Unhappy Hour

News that York-based Stonegate Group, the largest pub group in the UK, is going to introduce ‘surge’ pricing at busy times, caused a bit of a furore amongst regular drinkers. It probably also says something about pricing power and the need/desire to claw back some of the increased staffing cost in a tight UK labour market where despite a 0.5% rise in the unemployment rate to 4.3%, wages remain elevated at 7.8% for regular pay (ex-bonuses).

Arm’s Length

The initial public offering (IPO) for the UK chip maker, ARM, was ten times over-subscribed, valuing ARM at US$60 billion and opened at a 16% premium to its IPO share price of US$51 a share, ending the day 25% higher. No doubt vindicating ARM’s decision to list on the New York Stock Exchange (NYSE).

Opportunity Knocks

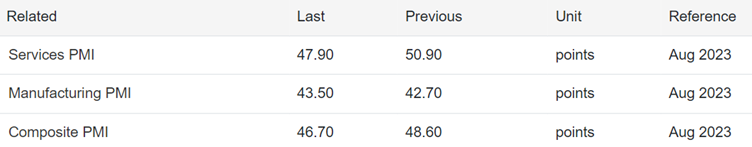

The European Central Bank (ECB) grasped the opportunity to raise official rates yesterday while they can, as although Eurozone inflation was unchanged at 5.3% in August, forward looking data such as the Purchasing Managers Index, was decidedly weak.

The Bank of England and the US Federal Reserve hold their interest rate setting sessions next week.

Yuan Direction

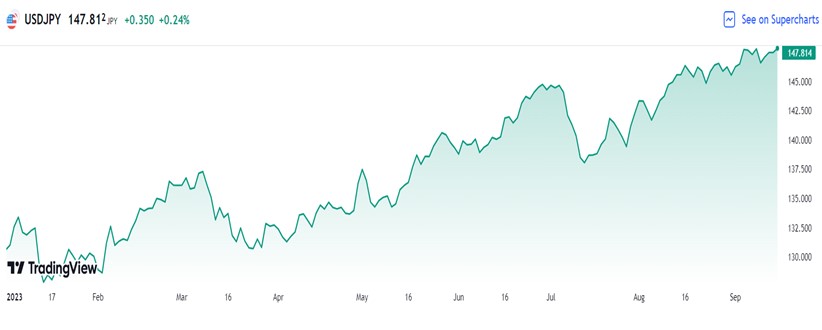

The Chinese yuan and the Japanese yen have been weak currencies for some time. The latter due the continuation of its accommodative monetary policy, the former due to disappointing economic performance, deflation and easier monetary policy. Both Japan and China keep a weather eye on each other’s currency as they are competitors for exports on the global stage. China watchers will have been heartened by today’s retail sales for August which surged 4.6% versus the same period last year. Both currencies have become relatively cheap and with rumours of intervention, have the potential to bounce against the US dollar.

The above chart shows the yuan’s 5.7% decline against the US dollar year to date and 8.7% decline since the yuan’s peak this year in February.

The above chart shows the yen’s 12.75% decline against the US dollar year to date. Both the above charts sourced from TradingView.

September

The first half of September was characterised by weaker economic data in the UK and Europe, weaker but still decent economic activity in the US amid inflation numbers that generally moved in the favoured lower direction but still too high for western developed market central bankers’ liking.

There was a welcome fall in Indian inflation from 7.4% year-on-year in July to 6.8% in August. The recent upward move in the oil price and the strike at the Chevron LNG facility in Australia will make central bankers twitchy but rising energy prices are in effect, a tax on consumption. Rising wages are the central bankers’ concern. Fortunately for them, there are further signs of a loosening of a tight labour market on both sides of the Atlantic which should translate into lower wages going forward.

With mixed messages from inflation, economic data and central bankers, markets have oscillated within a narrow range so far in September.

The narrative hasn’t really changed from a central bank perspective, in the west, official rates are close to or at their peak but may stay there longer than previously anticipated with the relevant futures curves having already adjusted to that scenario. In the east, further monetary stimulus is expected from China and in Japan, ten year yields will go higher again at some stage as yield curve control adjusts further.

Your Money

A few changes have been made in September to date. Gold was trimmed in Multi-Asset Dynamic to fund an increase in bonds. The allocation to debt in the two multi-asset funds is just below 20% primarily through 5 year UK gilts and 7-10 year US Treasuries (hedged into GBP). Higher yields might bring about a greater allocation but we feel the futures curve for short rates in the UK and US is about right so some good news is already in the price.

In Global Thematic Equity, a small position in Health Innovations was liquidated for cash as the fund hadn’t met our expectations. Japan continues to be a positive contributor but we chose to switch our holding in JPM Japan to a cheaper but equally as effective alternative.