Inflation Fixation

Monthly US CPI data has probably overtaken the monthly US employment data as the economic release to dissect the most. This month’s release last week caused an upgrading of the Federal Reserve’s next two rate hikes to two of 0.75% (from one of 0.75% and one of 0.50%) as the number was stronger than forecast by several measures. Financial markets reacted accordingly. Higher than forecast, higher than last month can paint a negative picture. As contrarian investors, we like to look at key data from many angles. Below is a contrarian view of US inflation from the well-regarded Bank Credit Analyst and their Director of Research and Chief Global Strategist, Peter Berezin.

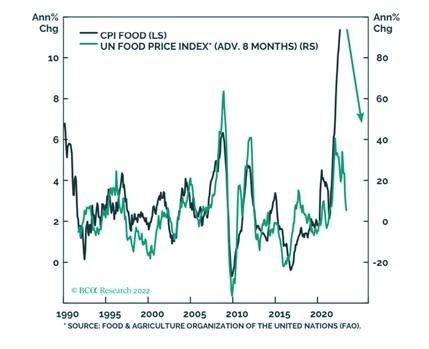

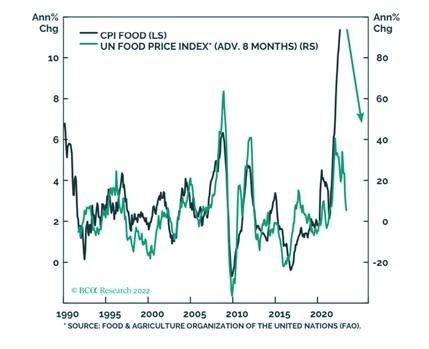

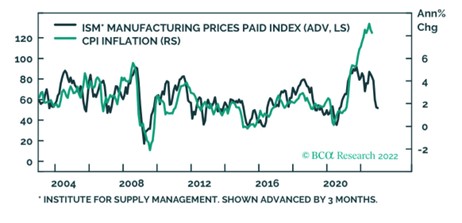

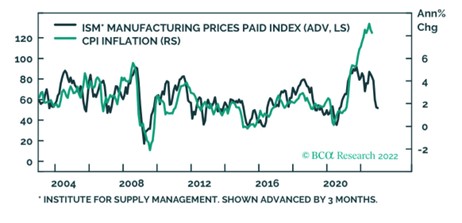

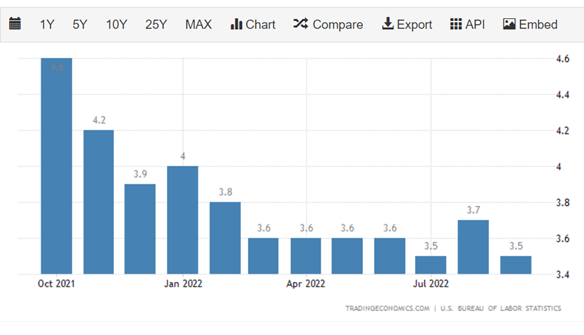

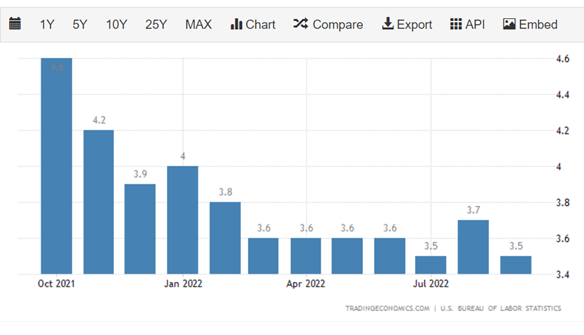

“The CPI report was not as bad as initial reactions suggest. All items ex food and shelter were up only 0.1% in September. As the charts below show, food inflation will fall and rents on new listings have already rolled over. Wage growth also looks set to cool.”

Source: Trading Economics

The US federal Reserve is banking on demand destruction to loosen the labour market.

UK Soap Opera

Step aside Eastenders, a new daily soap, ‘Westenders’, based in around Westminster, has grabbed our attention.

History will likely recall with some incredulity, how an incoming Prime Minister managed to caused so much market chaos in the UK currency and bond markets and translate a large parliamentary majority into a substantial lead in the polls for the opposition – in less than a month! The UK has now had four Chancellors of the Exchequer in four months. The latest, Jeremy Hunt, has effectively reversed his predecessor’s ‘mini-budget’. Given Liz Truss’s performance to date, it would appear that Hunt is de-facto Prime Minister. Surprisingly, he doesn’t figure as one of the favourites to succeed Liz Truss should she be forced out. UK credibility on the international front has been severely damaged. How the Conservative Party regain enough credibility before the next election is hard to fathom. It is unlikely to be with Liz Truss at the helm.

Jeremy Hunt’s reversal of Kwasi Kwarteng’s tax cuts has helped the gilt market, understandably. Sterling is relatively stable. This soap opera is likely to dominate the headlines a while yet.

Europe

European inflation rates have ratcheted higher but with marked differences from one country to another. There isn’t the labour market tightness evident in North America and the UK but energy prices remain the key ingredient in inflation. Government support schemes should help but it will be a tough winter, hopefully not too cold.

Ukraine continues to gain territory and a tactical advantage forcing Putin into wanting a ceasefire after bombing civilians as acts of terror from a desperate man. The Chinese are increasingly distancing themselves from their ‘special relationship’ with Russia as the 20th National Congress of the Chinese Communist Party got underway with President Xi under some pressure as the economy suffers from his lockdown policy.