The key non-financial event of the first half of September was the sad passing of Queen Elizabeth II on 8 September. Our thoughts are with the Royal Family at this time of national mourning to remember a remarkable woman.

Waging War

While Ukraine re-taking land from Russian forces is good news, it is the central banks of North America, the UK, Australasia and Europe’s commitment to fighting inflation that the title of this update refers to. Faced with tight labour markets and high inflation rates, central banks are seizing the opportunity to raise rates while they can, content to risk recession to tame inflation.

The key financial event so far in September was the US Consumer Price Index (CPI) release on 13 September. It caused a major sell-off in asset prices.

Inflation Fixation

Monthly CPI data has probably now overtaken the monthly US employment data as the economic release to dissect the most. A bit like company earnings, a miss on the wrong side can result in a massive reaction.

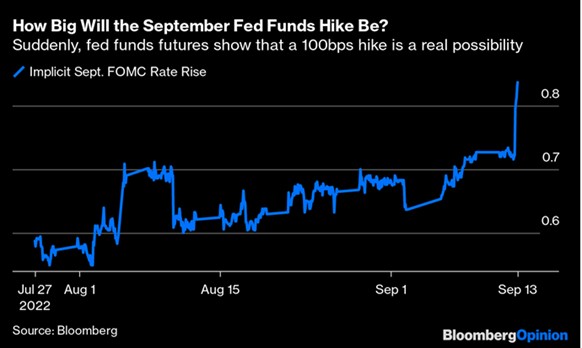

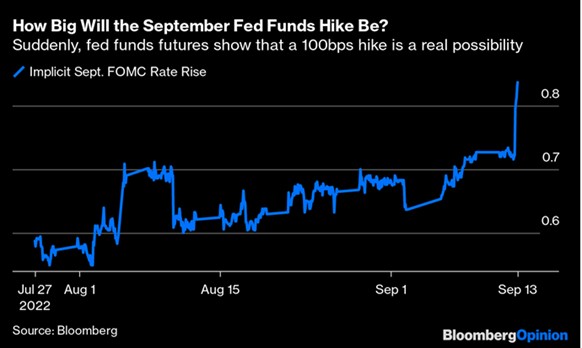

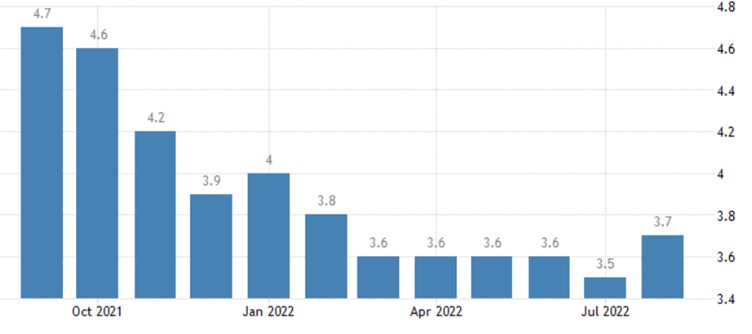

Source: Bloomberg

The probable US rate hike next week has moved from 0.50% – 0.75% to 0.75% – 1.00% as the above chart sourced from Bloomberg shows. However, it is difficult to rationalise the above with the fast and furious move down in bond and equity prices that occurred on Tuesday after the publication of the US CPI data. Consensus estimates were for August’s year-on-year inflation to be 8.1% whereas the outcome was 8.3%. This was down from the previous month due to lower fuel prices as a consequence of falling oil prices. Yet food and shelter were higher. Core inflation was higher than expected.

The US housing market is slowing down as a consequence of higher mortgage rates which are now above 6%. More people are renting as they have been unable to afford to buy which in turn has forced up rents. That should abate in time. Higher input costs viz fertilizer prices, droughts, etc. have caused food prices to continue to rise.

For the US and UK central banks, the CPI releases provide food for thought, the other immediate concern is the tightness of labour markets and the ability of workers to command higher wages through collective bargaining, employers’ fear of losing their employees to competitors or having to pay more to attract staff, skilled or unskilled. What the US Federal Reserve and the Bank of England want to see is higher unemployment.

