Rates not War

November has been about a decent bounce in developed markets’ equity prices in the first few days, on the belief that the central banks of the US, Europe and the UK were through with tightening monetary policy and Japan wasn’t for any meaningful change to its overly accommodative stance. There followed a bit of hiccup as those markets were given a reminder of the higher for longer narrative by US Federal Reserve Chair, Jerome Powell and Bank of England Governor, Andrew Bailey.

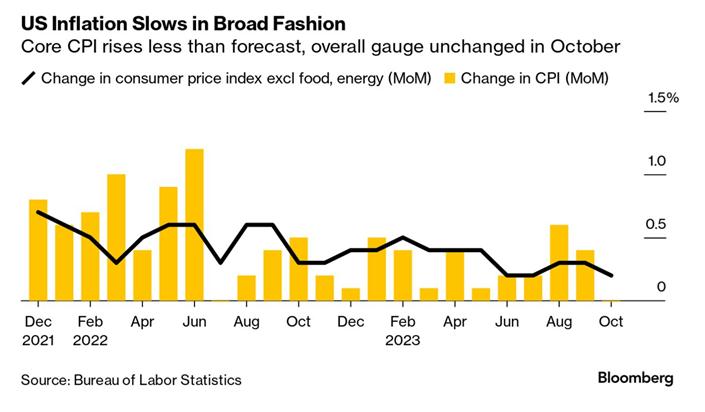

The release of the US Consumer Price Index (CPI) on 14 November showed a more moderate and better than expected outcome for inflation, prompting equities to bounce again and US Treasury yields to plummet as the following table from Bloomberg illustrates.

Source: Bloomberg

The sharp drop in bond yields was most likely exacerbated by hedge fund short covering, as many had been running extensive short positions.

The overall picture of slowing inflation will be good news to Jerome Powell and his colleagues. Within the broader picture, there were some notable falls in some inflation components. Medical Insurance, only a small contribution to the CPI number, was down 34% in October from a year earlier. Medical Care services were 2% lower but are 6% of the CPI calculation. The following graph from Bloomberg illustrates the gradual overall improvement:

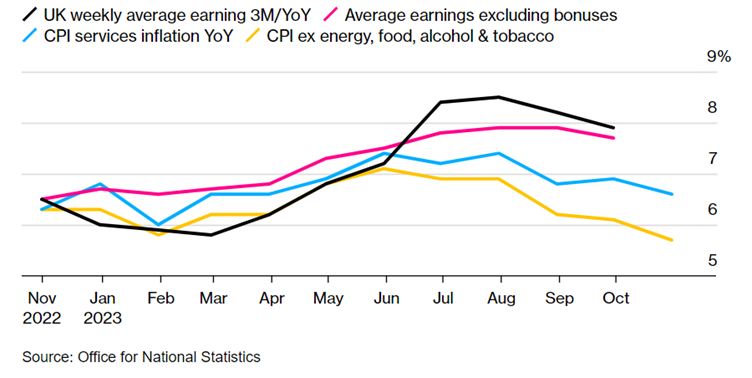

The following day, UK CPI followed suit by both being lower and lower than consensus forecasts. Better news following the UK employment report published the day before which showed wages growing at a 7.7% annual rate. A tight labour market continues to vex Andrew Bailey and his colleagues but inflation is heading in the right direction yet still above target. The top two lines in the following graph sourced from Bloomberg highlight the Bank of England’s concerns:

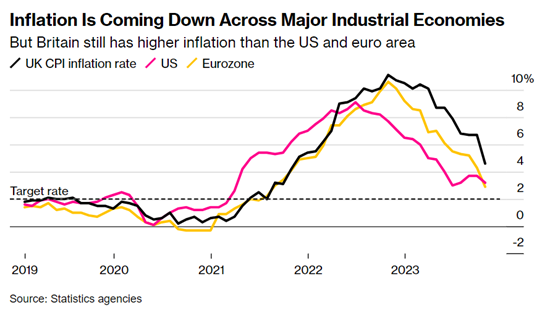

Here is the current and recent past inflation picture across the US, UK and Eurozone:

Source: Bloomberg

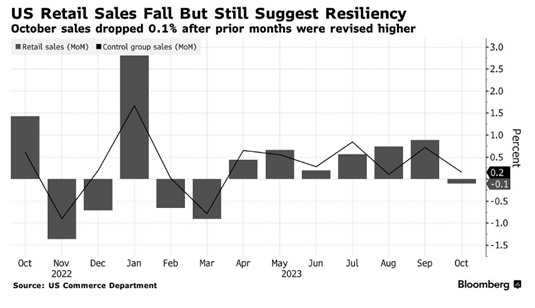

US and UK economies are cooling:

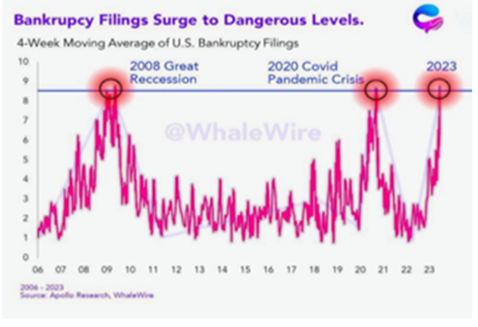

Something to keep an eye on – US bankruptcies:

In the UK we received the ‘good’ news that the UK economy hadn’t fallen into recession, it had flatlined between July and September 2023.

China has been disappointing economically as the much-awaited post-Covid recovery has failed to materialise. Signs of improvement in October though, in response to monetary and fiscal stimulus. Both retail sales and industrial data for October, announced in November, were ahead of expectations. Stimulative policy moves have caused the International Monetary Fund (IMF) to raise its 2023 growth forecast for China to 5.4%.

