The US economy continues to exhibit notable resilience, particularly in terms of consumer spending. Many consumers and businesses secured low interest rates during the pandemic, with fixed-rate mortgages serving as a prominent example, thereby mitigating the impact of current higher interest rates. Fiscal policy has been expansive, with the United States running a 6% budget deficit driven by government expenditures related to the CHIPS Act, the Inflation Reduction Act, infrastructure initiatives, and increased defence spending in response to rising global conflicts. Additionally, wealth effects have provided support, especially with the advent of artificial intelligence, which represents a structural growth narrative primarily centred in the US.

Nevertheless, the US economy is not the sole influence on the US equity market. On a weighted capital basis, expectations have consistently increased with each earnings season, especially for the largest corporations. The US equity market has become concentrated in what are referred to as the “magnificent seven” stocks. Valuations of these companies suggest that future expectations should be moderated, and the potential risks associated with this narrow market leadership should be recognized.

Source: JP Morgan Asset Management.

While ongoing economic expansion will generally support equities, there are opportunities in sectors that have been overlooked. Therefore, during the month, we introduced the iShares S&P500 Equally Weighted ETF across all T. Bailey funds of funds. As indicated by its name, this ETF’s equally weighted structure significantly reduces the influence of the largest US companies, placing greater emphasis on those with more moderate valuations on average.

Recent policy announcements by Chinese authorities to address economic challenges led to a brief rise in Chinese equities just before October; however, the positive effects waned throughout the month. Financial markets remain concerned that this may represent another false dawn for the country, as the recently announced stimulus packages appear insufficient to provide sustainable incentives for domestic consumption. The ongoing decline in the real estate market continues to adversely affect economic growth and consumer confidence.

Source: Bloomberg.

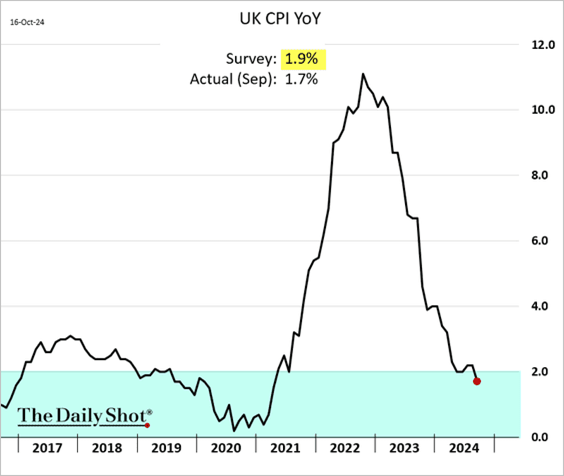

UK inflation surprised to the downside in the month with the headline rate falling to 1.7% year-on-year. On its own, this lends weight to further rate cuts from the Bank of England. However, at the end of the month, Chancellor Rachel Reeves presented her first Autumn Budget, defining the UK’s fiscal outlook for the upcoming years. The budget includes significant fiscal expansion, comprising approximately £70 billion in increased government spending (including on capital), which is being financed in roughly equal measure by tax hikes and additional government borrowing.

Source: The Daily Shot

This announcement created some unease as evidenced by the yield on the UK 10-year bonds approaching the levels seen during Liz Truss’s “mini budget” two years ago, indicating some disquiet in the gilt market. Nevertheless, this shift appears to be more an adjustment to interest rate expectations following the announcement of expansionary fiscal policies rather than concerns about an unsustainable debt trajectory. Consequently, it is expected the Bank of England will adopt a slower pace of interest rate cuts in the coming year.

UK 10-Year Gilt Yields

Source: LSEG Workspace.

Looking to the coming month, media attention will be dominated by the US presidential election so for now there is no respite in potential volatility across asset prices. Thus we continue to maintain broad diversification across regions, sectors and asset classes alongside a focus on relatively cheaper UK assets.

Regional composition of equity exposure in the T. Bailey Fund of Funds portfolios

Sources: T. Bailey. LSEG Workspace. 30 September 2024.