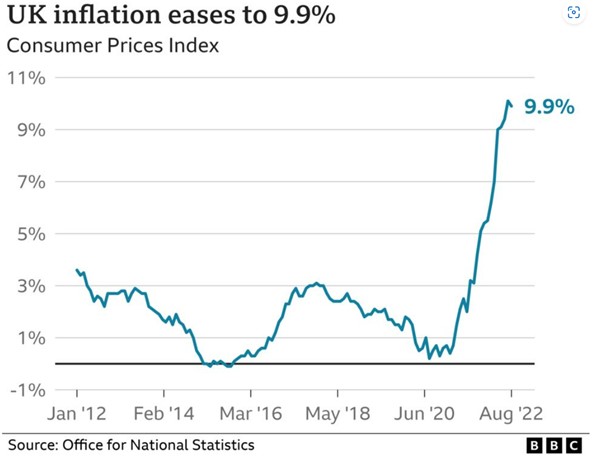

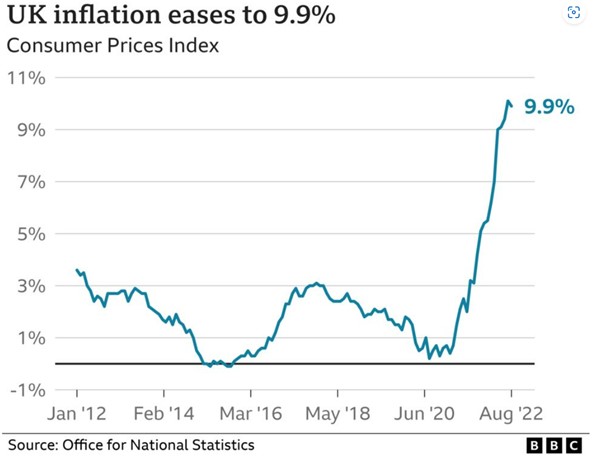

UK CPI was an improvement but still too high for comfort. New Prime Minister Liz Truss’s commitment to cap energy prices will significantly lower future inflation projections but like the US, higher food prices, offset by lower fuel costs were the features of the UK CPI report.

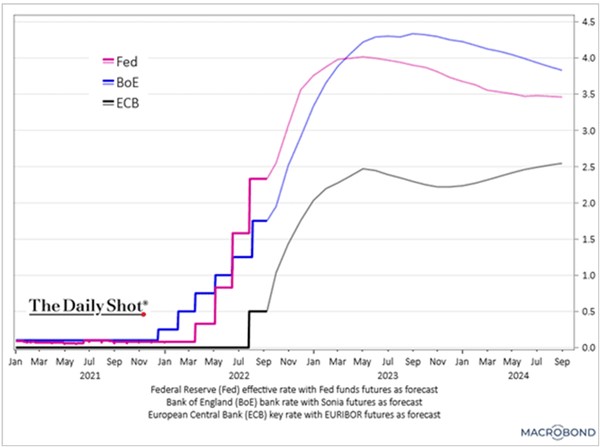

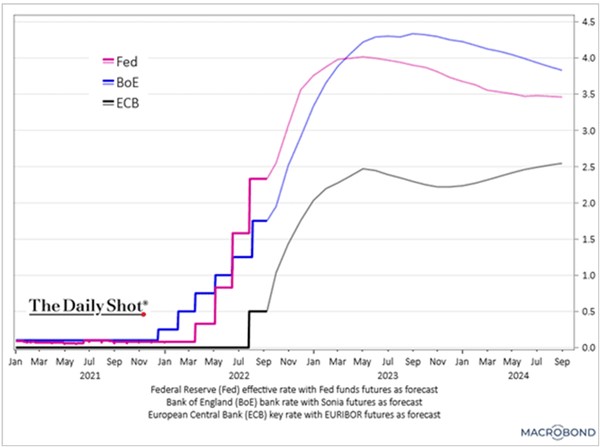

US and UK official rates are expected to peak around 4% sometime in the first half of 2023.

