The magnificent seven, not the bunch from 1960 film of the that name, but the seven US stocks – Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia and Tesla. These have been the outboard motor for global equities in the first half of 2023 but have done less well since. Their valuations are still elevated however. Yet parts of the US market and other global equity markets are more reasonably priced.

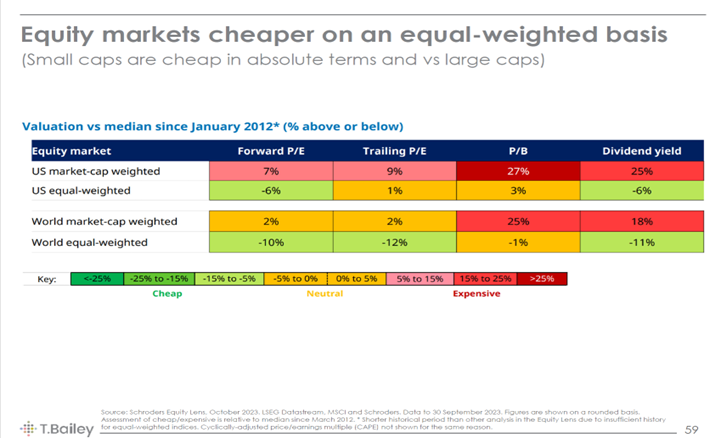

The following table from Schroders illustrates that there is value in other jurisdictions as well as in other parts of the US market. The latter, like other markets, is the sum of a number of parts. Where would you rather be?

Source: Schroders

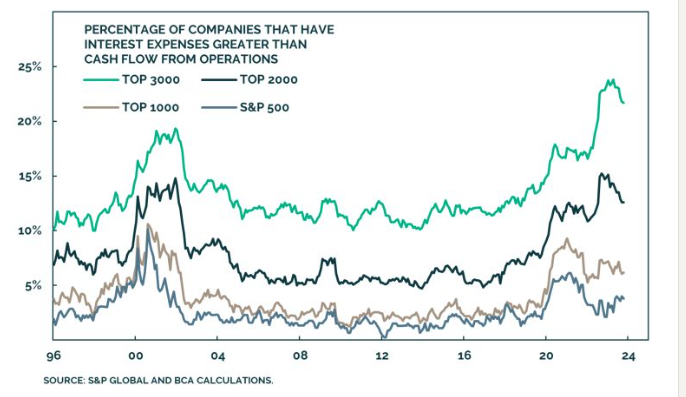

While some sectors and themes are cheap compared to the market behemoths, they might take some time to bear fruit. There is a liquidity squeeze occurring which doesn’t tend to favour smaller companies. For those with good memories, post 2008/9 the price of liquidity was on its way to zero yet many good companies couldn’t access financing until banks were persuaded by their central banks to lend rather than hoard cash.

Presently, liquidity is priced higher and for those who need to re-finance, it’s getting tougher. Interest rates are higher in western developed economies via official short-term rates and along the yield curve in various maturities. Lending standards are getting tighter. Corporate spreads in investment grade and high yield have widened as a consequence and it is interesting to note that US bankruptcies are likely to rise.

Source: BCA

The above is compounded by the bond vigilantes (or bond villains) seemingly punishing the US government for their expansive fiscal policy by taking borrowing costs higher. The yield rise hasn’t been as savage as September, but volatility has been heightened leaving investors pondering whether something is about to break behind the scenes like earlier in the year through regional banks borrowing short and lending long. UK gilt yields have risen too.

Inflation has improved in the UK and the US, but the danger of energy price rises is causing fear that the good news on inflation may have halted. The prospects of a further official interest rate hike from central banks have been diluted by rising bond yields doing the monetary tightening job for them, pacifying equity markets in the process.

In the far east, Japan’s pursuit of corporate governance reform continues to benefit that market. China, on the other hand, has yet to do enough economic stimulation

to assuage investors abroad and at home.

Middle East Tensions

Of course, financial markets have reacted to the horrific events unfolding in Israel and Gaza. It has been speculated that Iran is behind the October 7th events and is distrusted by the US, Israel and Saudi Arabia alike. Having got Hamas to allegedly do its war-mongering for it, Iran has the better equipped Hezbollah to call on to worsen the situation.

Whether Iran desires to cause further upheaval in the region for and what reason, remains to be seen but financial markets are hoping diplomacy wins the day and oil prices stabilise.