Markets

Equities

In October, global equities were primarily led by the US, driven by the expanding theme of artificial intelligence (AI) contributing to robust corporate earnings in the technology sector. Investments in the First Trust NASDAQ Cybersecurity UCITS ETF and Polar Capital Artificial Intelligence Fund demonstrated strong performance. However, there are indications that share prices in this sector may plateau as high valuations impose a significant challenge.

European equities have shown their vulnerability to global trade in recent months, particularly concerning competition and demand related to China, as well as geopolitical tensions. The European Central Bank (ECB) has offered some relief through interest rate reductions and the market is currently anticipating further easing of monetary policy.

In that regard, globally, monetary policy is broadly shifting to being more supportive for risk assets with a move towards interest rate cuts by the major central banks. However such expectations will likely ebb and flow with each data release providing a source for market volatility. Thus we continue to seek secular growth drivers whilst diversifying opportunities and across sectors and regions.

Bonds

Having initially dipped as Chancellor Rachel Reeves outlined substantial tax hikes amounting to c.£40billion in her budget, UK Gilt yields subsequently rose on anticipation of increased government borrowing leading to higher gilt issuance. The T. Bailey Multi-Asset Funds have modest exposure to UK Gilts and towards the shorter end of the curve (3-year duration). Nonetheless, valuations fell by 1.4% over the month.

As a diversifier, high yield debt continued to demonstrate greater resilience in this area of

the T. Bailey portfolios, and the credit specific approach of the Man GLG High Yield Opportunities Fund continued to deliver positive performance.

During the month we caught up with the fund’s manager Mike Scott. He and his team take an active approach to uncover opportunities in cash generative business with strong underlying asset values where the bond’s yield justifies holding it through the economic cycle. The present yield for the portfolio is in the region of 9.5%.

Such an active approach runs counter to the high yield market in aggregate, where concentration risk is something of an issue: the top 50 out of c.1,600 by market value making up 26% of the global high yield index.

Commodities

Gold reached new highs this month, reinforcing its role as a safe-haven asset. With moderating inflation, falling interest rates, economic uncertainty, geopolitical tensions, and central bank purchases, gold’s appeal has increased. The holding in the iShares Physical Gold ETC returned 8.4% for the month. However, due to the volatility of precious metals, we aim to keep exposure modest in the T. Bailey Multi-Asset portfolios.

Absolute Return

Both absolute return holdings in the T. Bailey Multi-Asset portfolios performed positively over the month.

We had the opportunity to speak with Jack Barrat and James Holden, the portfolio managers of the Man GLG Absolute Value Fund, during the month. The fund has shown impressive performance in 2024, gaining 11.9%, primarily driven by its short positions even amidst a robust overall UK equity market. It is also reassuring to see that the team adheres to their investment strategy, focusing on companies trading below replacement cost or that are expected to generate underestimated future profits, while establishing short positions in overvalued companies facing deteriorating operational conditions.

Your Money

In the T. Bailey Global Thematic Equity Fund we exited the holding in MI Chelverton UK Growth. The short-term expectations for the UK budget weighed on smaller-cap UK companies earlier in the month and this coincided with a desire to capture a broadening of equity markets in the US which led to the introduction of the iShares S&P500 Equally Weighted ETF.

The iShares S&P500 Equally Weighted ETF was also introduced into the T. Bailey Multi-Asset Dynamic and T. Bailey Multi-Asset Growth funds, largely funded from trimming areas that have performed well in recent months: Healthcare, Insurance, Gold and Japan.

In the T. Bailey UK Responsibly Invested Equity Fund we exited the positions in Next 15 and Bellway. Next 15 disappointed in September with the announcement of the loss of a major contract. This heavily impacted its share price. We do not envisage the company will immediately recover from this and it will take management some time to regain investor confidence. Bellway has performed strongly in 2024 in anticipation of a cyclical upswing in the residential property sector. Much of this was reflected in its share price and we decided to exit the position.