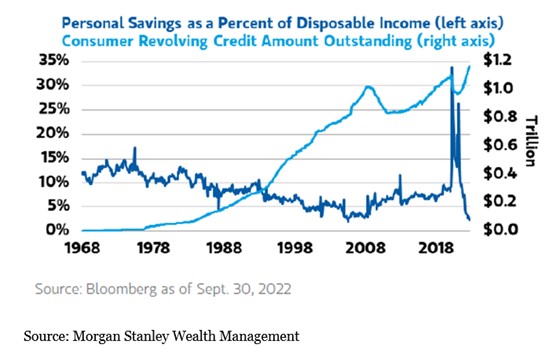

The consumer spending surge known as Black Friday, the day after Thanksgiving in the US, was muted but not as bad as some predicted. Since its commencement, Black Friday has been exported to countries like the UK and extended to a few more days with siblings such as Cyber Monday. The better than expected outcome for retailers came at the expense of savings and a greater use of credit.

The following analysis/quote from Bloomberg nicely sums up how US consumers are funding their consumer habits.

Dollar Reversal

Signs of a slowdown in the US economy helped reverse the fortunes of an expensive US currency. Sterling and the Japanese yen were the major beneficiaries but it was more of a US Dollar weakness story than one of Sterling strength, although Sterling was certainly helped by a relatively stable political situation (compared to previous weeks/months).

Crypto Chaos

The collapse of crypto currency exchange, FTX, shone an unfortunate spotlight on crypto currencies which responded accordingly. Central banks, concerned about the wild west of digital currencies, are probably glad they have avoided regulating them and by default, legitimising them. Bitcoin was down 20% over the month, others followed suit.

Cop Out?

COP27 took place in Egypt in November and failed to address the future use of fossil fuels. A last ditch coming together of participating nations did agree to provide financial support to poorer nations recognising their role as climate change victims via the establishment of a loss and damage fund.

China Covid Daily – Revolting Times

A backlash against China’s zero Covid policy erupted at the end of November at a time when signs were emerging that Chinese authorities were loosening some restrictions in some cities. Consequently, restrictions removal has gathered pace. Chinese stocks have responded favourably after enduring a difficult summer.

Trump – A Busted Flush?

November saw the US mid-term elections which usually result in a poor showing for the incumbent governing party followed by a positive stock market through to the New Year. Whether the latter happens, we will have to wait and see. However, the incumbent Democrats did better than expected, retaining control of the Senate. The poor outcomes for many Trump endorsed candidates was noteworthy, with the majority failing to achieve election. Nonetheless, Trump announced he will be running for the Republican nomination for the 2024 Presidential election. With a number of legal battles ahead, the Republicans may rally behind Florida Governor Ron DeSantis after his strong showing.

Asset Classes

- Equities

The US CPI release mid-month boosted the recovery in risk assets that commenced in the third week of October. The rally was widespread and notably benefited those that had been indiscriminately sold off earlier in the year. Consequently, quality growth businesses and smaller to mid-sized companies posted significant share price improvement reflecting their relative cheapness.

Themes

Infrastructure and climate change solutions did well as themes were again led by the related energy transition theme. Healthcare lagged those sectors but maintained its value.

Regions

Asian equities led the pack largely due to China being perceived to be relaxing lockdowns and an easing monetary policy. European, UK and Japanese equites bounced meaningfully outstripping their US counterparts.

- Bonds

Debt rallied in response to lower government bond yields across the board as lower future interest rate increases and expectations of lower inflation had a positive influence. This in turn helped credit which responded accordingly despite the rising risk of default in weaker credits.

- Commodities

Copper led the way as hopes of a China re-opening boosted demand. However, the long-term demand for copper versus its supply should provide sustained upward momentum overriding the dips caused by short-term factors. Gold improved in November in contrast to agricultural commodities which were softer on the month. Oil and natural gas prices fell over the month. A warmer start to the Northern hemisphere winter helped keep a lid on demand.