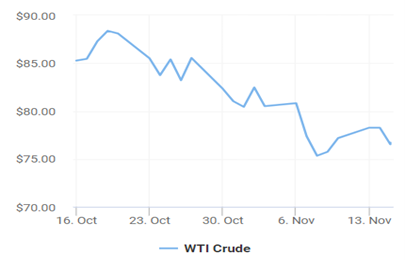

The apparent state of investor euphoria following a slightly better than expected US CPI number for October would appear to be something of a relief rally or bounce from oversold territory, ignoring the Israel/Hamas war and its potential to spread in the region bringing other players into the arena of conflict. There would appear to be complacency that the northern hemisphere is in for another warm winter that staved off the worst of an energy crisis a year ago. Oil has been soft in November to date though. Below is a chart of West Texas Intermediate (WTI) oil from its recent peak in mid-October.

Source: Oilprice.com

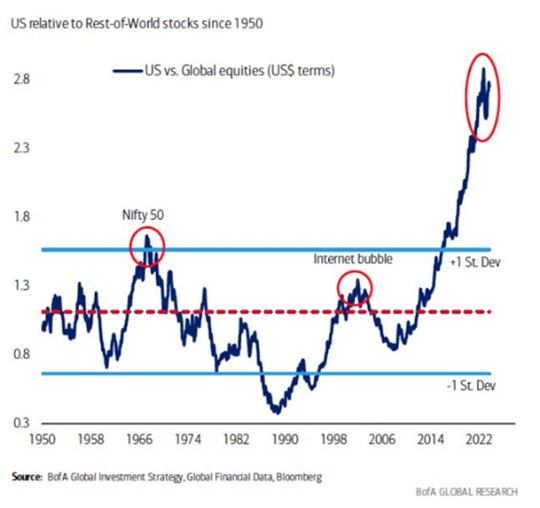

Much has been made of the outperformance of the US stock market versus its peers as the following graph from BofA Global Research starkly points out in a picture going back to 1950.

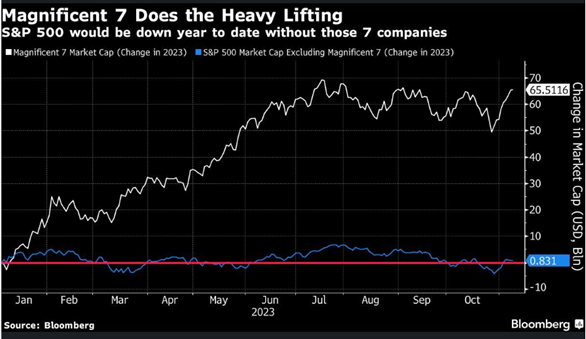

However, the magnitude can be misleading in 2023.

Reasons to be Active

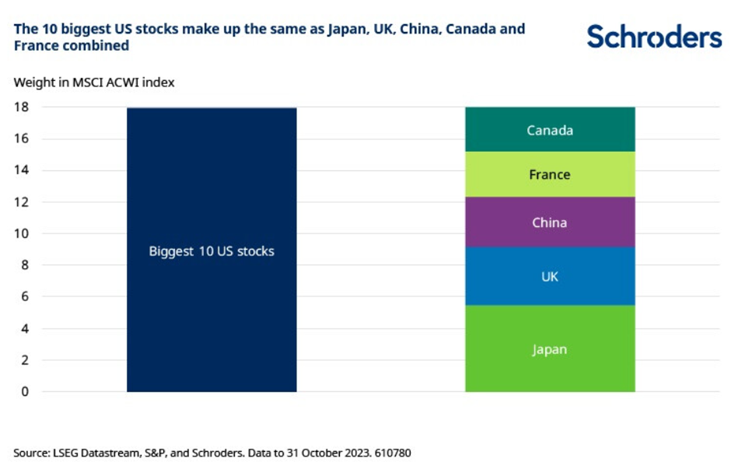

I’m grateful to Duncan Lamont, CFA Head of Strategic Research at Schroders for his recent work on how the resurgent price of a few stocks has distorted both the S&P 500 index and the MSCI ACWI (All Country World Index) making diversification harder to achieve for investors preferring a cheap index solution for global or US equity investing. The US now represents 63% of the MSCI ACWI with just ten (US) stocks representing 18% of the MSCI ACWI, the same as the UK, China, France and Canada combined.

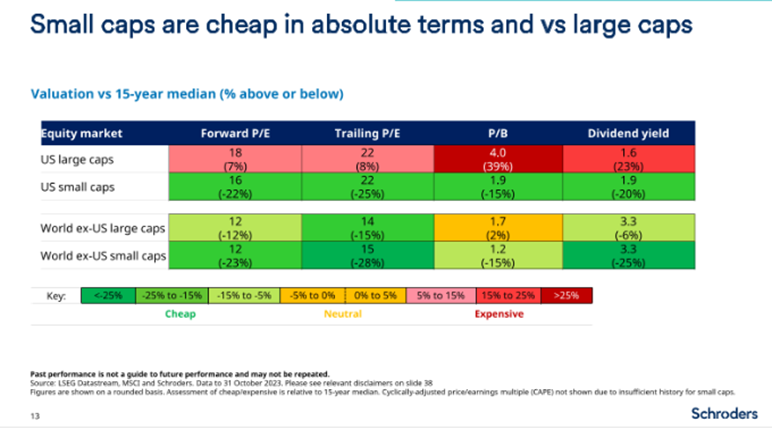

Investors gain comfort from buying what’s gone up – until it doesn’t. Those seeking diversification might deem this to be a good time to adopt a more truly global approach that also, by default, doesn’t give you a large US dollar exposure if you have Sterling liabilities. Additionally, as Duncan observes, smaller companies are cheap. Why should the size of a company identify as being the best value?