Summer’s Back & A Game of Three Halves?

Having endured a damp July and August, September has started with a few days of glorious weather which look set to last a bit longer. Bad luck on all the schoolchildren that have to look out of the classroom window while their parents might get to enjoy some of this fine weather. Of course, those that have been relocated due to crumbling concrete (aka RAAC) may have been ‘lucky’ enough to find themselves home-schooling.

For financial markets, July was good whereas August wasn’t until into the second half of the month. Like the added time of a Premier League football match, many investors would have liked August to continue a bit longer to offset the poor start to the month.

Following on from July’s positivity, August was a disappointment for investors. At one stage, August looked like being the worst month of the year for financial market performance based on the prospects for higher official rates in the US and Europe.

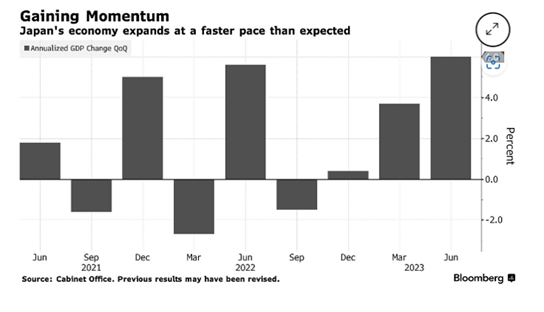

Strangely the catalyst for a sell-off in risk assets was the downgrade of US government debt by Fitch, one of the three major rating agencies. Standard & Poors, one of the other significant rating agencies, had made the same call twelve years ago but the size of outstanding debt post-covid has, when coupled with slow progress on lowering inflation, unnerved holders of US government debt. Adding to the uncertainty, was evidence that Japan and China were large sellers from their stockpile of US Treasuries as part of their foreign currency reserves. The sales were less about concerns over the credit quality of the United States and more about bolstering their own currencies. In Japan’s case, this was a consequence of overly easy monetary policy which, although permitting higher ten-year government bond yields, is seen to be at odds with economic reality as the Japanese economy’s upward momentum continues.

Source: Cabinet Office/Bloomberg

Despite the improvement in the Japanese economy, the yen continues to be soft reflecting the Bank of Japan’s monetary policy stance.

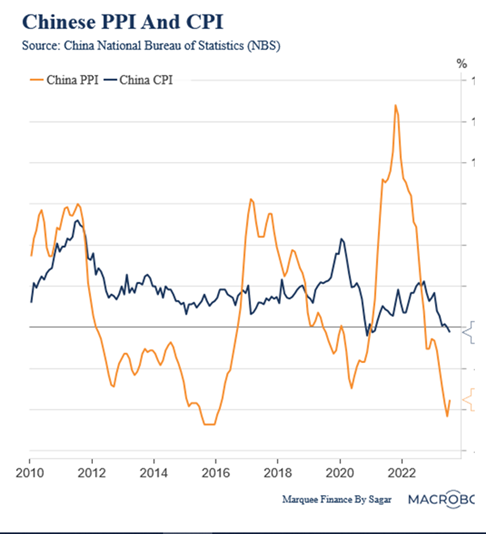

In China’s case, the continued disappointment of economic performance and deflation has led the yuan to be weak.

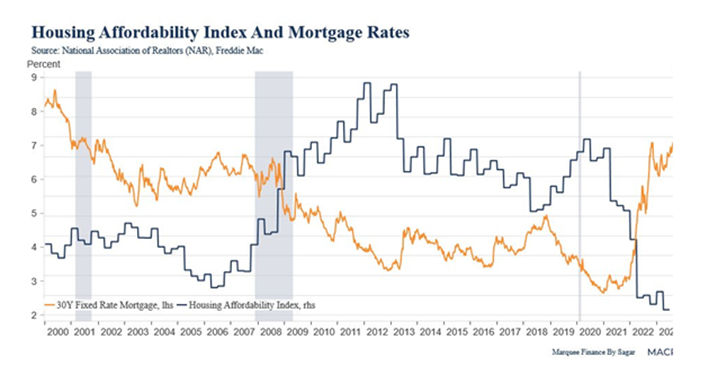

Bond yields rose in the first half of August in the US and elsewhere despite better (lower) inflation numbers. Ten year gilt yields were up 27bps by mid-month. US Treasury yields for the same tenure were up 22 bps to the same date, as the yield curve steepened to reflect the lowered chance of recession in the US. Real yields rose too. Holders of longer-dated government bonds took it on the chin. Thirty year mortgage rates crested 7%. Unsurprisingly, housing affordability has taken a hit as the chart below from Marquee Finance shows.

Source: Marquee Finance by Sagar

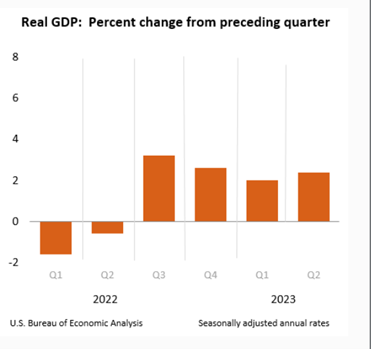

Better US Gross Domestic Product (GDP) may have underpinned the move to a steeper yield curve for US Treasuries.