Source: Macrobond

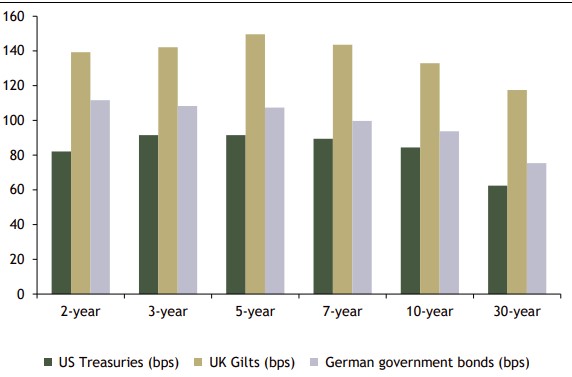

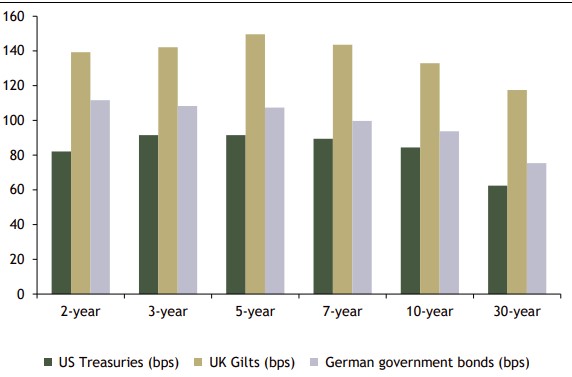

The rise in bond yields has been startling as evidenced by the following graph from Absolute Strategy Research illustrating the change in US, UK and German government bonds from 1 August 2022 to 13 September 2022.

Source: Absolute Strategy Research

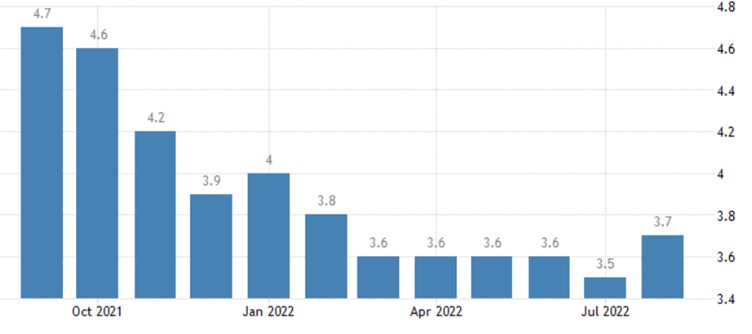

US unemployment was announced as it normally is, on the first Friday of the month, and a flicker of good news for the Federal Reserve as unemployment ticked up to 3.7% in August, higher than estimates but still low.

Source: TradingEconomics.com/US Bureau of Labour Statistics

The problem for the ‘Fed’ is average hourly earnings are running at 5.2%.

UK unemployment fell to 3.6% for the three months to July 2022 with wages at 5.2%, way below inflation and feeding the concerns of the Bank of England that workers will seek even higher wages to catch up with inflation.

UK GDP growth in July was in positive territory but below estimates at 0.2%.

The European Central Bank (ECB) raised its deposit rate by 0.75% from zero in its fight against inflation. This feels like getting rates back to where they ought to be and the ECB’s rhetoric was for more rate increases to fight off inflation. Europe does not possess the same labour market restrictions but is suffering from soaring energy prices. Energy prices have fallen back recently and it remains possible for Europe to avert an energy crisis. An energy price cap was announced.

Goldman Sacks

Previous statements by a number of companies referred to a freezing of new hires. That rhetoric has been updated to mentions of broader lay-offs. Central banks will be ‘pleased’ to see prospects of unemployment rising to unwind tight labour markets/wage pressure. While Goldman Sachs was widely quoted for stating it was going to lay-off hundreds of their employees, other companies from Twitter to Warner Bros, Peleton to Wayfair, have announced plans for significant lay-offs.

Change of Emphasis

Tight money/loose fiscal policy mixes have effectively altered the dynamics on currencies from a period when most developed economies sought a lower exchange rate to promote growth and export markets to firmer currencies dampening inflation by reducing import costs. The problem is that the US, UK and the EU are all doing the same thing at the same time.

Your Money

We have made some minor changes to our portfolios this month. In Dynamic, we have halved a holding in one of the Investment Trusts after its good performance has left it looking relatively expensive. Slightly disappointing returns from a macro fund has led to halving that exposure. Proceeds have been used to add to our healthcare theme as a defensive equity. For the Growth Fund, the healthcare addition was funded by cash.

We have maintained a good cash buffer as market volatility will throw up attractive opportunities from time to time. While our quality thematic equity approach will struggle to avoid the wholesale down moves in markets like we saw earlier this week, they should be the winners in the long run as demand for them exceeds supply. Bonds have become more attractive for the multi-asset funds but are not at the ‘buy me’ stage yet. No need to attempt to catch falling knives or be a hero with your clients wealth.

Market commentary focuses much of its attention on the present and immediate future. Investors tend to look further out with the result that financial asset prices stabilise with a six to nine month view (the length of time it takes monetary policy changes to take effect). At this juncture, it would be easy to be bearish but much bad news is already baked in. For those wishing to trade out and back in, history is against you.

We have increased our research resources in recent months and comprehensively evaluated all holdings in the funds we manage using a number of measures from leverage to numerous valuation metrics. We have done this to ensure portfolios are not at risk from higher borrowing or labour costs nor from looking relatively expensive by any metric.