Some better news for the US economy

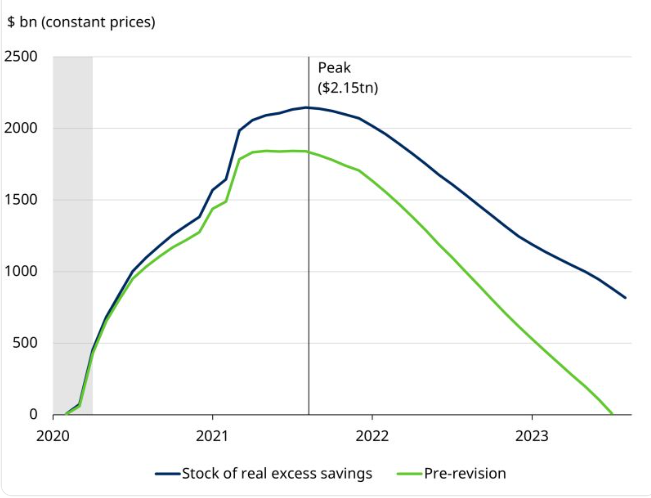

The US Bureau of Labor Statistics (BLS) announced a revision to their US savings data illustrating as in this chart sourced from Schroders, that savings have been drawn down far less than previously calculated.

Source: Schroders

The BLS also releases its monthly Job Openings and Labor Turnover Survey or JOLTS. The last edition was announced on Tuesday and showed a far greater number of job openings than forecast. The US bond market took fright at the likely inflationary path of employers having to pay more to fill those job posts although Friday’s keenly watched US employment data showed Average Hourly Earnings at 4.2%, below expectations but above inflation objectives. Unemployment also crept up although at 3.8%, it is still a relatively tight labour market as the JOLTS numbers would suggest.

Yields

US bond yields leapt at least twice last week as the yield curve disinverts/steepens with ten year yields rising faster than two year yields. The first jump was on the JOLTS number of job openings and the second on the higher than expected non-farm payroll numbers on Friday. Bond yields in the US and the UK look tempting but US bond yields’ volatility indicates something maybe lurking behind the scenes viz leveraged institutions having to bail out. Time will tell but rising nominal and real yields present a greater hurdle for other asset classes such as equities. Valuation discipline is paramount.

Liquidity

Liquidity comes in two parts, price and availability. You may recall post 2008/9, liquidity was priced close to zero, yet availability was poor; many decent companies went to the wall. Today, liquidity is more expensive and liquidity isn’t great for those who need it.

The Bank of England is prepared to gamble with inflation in order to curb inflation and temper wage demands. However, both the incumbent government and the Labour party opposition have stated their adherence to fiscal responsibility. Europe isn’t too dissimilar to the UK. In the US, fiscal policy has been loose via the Inflation Reduction Act and the CHIPS and Science Act, while monetary policy has been tight. That combination is usually supportive to a country’s currency. Bond markets have cheapened and short-term interest futures markets have almost adjusted to the likely path of official rates in the US, UK and Europe.

The amount of fiscal support lessens but doesn’t remove the chance of a US recession. The Fed’s official stance is that a soft landing can be achieved, difficult but not impossible. Political risk exists throughout the west. It is unlikely, due to lag effects, whether previous rate hikes have had their full effect yet. In the east, China remains a disappointment and the policy response to date has been underwhelming. Japan’s monetary stance cannot last forever but its stock market remains attractively priced as does the UK’s and both currencies too.

Our greatest concern is a liquidity squeeze which is already happening. Holding cash generative businesses that do not need to re-finance, quality companies and themes is paramount as are valuations. Those that have done well in the US aren’t cheap and have little appeal. Earnings optimism in the US is probably overstated.