Source: US Bureau of Economic Analysis

Balancing Act

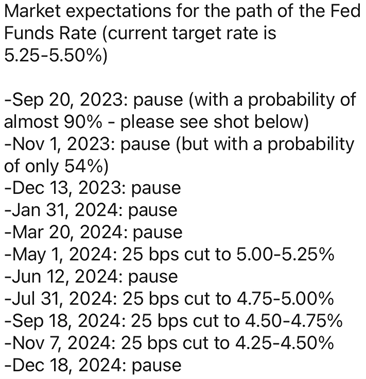

Fortunately, while both the central bank heads at the US Federal Reserve and European Central Bank (ECB) had hawkish tones to their respective deliveries at the annual symposium in Jackson Hole, Wyoming, more reassuring data on inflation and importantly, signs of a loosening in a tight labour market, led to a recovery in asset prices towards the end of August. The result was still a negative month albeit not as bad as it looked just past the mid-month point. Increasingly, rhetoric moved in the direction of official rates being near their peak but not declining for a while. The following illustrates the futures market’s direction of travel for the US Fed Funds rate as of 30 August 2023:

China Cracks

China’s economic performance continues to disappoint and in stark contrast to the developed world, inflation is absent in the face of deflation. Youth unemployment is estimated to be around double the last reported figure of 20%. So troubling is this number that the Chinese authorities will no longer report it. China’s malaise cast a negative shadow over global financial markets for much of August with China’s initial attempts at economic stimulus viewed as inadequate. It’s early days and the likelihood remains that money will be thrown at the problem.

Source: Marquee Finance by Sagar

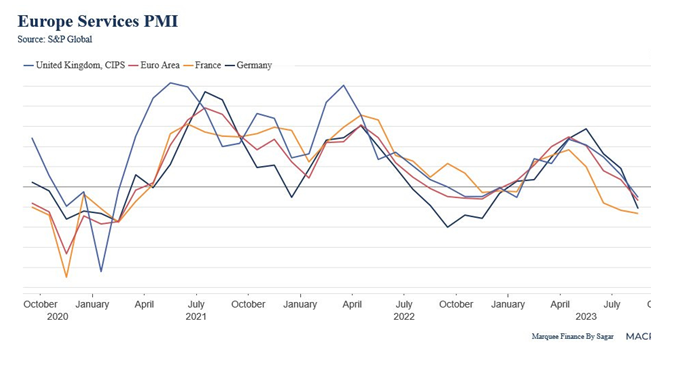

Europe Disappoints

The previously resilient services sector contracted across Europe.

Source: Marquee Finance by Sagar

Asset Classes

Equities

China’s negative impact on Asia meant that it was the worst performing region in August, down over 5%. Also within Asia, but benefiting from a weak currency, world class businesses and governance reform, Japanese equities were only slightly in negative territory. UK stocks as referenced by the FTSE All Share, were down about halfway between China and Japan, at minus 2.5%. Europe performed similarly to the UK, weighed down by weak economic data. The broader US equity market suffered too but like other regions was aided by a decent final ten days of August. US small cap equities were among the worst performers.

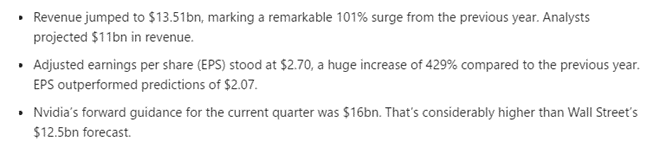

The price surge in AI related companies of the first half of 2023 (partly mean reversion from 2022’s falls) abated in August but the release of Nvidia’s stellar earnings and forecasts, breathed new life into many growth equities post Nvidia’s Q2 results on August 23rd. Here’s a summary of Nvidia’s results:

The following chart illustrates the price improvement over the month and post results.

Source: Yahoo Finance

Government Debt

The key feature for government debt in August was the steepening of the US yield curve. The resilience of the US economy and the decreased likelihood of a recession caused longer-dated Treasury yields to rise and real yields too. UK gilts were slightly weaker in August with index-linked gilts faring worse than their conventional counterparts. Japanese government bonds continue to look like a one-way bet after the yield curve control tweak to a higher yield cap.

Credit

Credit markets started August with spreads to government looking too tight. It was slightly surprising to see high-yield debt leading the way with a positive return in August, aided by the higher income effect.

Currency

Outside the weak currencies of China and Japan, the currency markets were relatively quiet. The US dollar was marginally firmer against sterling in August.

Commodities

Industrial metals had a poor month on the perception of weaker Chinese demand but like other asset classes, recovered somewhat towards the end of August.

Gold had a positive month due to its role as an alternative currency/hedge against uncertainty.

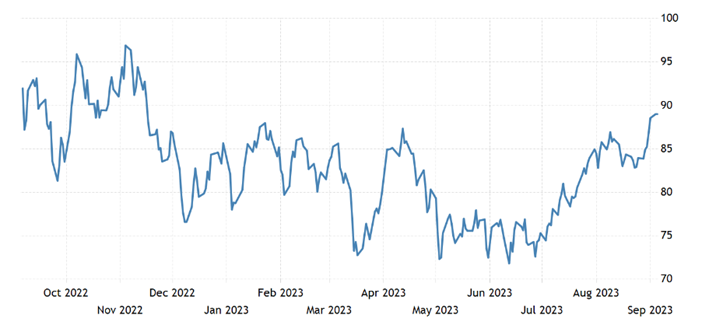

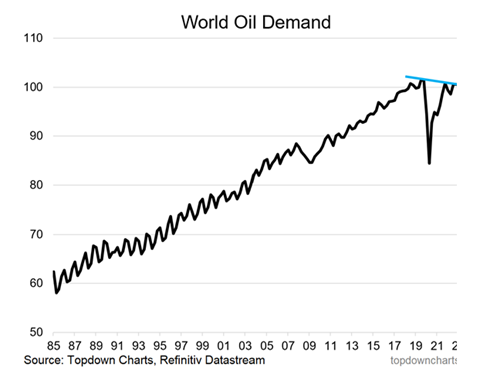

Oil continued its recent upward momentum as the below chart illustrates:

Source: Trading Economics

Oil’s momentum was boosted by rising demand amid OPEC supply cuts.

Source: Marquee Finance by Sagar